How to Grow Wealth Tax-Deferred with Private Placement Life Insurance

A strategy to help you serve the unique needs of the most affluent clients

Do you serve highly affluent investors in your financial advisory practice? Do you seek such clients?

Affluent investors have unique challenges compared to other types of investors. You must be able to help your wealthiest clients meet a fundamental investment objective:

Growing Generational Wealth Tax-Efficiently While Investing in Tax-Inefficient and Alternative Investments

To succeed, you must distinguish yourself as an advisor who can help solve the greatest wealth preservation and accumulation challenges of the most affluent investors. Private placement life insurance (PPLI) is an investment strategy uniquely positioned to help meet those challenges. This time-tested investment solution can help your clients succeed by enhancing the compounding of wealth and relieving the tax friction that erodes returns.

PPLI is an investment solution for wealthy investors seeking to enhance the after-tax returns of alternative strategies and other investments that may generate substantial taxable income.

By building your expertise in PPLI or by working with specialists, you can expand your private client practice and recruit clients for a lifetime and across generations. This discussion will help you understand the basics of PPLI and how you may use it in your practice with your most affluent clients.

Meeting the Tax Challenge for Investors

"It’s not what you earn, it’s what you keep that counts.”

Investors face a heavy potential tax burden. The combined impact of federal and local taxes can significantly reduce after-tax returns for investors using alternative investments and other tax-inefficient strategies.

PPLI as a Potential Solution

PPLI can provide a way for affluent investors to mitigate the tax burden on their investments and increase after-tax returns. You can utilize this vehicle to achieve “tax alpha” and enhance results for your clients.

"Tax alpha is the potential value and enhanced returns created by effective tax management when investing.”

In addition to offering enhanced after-tax returns, PPLI provides an insurance benefit for beneficiaries that is not subject to income tax. Moreover, owning PPLI within a properly structured irrevocable trust can mitigate estate taxes.

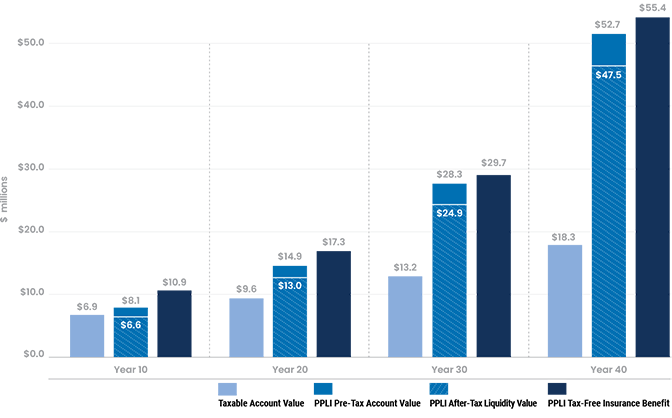

The chart below illustrates the power of tax-deferred compounding in a Private Placement Life Insurance policy. Over 40 years, investors can triple their after-tax legacy to beneficiaries.

PPLI Can Enhance the Value of a Legacy Through Tax Deferral and Mitigation

PPLI vs. Taxable Account: Hypothetical Growth of $5 Million with 7% Net Annual Return

Note: Hypothetical illustration only. Not actual results. Not indicative of the performance of any investment. PPLI returns will vary, and you may receive more or less than the amount invested. Source: Winged Keel

Assumptions:

- Hypothetical Connecticut resident with $50 million net worth

- Funding of $1.25 million per year for 4 years

- 7.00% net rate of return

- M&E expenses: years 1-20 = 55bps; years 21+ = 30 bps

- Cost of insurance assumes preferred health rating

Based on 2022 maximum marginal tax rates:

- 37.00% federal income tax

- 20.00% long-term capital gains tax

- 3.80% Medicare surtax

- 6.99% Connecticut income tax

- Assumes 47.79% combined tax rate for short-term capital gains and ordinary income, and 30.79% combined tax rate for long-term capital gains

Who Can Invest Through PPLI?

Investors must meet 3 key criteria to purchase PPLI:

- First: Investors must meet SEC Accredited Investor standards, with a net worth of $1 million (excluding primary residence) and annual income of $200 thousand per year or $300 thousand per year for joint filers

- Second: Investors must meet the SEC Qualified Purchaser standards, with $5 million or more of investments

- Third: Investors must have sufficient liquidity to invest the minimum required by insurance companies, typically $1 million

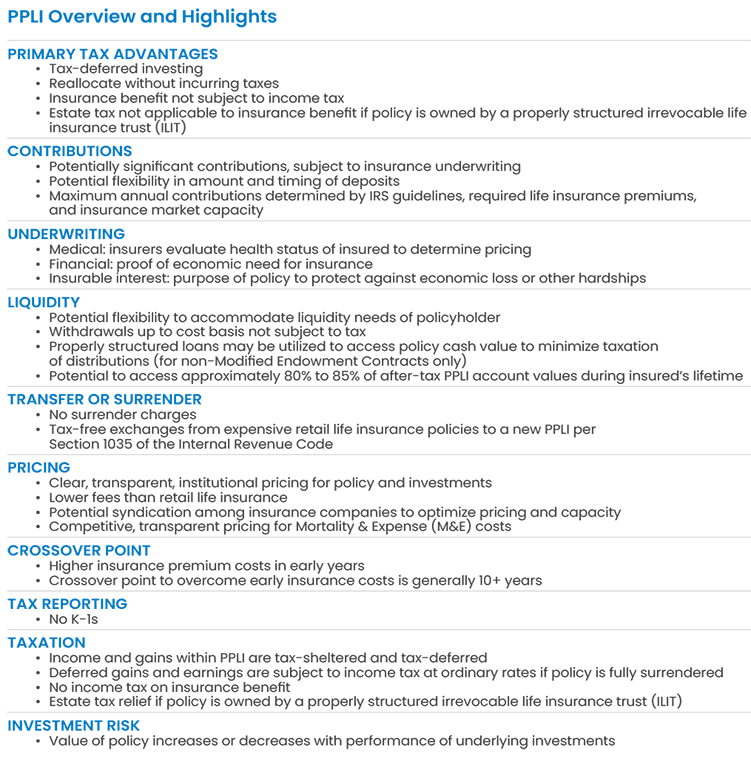

PPLI Overview & Highlights

Discover the key features and highlights of PPLI in the quick reference list below:

MEC or Non-MEC?

Careful structuring of PPLI is key to maintaining the potential tax benefits. Based on the structure, the IRS will consider a life insurance policy to be a modified endowment contract (unfavorable) or a non-modified endowment contract (favorable).

A modified endowment contract (MEC) is a cash-value life insurance policy that loses a variety of tax benefits. If a life insurance policy has too little insurance and too much cash value, policy loans can become subject to income tax. PPLI contracts are carefully structured and require a sufficient insurance component, particularly in the first seven years of a contract, to be considered “non-MEC” contracts and thus retain the significant tax planning benefits of life insurance.

Investing Within PPLI: Insurance Dedicated Funds

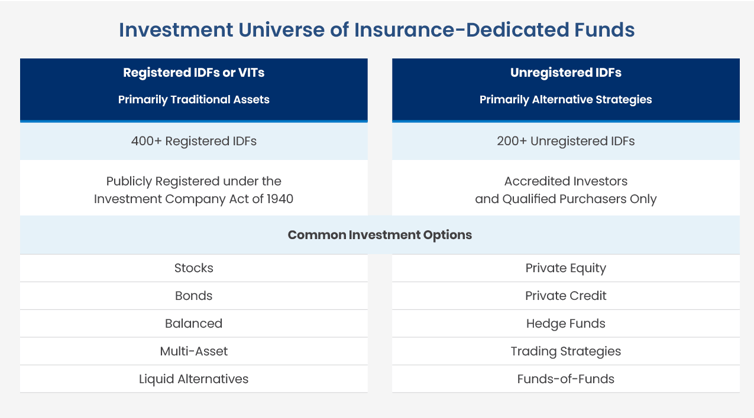

As noted previously, numerous options exist for investing within PPLI. These investment options are structured specifically to meet the stringent tax regulations applicable to insurance. These funds are called “Insurance Dedicated Funds” or “IDFs.” There are two primary types of IDFs:

- Registered IDFs, also called Variable Insurance Trusts or VITs, which invest mainly in traditional assets, such as stocks and bonds

- Private or unregistered IDFs, which invest primarily in alternative strategies, including private credit, private equity, hedge funds, trading strategies, and funds of funds

The universe of IDFs is robust, with over 600 investment options. Each insurance carrier will offer a curated selection from this universe for their policies. Investors may allocate and reallocate between IDFs without incurring taxes.

Separately Managed Accounts

Separately managed accounts represent a growing trend for the largest investors in PPLI. With this approach, the insurance company retains an investment manager to supervise a custom-segregated insurance company separate account on behalf of the client.

Investor Protection

Assets held within an insurance company separate account, IDF, or VIT are segregated from insurance company assets and are protected from insurance company creditors.

Coordinating the Client Team

Developing and implementing the right PPLI solution for your client requires a team of specialists. The client will look to one or more of the professional team members to guide the process. The professionals working on the client's behalf may vary, depending on the case, with some advisors serving multiple roles.

Put PPLI to Work for Your Clients

PPLI is a powerful tool to potentially enhance after-tax returns for your most affluent clients. PPLI can strengthen your clients’ finances over time, as well as your practice.

To recap, PPLI provides for tax-deferred accumulation of policy values and can be structured to mitigate the impact of income and estate taxes. Keep in mind that PPLI entails insurance underwriting, medical exams, and the cost of insurance. Policyholders can make significant contributions to PPLI, but annual deposits may be constrained by IRS guidelines and insurance market capacity.

PPLI provides a wide variety of investment options through IDFs and VITs. In particular, PPLI enables tax-deferred compounding for investors in alternatives and other investments that may otherwise produce significant taxable income.

To learn more about PPLI, please visit our website and download your complimentary copy of Harness the Power: Private Placement Life Insurance and Variable Annuities.

Clarion does not offer tax advice or tax accounting matters to clients. The recipient should not construe the contents of this presentation as legal or tax advice and contact their own professionals for legal and tax advice and other matters relevant to the suitability of an investment for the recipient. Calculations that appear throughout this presentation are for demonstration purposes only. In addition, different assumptions will lead to different results. Any charts discussed in this presentation and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. No system or methodology has ever been developed that can guarantee profits or ensure freedom from losses. No representation or implication is being made that using the methodology or system discussed in this presentation will generate profits or ensure freedom from losses. There is no guarantee that the investment objectives will be achieved. The results shown do not include the deduction of advisory fees or other expenses which will reduce returns.

Tags:

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

Part 2: Case Studies In Part 1 of our blog series on the power of Section 1035 exchanges, we explore...

Part 1: Fundamentals High net worth investors and their advisors frequently encounter legacy life in...

Navigating the investment landscape as an institutional investor comes with particular challenges an...