How Active Portfolio Management Can Enhance Returns and Reduce Risk in CLOs

Active portfolio management is fundamental to CLO investing. Underlying each CLO is a customized pool of loans that may be traded during a defined reinvestment period. Active management and manager selection are critical in CLO investing to drive value for CLO equity shareholders.

Active portfolio management with CLOs provides two opportunities to add value:

- Managers of underlying loan pools can opportunistically trade positions to mitigate risk, increase yields, or enhance total returns.

- Experienced investors in CLO securities can add value through security and manager selection.

Of course, managers and investors may not earn the “value add” they seek, but these opportunities are integral to successful CLO investing.

“Active management and manager selection are critical in CLO investing.”

In the Beginning…

To start, the manager of a CLO underwrites the loans for each CLO pool. Credit analysis, loan selection, diversification, and portfolio construction are the first steps in active portfolio management. While underlying loans are generally senior and secured, borrowers are typically below investment grade. Thus, diligent credit analysis and active loan selection are important.

To effectively evaluate the underlying credit risk of each individual loan, pool managers must have the expertise and teams capable of conducting thorough, bottom-up research. CLOs may consist of 200 to 300 or more loans. Therefore, it is crucial for CLO managers to possess deep research capabilities.

CLO industry standards and trust documents require a high level of diversification across borrowers and industries. Moreover, active managers overlay their own collateral and portfolio guidelines, limiting position and industry concentration as well as allocations to lower-rated loans.

Active Risk Management

CLO collateral and pool managers can adjust portfolio positions over time across the $1.4 trillion loan universe. Once again active portfolio management is critical. CLO managers must have the skills as well as relationships with primary and secondary market desks to effectively trade and source opportunities in the loan market.

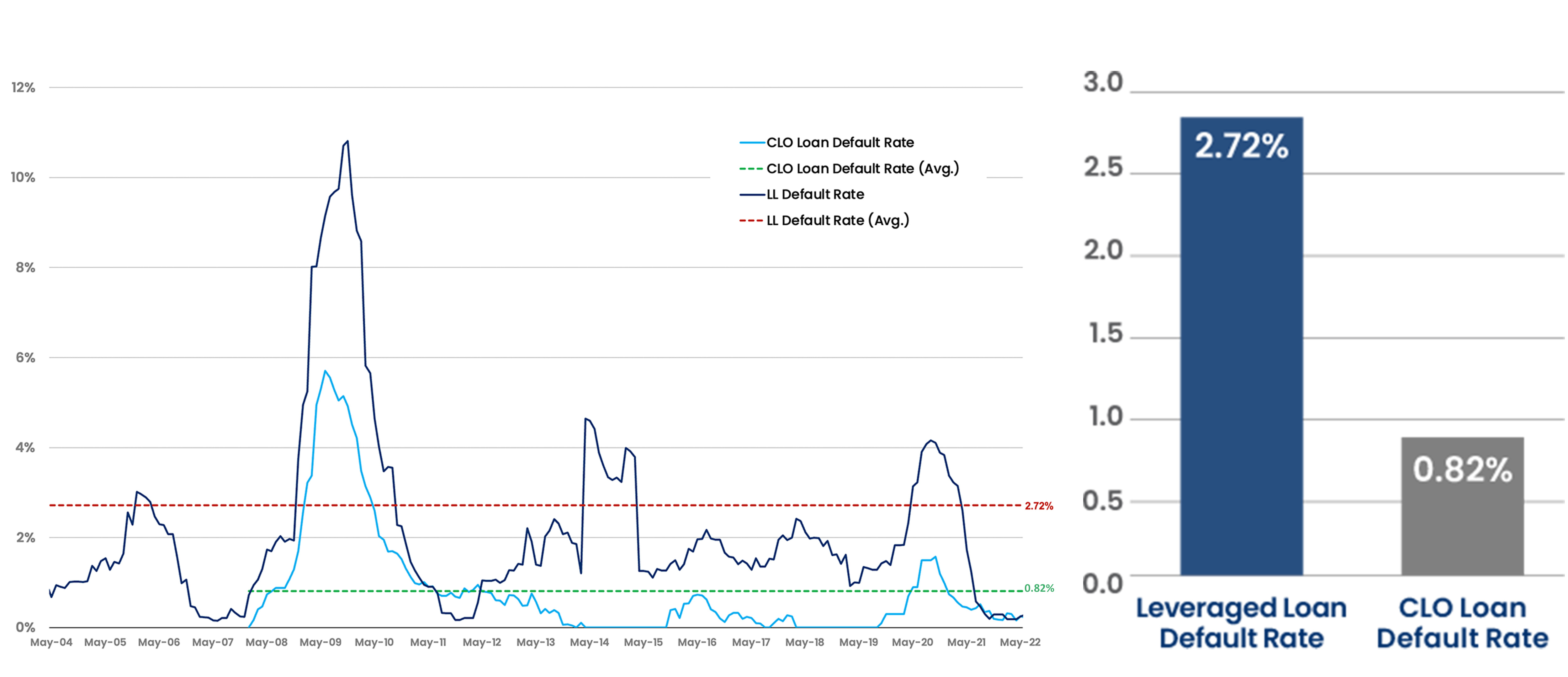

First, a manager can adjust risks in the portfolio, in case of credit deterioration or potential default by a borrower. Industry statistics show that CLO managers have added value as a group in this respect. According to S&P Global, the average long-term default rate for loans within CLOs is 0.82%, while the average long-term default rate for the overall leveraged loan market is 2.72%.1

Since managers must meet monthly cash flow and collateral tests, risk oversight is key. If the CLO does not pass one of the monthly tests, cash flow to equity tranches (and sometimes mezzanine tranches) is diverted to redeem the most senior tranches or used to purchase additional loans in the portfolio to increase a CLO’s collateral balance. This “self-healing” process is designed to bring the CLO back into compliance with the monthly tests and restore cash flow to the equity tranches.

CLO managers share a strong alignment of interests with CLO equity investors, as CLO managers are often holders of CLO equity and wish to avoid interruptions to their cash flow.

Pursuing Higher Yields and Total Returns

A manager can also pursue higher yields and trading profits during the reinvestment period for the pool.

During periods of market volatility, loan markets may sell off, enabling the manager to purchase higher yielding loans. This can increase the overall interest income generated by the CLO’s loan portfolio. This may also increase distributions to CLO equity holders, who earn the residual interest after payments to higher-rated tranches.

In addition, during periods of market volatility, CLO managers can buy loans at a discount to par in pursuit of trading profits and appreciation. This is called “par build,” since these investments can increase the par value of the loan portfolio in a CLO. The accumulation of extra par value can increase the collateral available to support all CLO tranches, as well as increasing the profit margin to CLO equity.

The Pandemic Test

CLO manager selection is a key component when investing in CLO equity. The importance of manager selection becomes evident in volatile market environments, which can create significant performance dispersion. During these periods, it is important to invest with CLO managers that can promptly identify deterioration in the credit quality of loan borrowers and navigate price volatility in the loan market.

The pandemic-induced market decline in 2020 provided a recent test case. In 2020, 25% and 18% of CLOs experienced payment interruptions in the July 2020 and October 2020 payment cycles, respectively, according to Bank of America CLO Research. This led to cash flow interruptions for a variety of CLO equity tranches, before payments normalized and resumed across the CLO universe.

Despite cash flow interruptions for some, the majority of CLO managers were able to avoid payment interruptions for their CLO equity tranches. Moreover, some funds investing in CLO equity tranches were able to avoid payment interruptions through diligent CLO manager selection. Such “double winners” were able to earn both higher yields and appreciation as a result.

Potential to Add Value

There is significant diversity in the CLO market:

- Every loan is different.

- CLO managers have widely varied approaches and capabilities.

- CLO documentation and terms create structural differences that affect outcomes.

- Some CLO manager styles favor debt tranches, and others favor equity

As a result of these differences, there is significant potential to add value with an active approach. Specialized expertise, long experience, and deep resources are required to analyze and capitalize on opportunities in the CLO market.

Learn More

Effective active management is critical to enhancing resilience and performance for CLO investors. This is what we strive to offer our investors at Clarion Capital Partners.

To learn more, please contact us for an in-depth discussion of the risks and opportunities in this specialized sector.

Tags:

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

Introduction Marc Utay, Founder and Managing Partner at Clarion Capital Partners, sat down with ION ...

“In the beginning … there were potential profits.” While “warehouse” may be a metaphor, the potentia...

CLO mezzanine investments offer some of the highest yields within the Collateralized Loan Obligation...