Part 2: Explore 3 Ways to Increase Potential Yields Through CLOs | BB Mezzanine CLOs

CLO mezzanine investments offer some of the highest yields within the Collateralized Loan Obligation (CLO) universe—higher than comparably rated fixed income securities and with low correlation to broader fixed income markets. These higher yields and diversification characteristics attract a variety of sophisticated yield-seeking and opportunistic investors.

Among CLO mezzanine tranches, we believe BB tranches offer a powerful combination:- Highest yielding debt tranche for most CLOs

- Credit protection behind the first loss position of the CLO equity

- “Self-healing” protections of the CLO structure

- Compelling buying opportunities during periods of market volatility

Clarifying Definitions

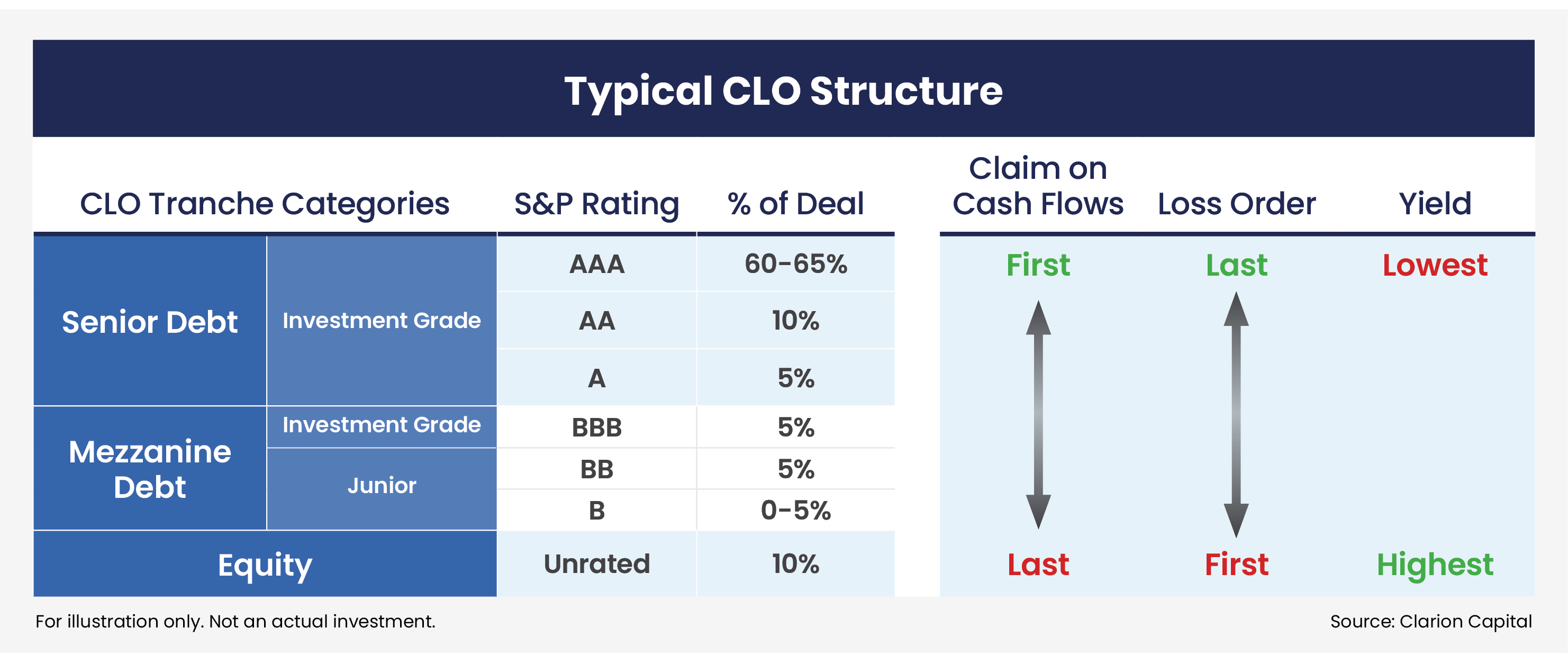

First, it is useful to revisit where CLO mezzanine and BB tranches in particular sit within the CLO capital structure.

CLOs receive cash flows from interest and principal payments on underlying pools of floating-rate, first-lien, senior secured corporate loans. As securitizations, CLOs are divided into tranches of differing seniority, which carry distinct risk/return profiles.

CLOs for Conservative Investors

Conservative investors may be interested in the higher rated, senior tranches which have a priority claim on the cash flows from the underlying loan pool. Senior tranches, representing approximately 75% of the overall CLO structure, comprise most of the capitalization of a CLO. The AAA-rated CLO tranche is the largest, representing 60% to 65% of the typical CLO structure, are the highest rated, and have never recorded a principal or interest impairment or default.1

Other investment grade tranches are rated from AA to BBB. The definition of a “senior” tranche varies across the industry, depending on who is doing the categorizing. In general, “senior” may refer to:

- Any investment grade CLO tranche

- Only those CLOs rated A or better

- AAA and AA tranches only

- Only the AAA tranche

Like beauty, CLO seniority is in the eye of the beholder! At Clarion Capital Partners, we often refer to the AAA, AA, and A-rated tranches as a CLO’s “senior” tranches.

CLOs for Aggressive Investors

Some investors seek the higher yielding tranches of a CLO but wish to avoid the first loss position of CLO equity. These investors often look to lower-rated CLO tranches, particularly those that carry BB ratings.

Occupying positions in the middle of the CLO capital structure, several CLO tranches are sometimes referred to as mezzanine. As with the senior tranches, the definition of mezzanine varies across the CLO industry, and may include tranches rated from AA to B, depending on who is providing the definition. Most investors consider AA and A to be “senior” rather than “mezzanine” or “junior.”

At Clarion Capital Partners we consider tranches with the letter “A” (such as those rated AAA, AA, or A) to be senior and tranches with the letter “B” (such as those rated BBB, BB, or B) to be “mezzanine” or “junior.”

Few CLOs issue tranches rated B. Most CLO capital stacks do not include B-rated tranches—often too expensive due to the high coupons required by investors.

For this discussion on high yielding CLO tranches, we’ll focus on CLO BB notes, also called junior mezzanine for their position in the capital stack just above the equity tranche. Due to the rarity of B-rated CLOs, the BB note is often thought of as the most junior of all the debt tranches.

CLO BB Yields & Total Returns

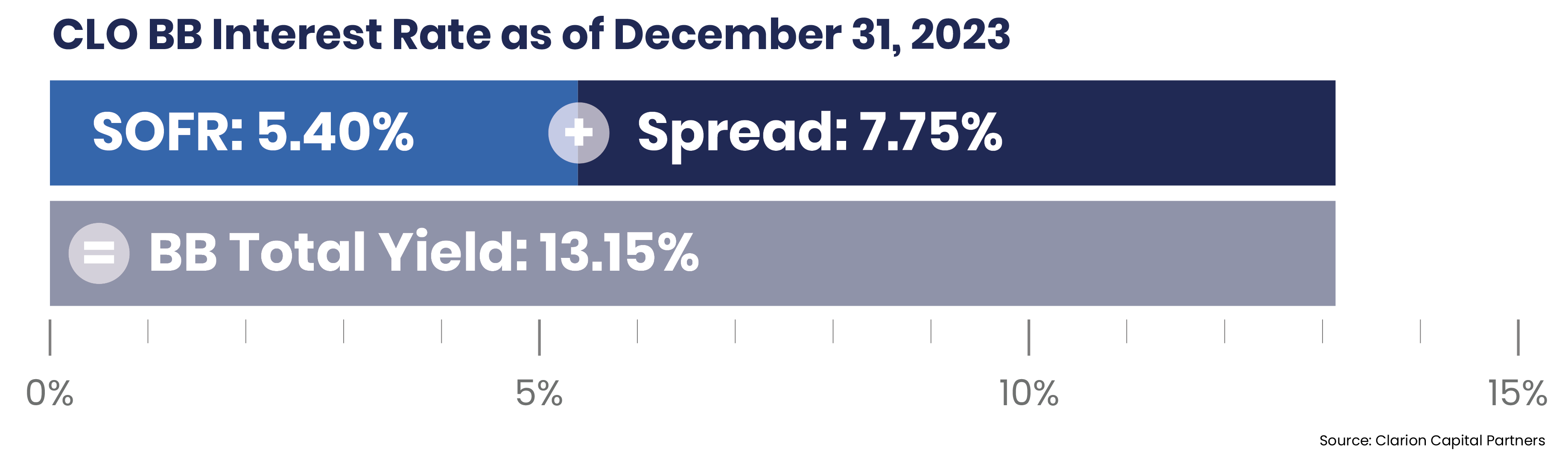

The yields on BB tranches have risen along with the sharp rise in interest rates driven by recent Federal Reserve action. Like other CLO tranches, the CLO BB notes pay an interest rate equal to a spread over SOFR (Secured Overnight Financing Rate). At the end of 2023, the average new issue all-in yield for CLO BB notes was 13.15% (based on a 3-month SOFR rate of 5.40% plus a stated spread of 7.75%).2

Currently, CLO BB notes target equity-like returns in the low teens. Looking back to 2023, CLO BB total returns were over 24% through the end of December. Over a longer period in the past 5-years, CLO BBs had an annualized total return of 9.9%.3

At Clarion Capital Partners, we typically target our entry point for CLO BBs during periods of market dislocation and high volatility, when CLO mezzanine debt is trading at prices well below potential future values.

Structural Risk Protections for CLO BBs

CLO BBs benefit from the structural protections of the CLO structure. As noted above, CLO BBs have multiple sources of risk protection that significantly reduce the possibility of default:- Credit protection behind the first loss position of the CLO equity

- “Self-healing” protections of the CLO structure

- Non-mark-to-market treatment for most underlying loans

- Term-matched financing of the CLO deal

The CLO Equity Buffer

CLO BB tranches benefit from the buffer provided by CLO equity, which is in the first loss position. CLO equity typically comprises 10% of the capital structure of the CLO.

In an extreme risk scenario, BB tranches are reliable until all the buffer provided by the CLO equity tranche has been lost. Based on our analysis, the BB-rated tranche of a typical new issue CLO, with an underlying pool of broadly syndicated loans, can withstand a sustained annual default rate of 5% for the underlying loans. According to Pitchbook/LCD, the average default rate for leveraged loans in the past decade has been 1.57%.4 The leveraged loan default rate reached 10.8% only briefly during the Great Financial Crisis (GFC).5

“Self-Healing” CLO Protections

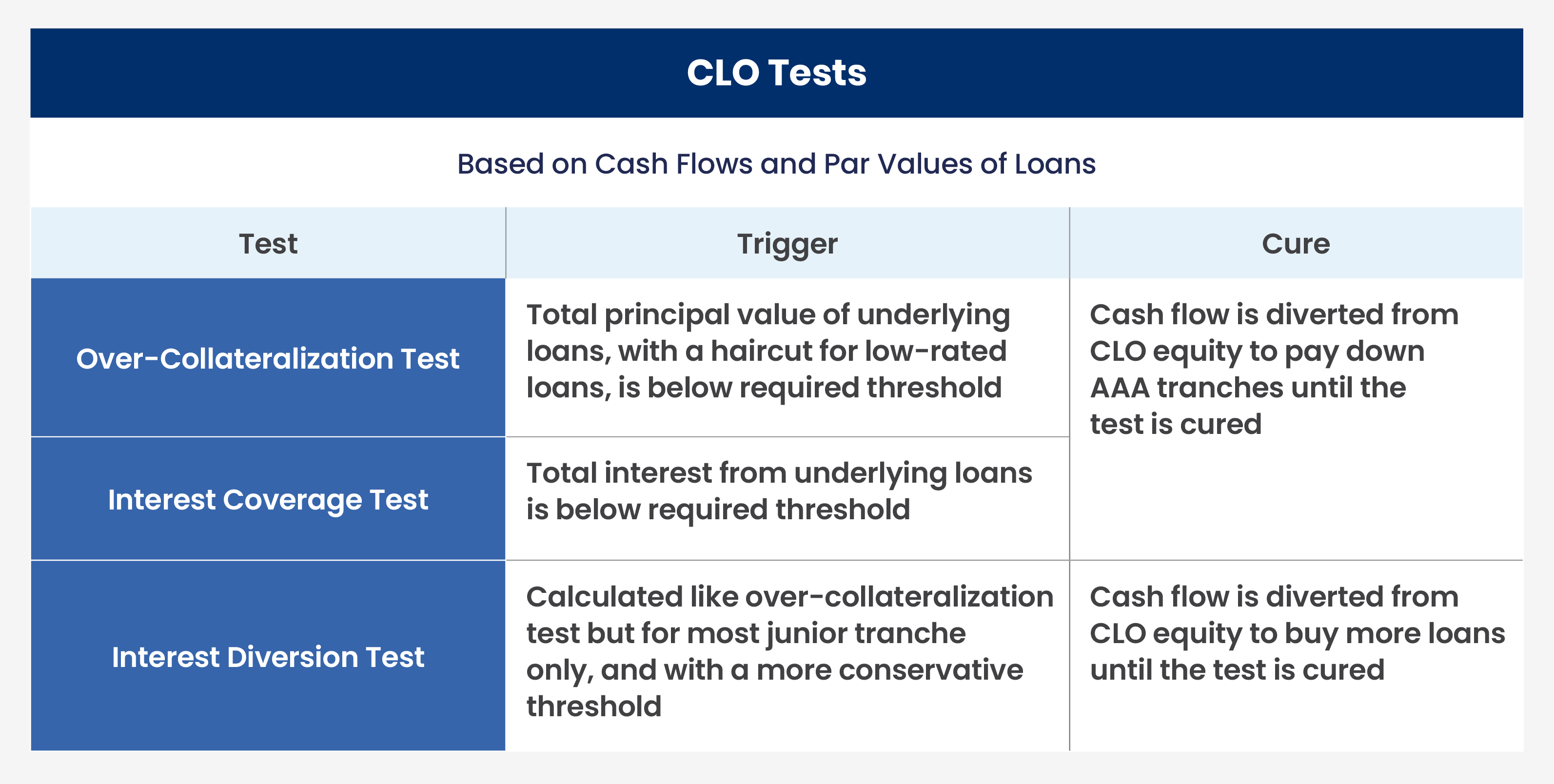

CLOs have been robust across market cycles, including the Great Financial Crisis (GFC) and most recently during the pandemic of 2020. A key reason for this is the “self-healing” nature of the CLO. CLO managers are required to test their collateral pools quarterly to prove they provide adequate coverage for payments of interest and principal. The three key quarterly tests include:- Overcollateralization test

- Interest coverage test

- Interest diversion test

These tests are triggered if a portion of the underlying loans default on their interest payments or if there are too many loans downgraded to CCC. If the pool of loans is stressed and does not meet the CLO’s over-collateralization or interest coverage tests, cash flow is diverted from CLO equity to start paying down the AAA tranches until the test is cured. In the case of interest diversion test breach, cash flows are diverted to buy more loans. This cash flow diversion strengthens the CLO, including the BB tranche. When interest diversion occurs, the CLO BBs receive their scheduled interest payment and benefit from the de-levering of the structure. Only when the CLO tests move back into compliance will cash flow to the CLO equity resume.

The “self-healing” mechanisms of the CLO structure defend against the worsening of portfolio fundamentals and help to protect the CLO mezzanine debt (as well as the other debt tranches). If portfolio credit fundamentals deteriorate, structural tests are triggered, and the CLO begins to de-lever and de-risk.

Non-Mark-to-Market Financing of CLOs

Loans in a CLO are generally carried at par for the above tests. CLOs do not apply mark-to-market tests to most of the loan collateral. Timely payment of interest and principal is what matters. Thus, CLO managers are insulated from loan market price volatility and are not forced to sell performing loans at inopportune times. For periodic over-collateralization tests only, defaulted, CCC-rated loans in-excess of the 7.5% concentration allowance, or low-priced loans (considered distressed by the market), are carried at market value.

The non-mark-to-market feature of CLO financing provides protection to the CLO structure as a whole, including BB tranches. This provides the CLO manager with the ability to actively manage the health of the loan portfolio during periods of volatility.

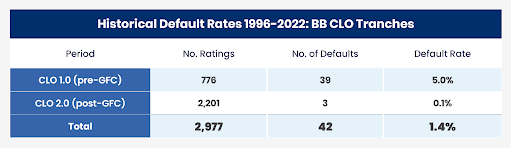

Minimal BB Defaults Over Time

As a result of the above protections, actual BB defaults have been minimal over time. According to S&P Global, only 42 out of 2,977 BB tranches have defaulted since they began tracking the data in 1996. Since the GFC, only 3 out of 2,201 BB tranches defaulted, a rate of 0.1%.6 The improvement reflects the extra credit protections of the CLO structure adopted by the industry after the GFC.

In comparison to the low default rates for BB-rated CLO tranches, the default rate of BB-rated U.S. corporate credit was 19.6% between 1981 and 2021.

Note that BB CLO debt tranches will accrue any missed interest payments in the form of deferred interest payments or additional par balance, called Payments-in-Kind or PIK. A limited number of CLO BB notes were “PIK’d” in the depths of the Covid downturn (to maintain payments to the BBB tranches) but eventually received all interest due.7

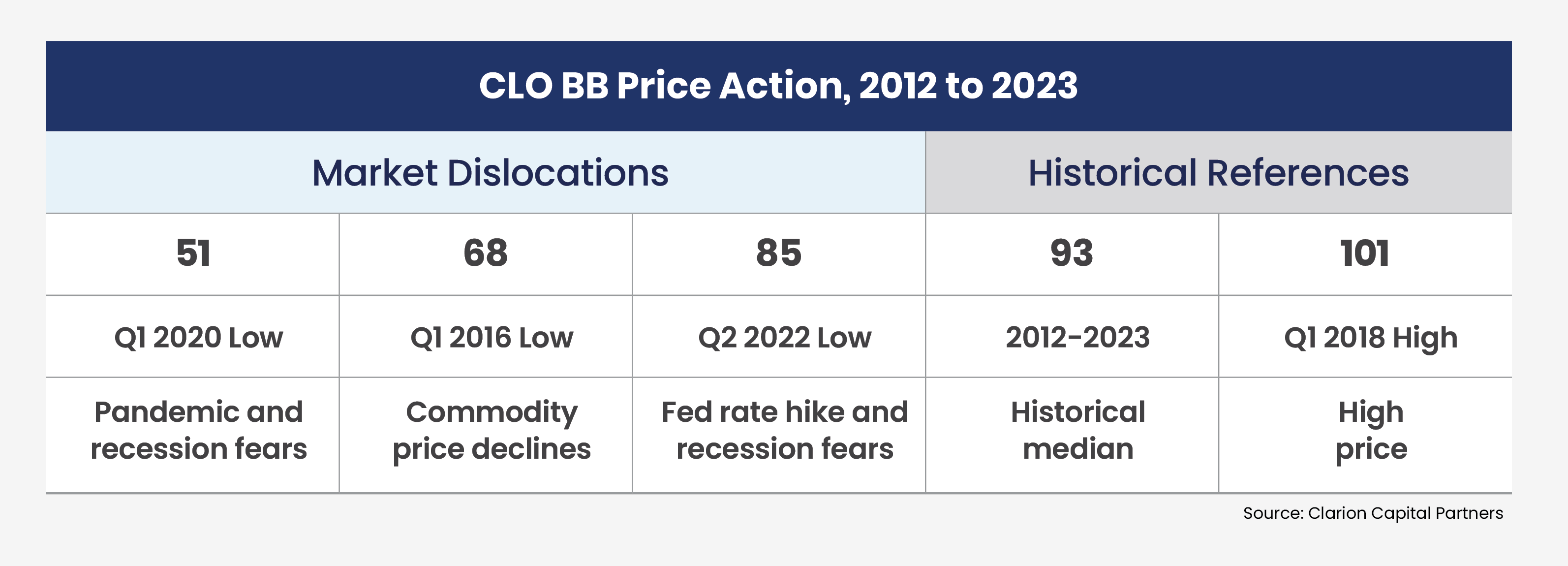

Opportunistic Investing in CLO BBs

At Clarion Capital Partners, we believe the most opportune time to invest in CLO mezzanine tranches such as CLO BBs is during market disruptions and during periods of volatility. During a downturn in credit or broader financial markets, mezzanine and BB tranches have historically traded off to levels well below par. We believe that these tranches have historically been oversold by the market. These opportunities allow agile CLO investors, like ourselves, to purchase these CLO tranches at significant discounts to the ultimately realizable par value.

These discounted trading prices on CLO BB tranches often have no connection to any fundamental problems in CLOs’ underlying loan portfolios, but rather are a result of forced liquidity needs at the sellers of those CLO securities. Hedge funds, a common investor in CLO BB tranches, have historically been forced sellers, facing high levels of investor redemptions during downturns.

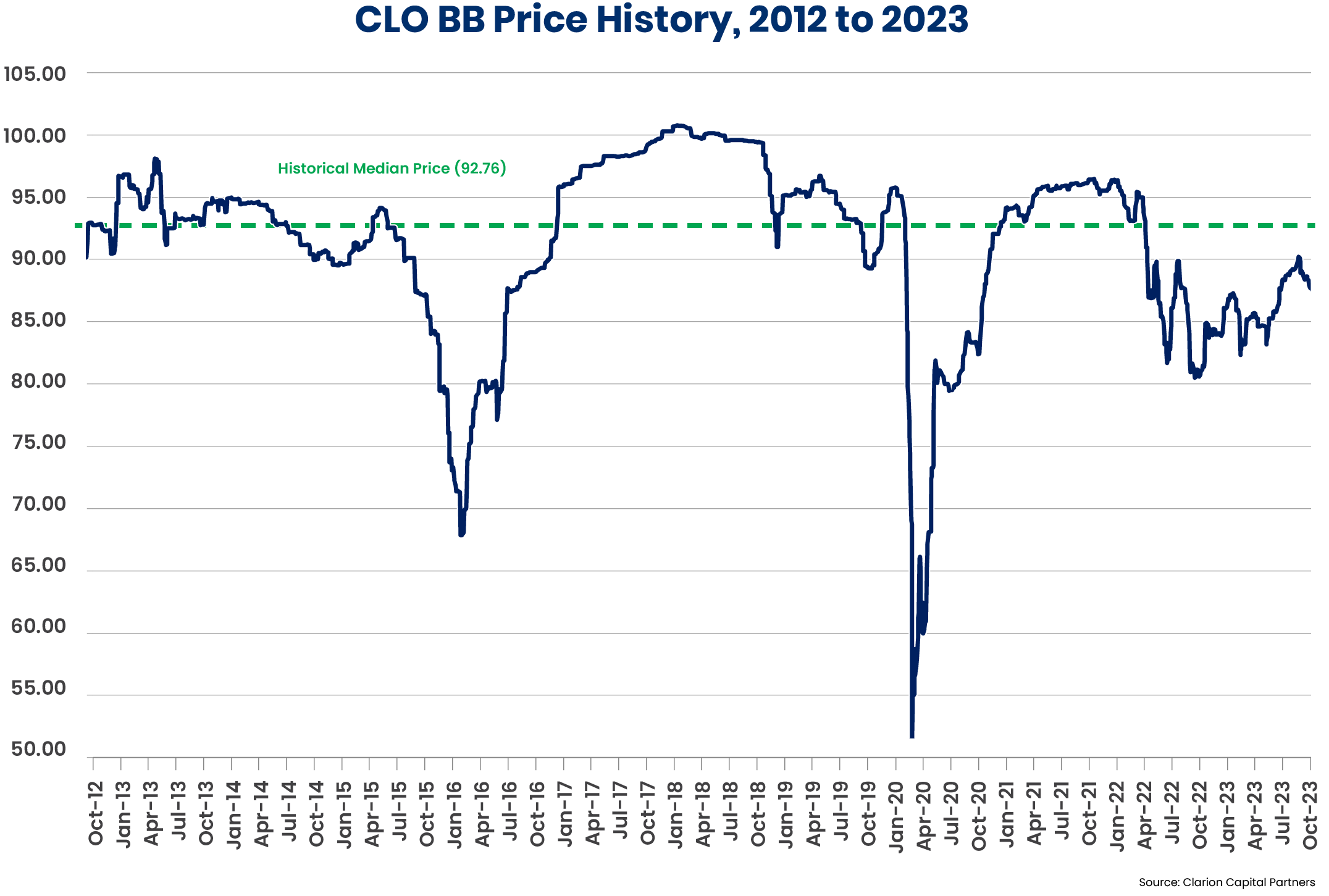

The chart below reflects how the average prices of CLO BB tranches can vary.

The summary below of the historical data highlights the trading opportunities of the last decade CLO BBs. After reaching each trough, discount prices returned to the long-term average and closer to par.

Selectivity is Key

Trading these price swings successfully is best accomplished through a disciplined approach. During a market downdraft, many CLO BB securities may appear to be bargains, but quality is still critical to the outcome. At Clarion Capital Partners, we seek what we consider to be the most attractive relative value among CLO BBs with a compelling risk-and-reward profile.Downside protection is paramount. We seek CLOs with more robust loan portfolios and defensive characteristics such as:

- Lower weighted average spreads, indicating more defensively positioned loan portfolios

- Higher market values for underlying loans, indicating stronger and more liquid loans

- High diversity scores, representing greater portfolio diversification among loans

- Few low-priced loans, meaning less distress in the underlying pool of loans

- Limited allocations to CCC rated loans, to minimize the number of loans close to default

These are just a few of the defensive characteristics we seek when pursuing CLO BB opportunities.

Risks of CLO BB Mezzanine Investments

Investors must be mindful of multiple risks when investing in CLO BBs. Key risks include, among others:- Volatility risk

- Default risk

- Downgrade risk

- Complexity risk

Volatility Risk

The price charts above illustrate the opportunity for buyers provided by major price movements. However, this volatility can be challenging for existing investors watching the value of their holdings decline (despite underlying fundamental values) or investors that may face liquidity needs or redemption pressures.

Default Risk

While infrequent, defaults may occur. Moreover, the default rate may increase significantly in a sustained economic downturn.

Downgrade Risk

Rating agencies may downgrade both underlying loans as well as specific CLO tranches, which can contribute to lower values and liquidity for the affected securities.

Complexity Risk

The structure, terms, documentation, and holdings of a CLO are complex. This is an asset class that can be navigated, however, by sophisticated investors that have a deep understanding of the CLO structure and industry and those who participate in this market on a daily basis.

Accessing CLO BB Mezzanine Investments

CLO BB tranches can be a compelling opportunity for opportunistic investors. However, these investments require specialized expertise for effective implementation and risk management. We believe the years of experience offered by the Clarion Structured Credit team is a resource for investors seeking to explore this asset class.

Learn More

To learn more about how to access CLO BB investments and Clarion Capital Partners’ approach to CLO investing, please contact us.

1. Evan M Gunter and Nick W Kraemer, “Default, Transition, and Recovery: 2022 Annual Global Leveraged Loan CLO Default And Rating Transition Study,” S&P Global, May 23, 2023. https://www.spglobal.com/ratings/en/research/articles/230526-default-transition-and-recovery-2022-annual-global-leveraged-loan-clo-default-and-rating-transition-study-12741307

2. J.P. Morgan Research, as of January 2, 2024.

3. J.P. Morgan Research, as of January 2, 2024.

4. Rachelle Kakouris, “In first blemish-free month of 2023, US leveraged loan default rate falls to 1.27%,” Pitchbook Leveraged Commentary and Data (LCD), October 3, 2023. https://pitchbook.com/news/articles/in-first-blemish-free-month-of-2023-us-leveraged-loan-default-rate-falls-to-127

5. LCD News, “Coronavirus crisis vs 2008: US leveraged loan distress, CLOs, credit quality,” S&P Global, March 26, 2020.

https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/coronavirus-crisis-vs-2008-us-leveraged-loan-distress-clos-credit-quality-57775508

6. Evan M Gunter and Nick W Kraemer, “Default, Transition, and Recovery: 2022 Annual Global Leveraged Loan CLO Default And Rating Transition Study,” S&P Global, May 23, 2023. https://www.spglobal.com/ratings/en/research/articles/230526-default-transition-and-recovery-2022-annual-global-leveraged-loan-clo-default-and-rating-transition-study-12741307

7. Shiloh Bates, CLO Investing: with an Emphasis on CLO Equity & BB Notes (Flat Rock Global, 2023), p. 164.

Tags:

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

Introduction Marc Utay, Founder and Managing Partner at Clarion Capital Partners, sat down with ION ...

“In the beginning … there were potential profits.” While “warehouse” may be a metaphor, the potentia...

Why have Collateralized Loan Obligations (CLOs) grown into a trillion-dollar asset class?