Part 1: Explore 3 Ways to Increase Potential Yields Through CLOs | CLO Equity

Why have Collateralized Loan Obligations (CLOs) grown into a trillion-dollar asset class?

Since their origins in the 1990s, CLOs have developed into a mature asset class with built-in risk protections that have been tested across multiple economic and credit cycles. CLOs demonstrated resilience in the Great Financial Crisis (GFC), the oil price crash and retail bankruptcy wave of 2015-2016, the pandemic-induced downturn of 2020, and more recently amidst the most aggressive rate hikes by the Federal Reserve in the last two decades.1

Across the ratings spectrum, CLOs offer higher yields than comparably rated fixed income securities, with low correlation to broader markets.2

Investors can select CLO tranches to match their preferred level of risk, from conservative to opportunistic. Among the opportunistic CLO tranches, investors currently receive double-digit yields.

In this series, we will cover the 3 highest-yielding segments of the CLO asset class for opportunistic and return-seeking investors:

- CLO Equity Investments

- CLO BB Mezzanine Investments

- CLO Warehouse Investments

This first blog will explore the high yields (and risks) of CLO equity investments.

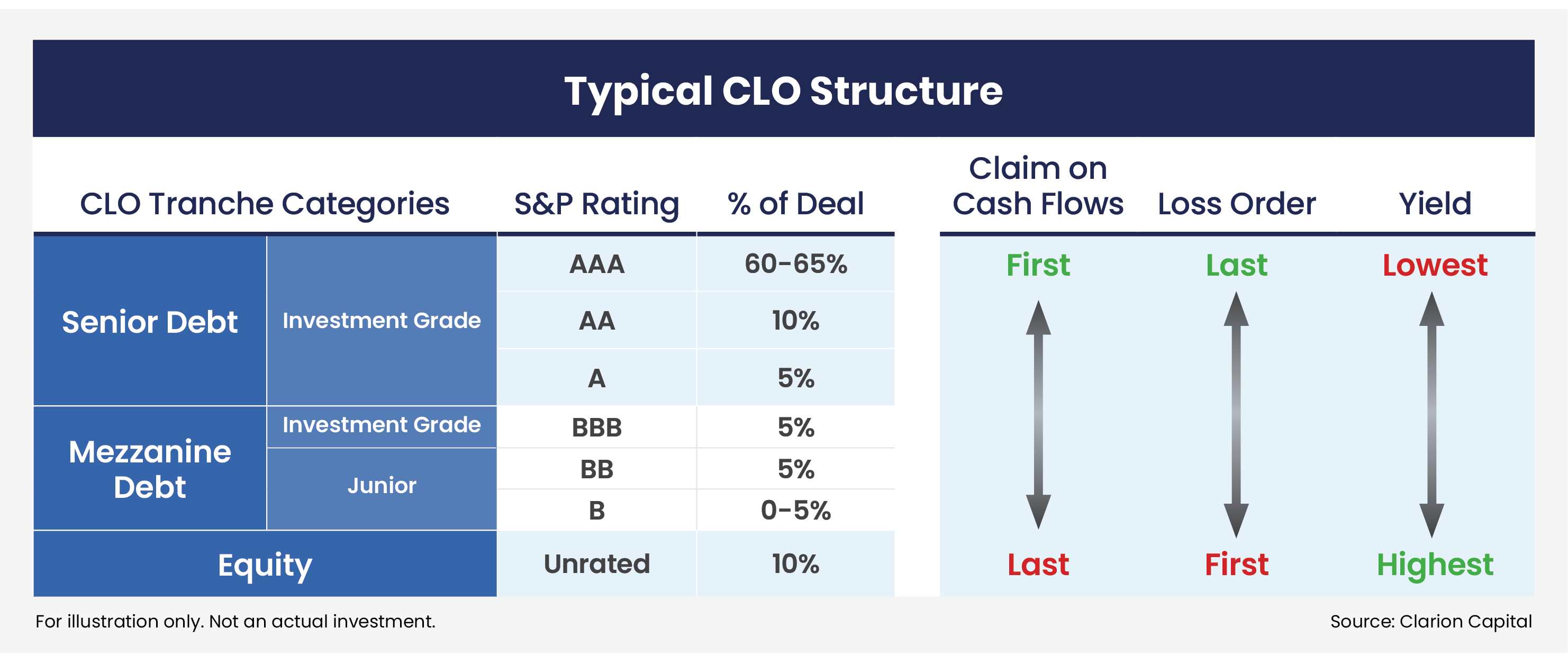

CLO Fundamentals

CLOs hold portfolios of senior secured, first lien, floating rate leveraged loans from major U.S. corporations. These portfolios are typically diversified across hundreds of issuers and dozens of industry sectors. A typical CLO is divided into five (and sometimes six) debt slices or tranches, and one equity tranche. The tranches are organized by seniority.

The most senior tranches have priority among all the tranches for payments of principal and interest, but the lowest yield. While the definition varies across the industry, Clarion Capital Partners defines senior CLOs as those rated AAA, AA, or A. According to S&P Global, there has never been a default among AAA CLOs, only one default among CLOs originally rated AA, and 5 defaults among CLOs originally rated A—among thousands of issues. Since the implementation of more stringent risk requirements for CLOs after the Great Financial Crisis (CLO 2.0), there have been no defaults among any investment grade CLOs rated from AAA to BBB.3

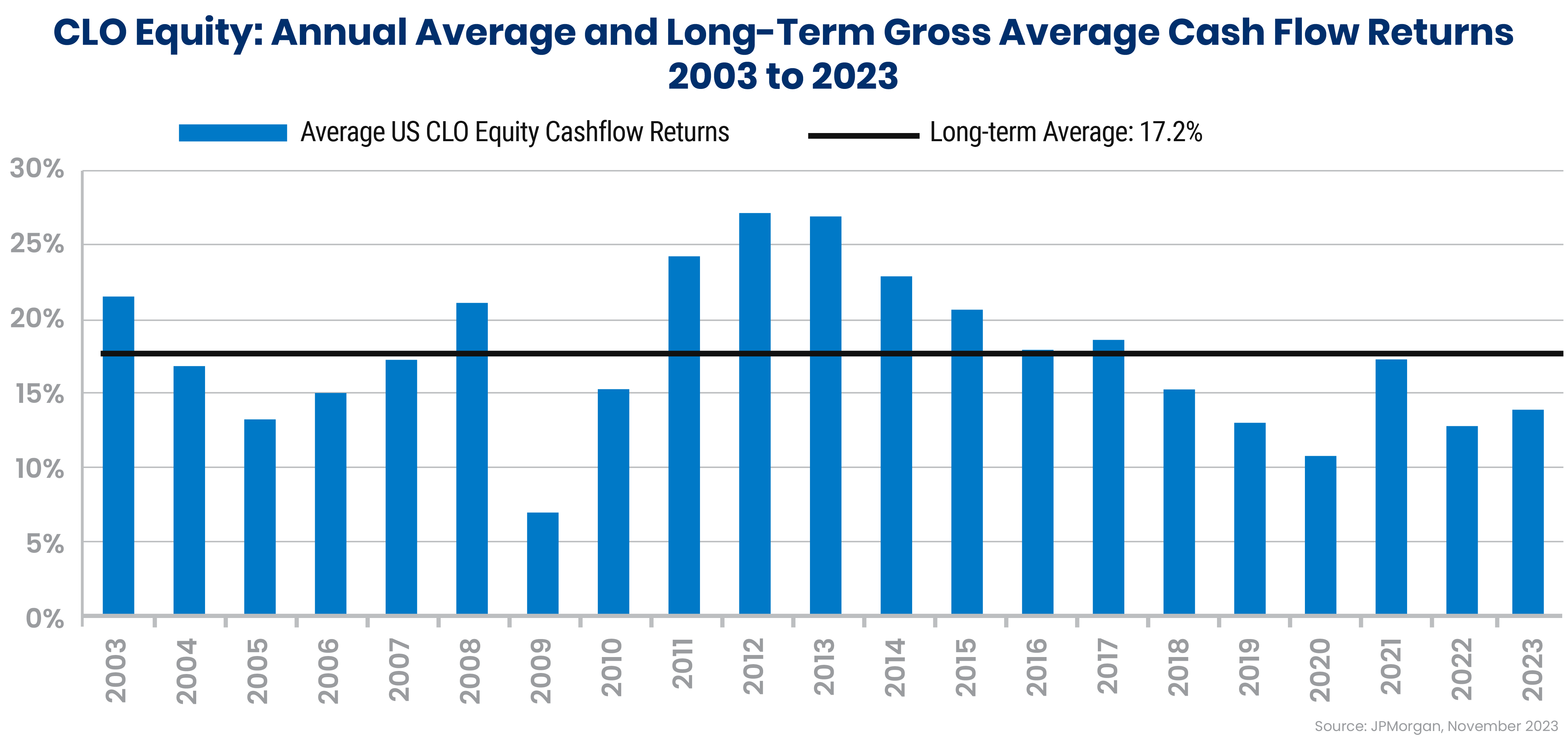

Conversely, the equity tranche, sometimes referred to as the “first loss” tranche, has the lowest priority and only receives the residual cash flow after all debt tranches are paid. For this higher amount of risk, the CLO equity investor is compensated with the highest potential return. Notably, the average cash flows over time for CLO equity has been 17.2%, according to JPMorgan.4

“The average cash flows over time for CLO equity has been 17.2%, according to JPMorgan.”

Between the senior tranches and CLO equity are the mezzanine tranches. Again, while industry definitions vary, Clarion Capital Partners defines mezzanine CLO debt as those rated BBB, BB, or B. (B-rated mezzanine tranches are very uncommon in most CLO structures.) While BBB tranches are considered investment grade, BB (and B) tranches are not.

While senior tranches are popular with banks, insurance companies, and institutional asset managers, mezzanine or junior tranches are popular with hedge funds and credit investors. During bouts of market volatility, junior mezzanine tranches may trade at significant discounts to par as investors seek liquidity or raise funds needed to meet investor redemption requests. These discounts represent a potential investment opportunity for nimble buyers, like ourselves, that seek to take advantage of the price dislocations, since prices have historically recovered when markets stabilized.

Keep in mind that the underlying borrowers are leveraged companies. B or B- is the most common rating for loans within CLOs,5 and both ratings are below investment grade. To mitigate this risk, diversification is critically important to CLO loan portfolios. Diligent and active risk management by the CLO manager are also key contributors for long-term CLO performance.

The CLO Yield Advantage

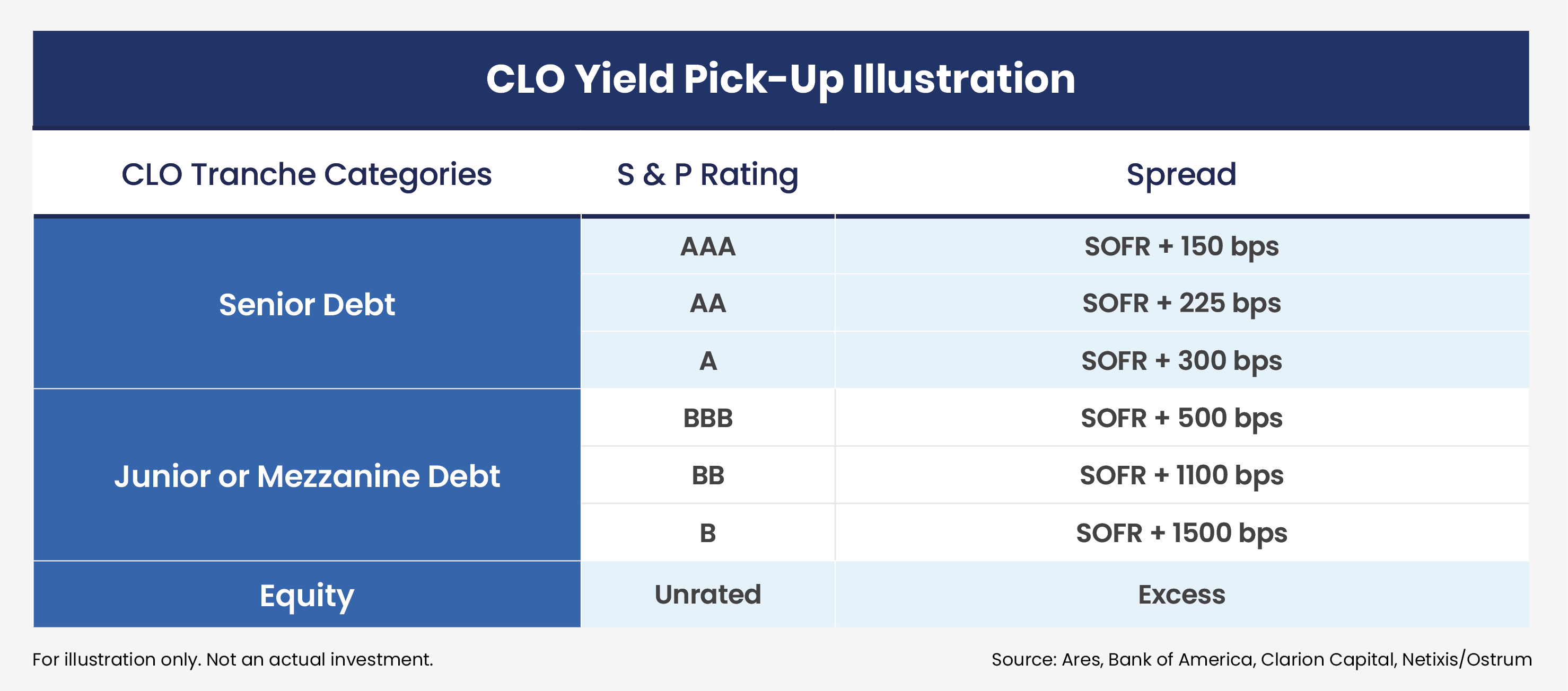

CLOs are popular with investors seeking extra yield. CLOs generally offer a yield premium relative to comparable instruments across each level of the rating spectrum. The perceived complexity of CLOs further contributes to the yield premium of CLO securities. Astute investors can capitalize on this perception and “complexity premium.”

Below is an illustration of the excess yield CLO investors may receive at each rating level. CLO yields are quoted as a spread above the Secured Overnight Lending Rate (SOFR), the global benchmark for short-term interest rates. In 2023, SOFR increased from approximately 4.3% to over 5.3%. Yields on CLOs rose to over 6% for AAA tranches and over 14% for B-rated tranches.

Keep in mind that CLO spreads will vary over time as markets evolve.

CLOs offer higher yields for additional reasons beyond perceived complexity. For example, CLO debt tranches have higher yields since they eventually become callable and subject to refinancing. Today’s CLOs are mostly structured with CLO debt tranches that are non-callable for 2 years from issuance. After that, these tranches can be refinanced or reset at the direction of the CLO equity investors, usually with consent from the CLO manager. A diversified portfolio of CLOs can reduce risk of any one deal being called while capturing the higher yields of CLOs overall.

CLO Equity Holds the Power and Enhanced Yield

The highest yielding (and riskiest) tranche of the CLO market is CLO equity. The long-term gross average cash yield for CLO equity was 17.2% from 2003 to 2023 (estimated net 12.6%6):

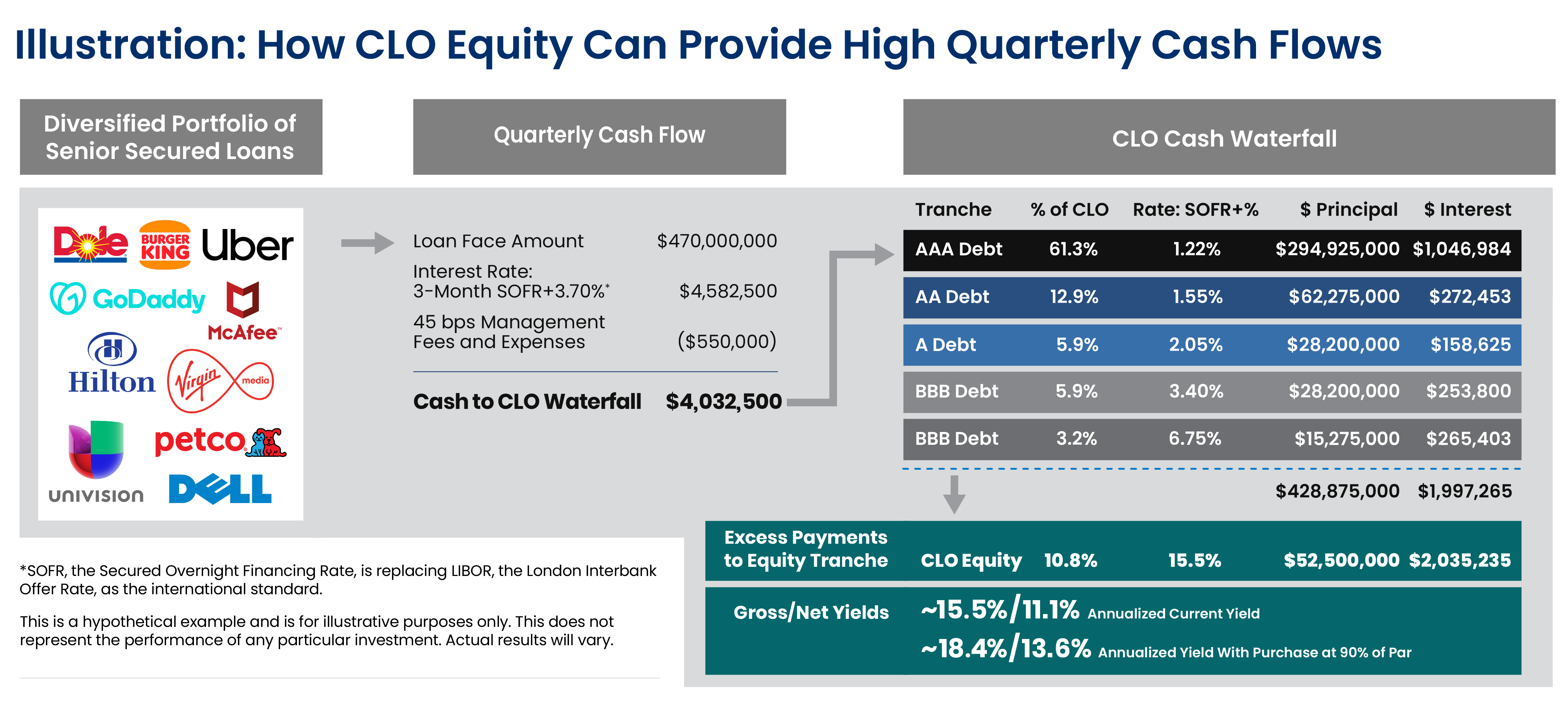

CLO equity has historically been able to achieve these returns over varying credit environments by leveraging the net excess interest received from the underlying loan pools after interest payments to CLO debt tranches. The potential return opportunity of CLO equity tranches is illustrated below:

Source: Clarion Capital Partners

Note: Illustrative example. Assumes an equity purchase price of 90% of par. Does not represent the performance of any particular investment. Actual results may vary. CLO equity investments are subject to high levels of risk. Net amounts reflect deductions for fund related expenses, management fees, and incentive fees. For fund-related expenses, ongoing annual expenses are estimated at $0.1 million. The assumed management fee is 1.65% annually with a 15% incentive fee over an 8% hurdle (with a 100% catch up).

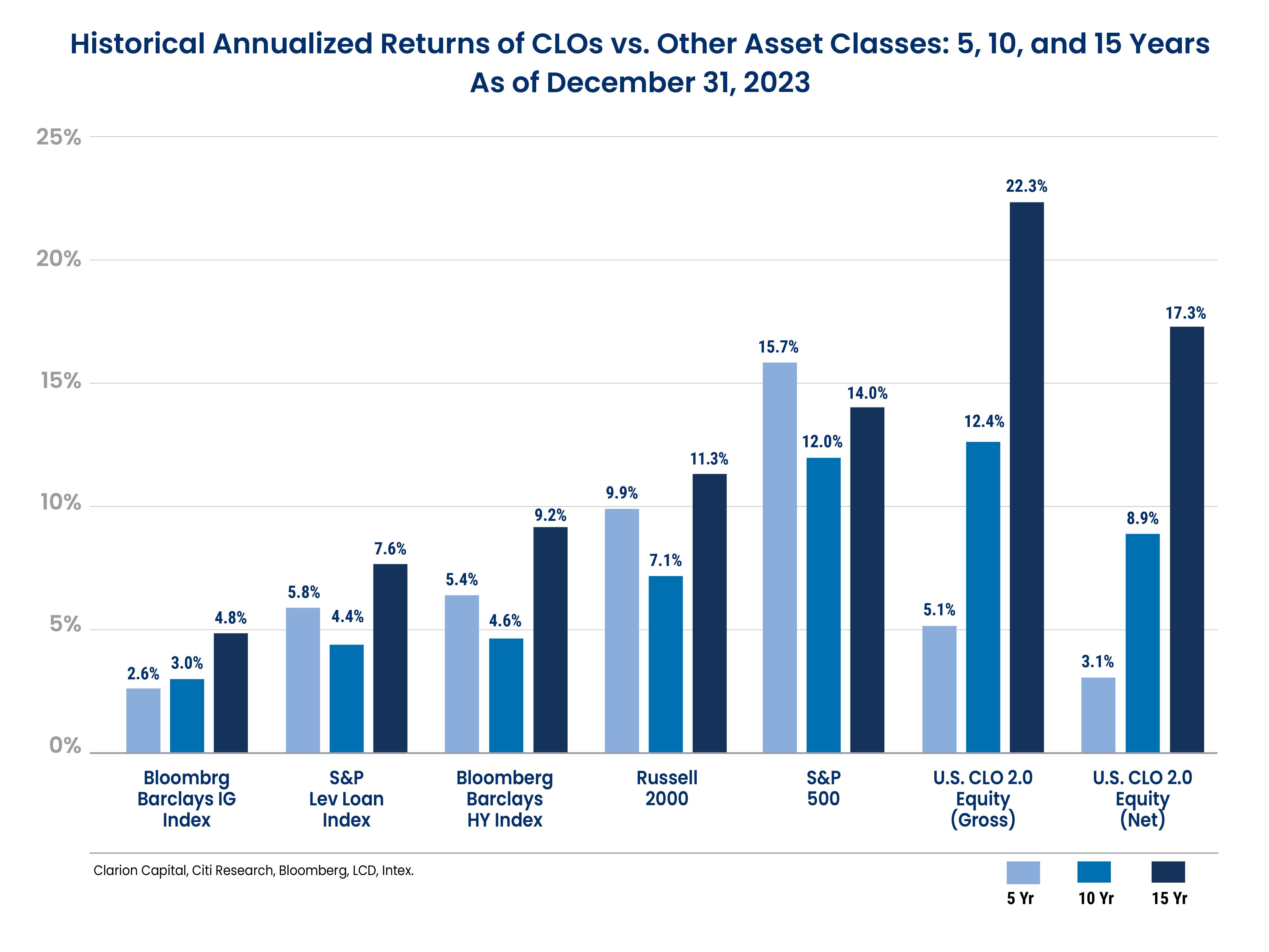

The higher relative cash yields of CLO equity contribute to long-term total returns. CLO equity (based on CLO 2.0 results since the GFC) has outperformed other major asset classes over the long-term on a total return basis:

The Risks of Higher Yields and Returns

While CLO equity investors benefit through enhanced cash yields and total returns, these investments come with additional risks. Remember that CLO equity is the first layer of a CLO to absorb the impacts of credit losses in the underlying loan portfolio. If too many underlying loans default, the cash flow to CLO equity may be impacted.

CLO equity may face a suspension of cash flows if the CLO overall fails to meet regular overcollateralization, interest coverage, and interest diversion tests. These tests are designed to protect income and principal payments across the CLO capital structure, and senior tranches in particular. If a CLO fails any of these periodic tests, cash flows must be diverted from CLO equity to redeem senior tranches or to buy additional collateral until the CLO collateral pool moves back into compliance. Then, cash flows to CLO equity can resume, with the strength of the CLO capital structure restored.

COVID Crisis: CLO Test

The COVID crisis provides a recent illustration of the risk inherent in CLO equity investments. In the early stages of the COVID crisis, many businesses were struggling. Some underlying borrowers were unable to make payments on their loans. As a result, 24% of CLO equity tranches temporarily needed to suspend payments to investors as CLO cash flows were diverted to support senior CLO debt tranches and restore the credit quality of the underlying collateral pool.7

Fortunately, this was temporary. As governments and central banks intervened with economic stimulus and market support, CLOs were able to quickly resume all their payments, including to CLO equity holders.

The COVID crisis highlighted the importance of investing with CLO managers who excel at risk management. At Clarion Capital Partners, none of our underlying CLO equity investments experienced full payment interruptions, even in the trough of the COVID crisis. In our observations, the managers who suffered the most tended to be those who took excess risk, or who invested in lower quality loans in an effort to augment yield. We had been concerned about potential credit risk in 2019—without any advance knowledge of a pandemic—and invested accordingly in advance of the downturn.

COVID Crisis: CLO Opportunity

The COVID crisis also highlighted how nimble CLO investors can profit amidst volatility. Broadly, prices tend to fall indiscriminately during a market retreat. This provides two specific opportunities:

First, CLO managers can trade loans to reduce risk (for example, by shedding loans in risky sectors) or to enhance exposure to loans that are still in favor. Agile managers can buy quality loans at a discount with higher yields, while anxious investors or those needing liquidity can sell. At Clarion Capital Partners, we seek to identify CLO managers who actively trade consistently and add value during these events and over time.

Second, investors can buy heavily discounted CLO positions during market breaks, when selling can become indiscriminate. We have historically seen this occur in lower-rated CLO mezzanine and equity tranches. For example, hedge funds may be subject to investor redemptions, compelling the funds to sell their holdings at the available price. Prices may also fall as buyers step back and await more stable markets. At Clarion Capital Partners, we take advantage of opportunities in periods of market turbulence.

As markets recovered after COVID, CLO equity holders enjoyed not only a high level of income, but significant price appreciation. Such periods demonstrate how CLO equity can become a call option on volatility.

How to Invest in CLO Equity

CLO equity is a specialized investment. Investors benefit from investing with a manager dedicated to this niche credit space when accessing this asset class. Investment managers, research analysts, and traders immersed in the asset class are prerequisites to success. A pooled approach also offers diversification. At Clarion Capital Partners, we are proud of the long history of our structured credit team as CLO equity investors.

Learn More

We’re happy to share our knowledge and field your questions. Please reach out to speak further.

1. “Federal Funds Effective Rate,” FRED, Federal Reserve of St. Louis, October 19, 2023. https://fred.stlouisfed.org/series/FEDFUNDS

2. Citi CLO Research, as of November 29, 2023.

3. Evan M Gunter and Nick W Kraemer, “Default, Transition, and Recovery: 2022 Annual Global Leveraged Loan CLO Default And Rating Transition Study,” S&P Global, May 23, 2023. https://www.spglobal.com/ratings/en/research/articles/230526-default-transition-and-recovery-2022-annual-global-leveraged-loan-clo-default-and-rating-transition-study-12741307

4. JPMorgan, November 2023.

5. Stephen Anderberg et al., “US BSL CLO And Leveraged Finance Quarterly: Navigating The Rough ‘CCCs’,” S&P Global Ratings, February 9, 2023, p. 6. https://www.spglobal.com/_assets/documents/ratings/research/101572430.pdf

6. Net amounts reflect deductions for fund related expenses, management fees, and incentive fees. For fund-related expenses, ongoing annual expenses are estimated at $0.1 million. The assumed management fee is 1.65% annually with a 15% incentive fee over an 8% hurdle (with a 100% catch up).

7. Chris Flanagan, Pratik Gupta, and Alexander Batchvarov, “July Reports: Improved OC ratios and lower equity payments,” Bank of America CLO Research CLO Weekly, July 24, 2020.

Tags:

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

Introduction Marc Utay, Founder and Managing Partner at Clarion Capital Partners, sat down with ION ...

“In the beginning … there were potential profits.” While “warehouse” may be a metaphor, the potentia...

CLO mezzanine investments offer some of the highest yields within the Collateralized Loan Obligation...