Part 2: The Importance of CLO Managers — Why CLO Equity Investors May Have an Edge in a Changing Interest Rate Environment

In an era of interest rate volatility, investors seek income opportunities with less sensitivity to interest rates.

When rates rise, floating rate instruments may see higher coupons and greater price support while fixed income investments generally fall in price due to duration risk and the consequence of lower fixed yields relative to what’s available in the marketplace. Conversely, when rates fall, conventional fixed income may increase in value, but floating rate instruments see their income decline. Thus, different parts of the fixed income markets may suffer (or benefit) from changing rates.

This is why income investors may seek to diversify their portfolios with instruments that exhibit less rate sensitivity.

In Part 1 of this 2-part blog series, we introduced spreads as a driver of returns for the equity tranche of Collateralized Loan Obligations (CLOs). CLO equity, with high potential cash flows and low interest rate sensitivity, may offer a distinctive edge in a changing interest rate environment.

Source of the Edge: Start With Spreads

There are two potential sources for the distinctive edge of CLO equity in a changing interest rate environment: spreads and CLO managers. We reviewed the importance of spreads between CLO assets and liabilities in part 1 of this two-part blog series. Let’s revisit the importance of these spreads, before delving into the important role of CLO managers in determining results for CLO equity investors.

The spread between the interest earned on the underlying collateral in a CLO and the cost of the CLO debt tranches drives the cash flows and returns for CLO equity. The underlying collateral (the CLO’s loan portfolio) and CLO debt tranches (the primary financing for the structure) are both floating rate. Thus, their yields tend to move up and down in tandem. Any interest rate changes tend to offset each other. The higher average yields of CLO assets above the debt financing produces a positive spread. These spread earnings are leveraged approximately 10x, since CLO equity generally puts up 10% of the capital to acquire the loan portfolio.

This structural leverage produces high yields and cash flows for CLO equity investors. The data from 797 CLOs which have gone full cycle to maturity illustrates how spreads and leverage combine to produce a compelling investment opportunity in CLO equity1:

Source of the Edge: CLO Managers Are Critical

The success of a CLO manager in overseeing the CLO structure and the underlying loan collateral pool is key to the returns achieved by CLO equity managers over the life of a CLO.

What happens to the CLO collateral pool over time determines how much cash flow CLO equity investors ultimately receive. Over the multi-year life of a CLO, leveraged loans, with average ratings below investment grade, may suffer defaults. How well a CLO manager manages this risk is paramount. Markets may go through credit cycles and bouts of volatility: will a manager capitalize on opportunities created by credit cycles and market volatility or will a manager’s portfolio suffer?

Top Quartile vs. Bottom Quartile

The market environment across the life of a CLO and manager skill may determine the ultimate outcome for CLO equity investors. Manager quality and effectiveness is critical. The dispersion of returns between top quartile and bottom quartile managers is significant in the CLO universe, as illustrated below. A 7% to 10% difference per annum is common between top and bottom quartile managers. Some vintage years show even more divergence2.

Notably, performance winners among CLO managers tend to repeat. An analysis of manager persistence by Santander revealed that “managers with a deal in the top, middle, or bottom third of vintage IRR tend to have a following deal that also performs in the same tercile of its vintage.”3 Approximately half the deals in the top third were followed by another deal in the top third for a CLO manager. The middle and bottom terciles also showed a tilt to deal-to-deal ranking persistence.

Potential Consequences?

What happens if a CLO manager faces a difficult cycle and does not manage it well? CLO equity investors will see their income decline and may suffer losses if a disproportionate share of underlying loans default.

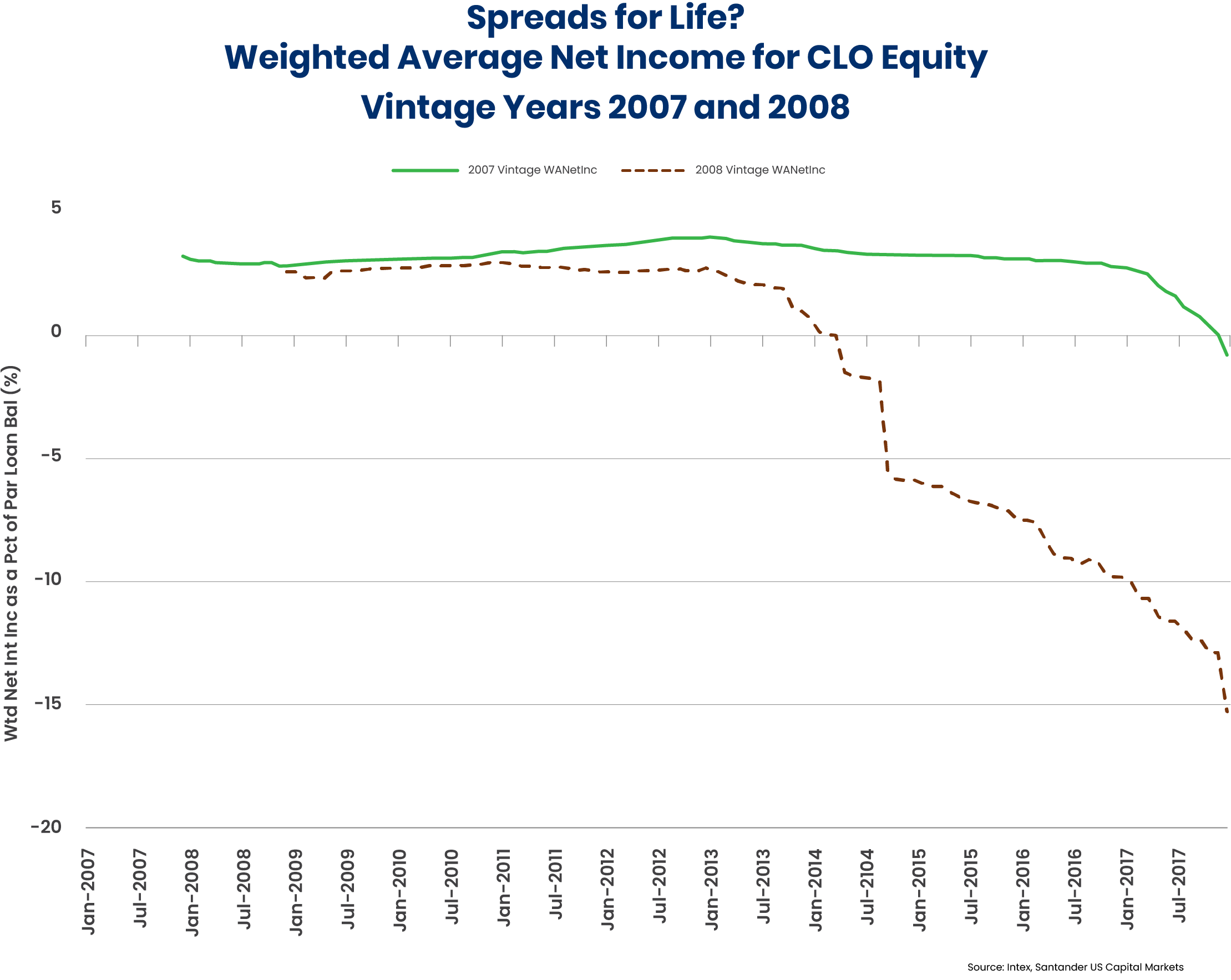

The graphic below illustrates how the positive spread of CLO equity may endure or evaporate based on:

- Credit market conditions across the life of a CLO

- Manager skill

Note how the CLO spreads may be positive or even turn negative based on the performance of the underlying loan portfolio.

The top line of the chart shows how average spreads remain positive for nearly the entire life of CLOs from the 2007 vintage year. The spread approaches zero as underlying loans mature, CLO debt tranches are paid down, and the CLO winds up operations.

A less favorable period followed for CLOs issued in vintage year 2008. Spreads turned negative for the average CLO of that vintage approximately six years after issuance, reflecting an increasing level of troubled loans and defaults. Losses of principal offset interest income. A negative credit cycle, driven by a recession or a sustained rise in financing costs, can negatively impact results for CLO equity investors.

The illustration above shows the critical importance of managing the credit quality of each holding in the underlying loan portfolio for the entire life of a CLO.4

Most Impactful Factors

The driving factors of CLO equity performance are related to manager effectiveness, not the absolute level of interest rates. The top five variables impacting the IRRs on CLO equity according to Santander U.S. Capital markets are:

1. Weighted Average Cost of Capital

A CLO manager must be able to negotiate and structure favorable terms when issuing CLO debt. Also, a manager must take action to call, reset, or refinance a CLO when financing rates decline.

2. Initial Leverage

The degree of leverage is important to CLO equity, both in driving cash flows and total returns. Higher leverage can produce higher returns for CLO equity. The manager must find a balance between the additional leverage and the additional risk.

3. Failed Tests

“Don’t screw up,” is a simple axiom for all risk takers. The CLO structure requires regular tests of the underlying loan portfolio to assure that the portfolio is sufficiently robust to pay interest and principal on all its debt obligations. If the portfolio fails one of the required tests, cash flow is diverted from CLO equity to pay down senior debt tranches or buy new loans for the collateral pool until the test violation is cured. Suspending cash flow to CLO equity can be expensive for CLO equity investors.

A breach of collateral or interest coverage tests are not uncommon for CLOs. Out of 797 completed CLOs, 52% failed an over-collateralization test for an average of 6.4 months across the life of the CLO.5 During periods of credit distress, the likelihood of test breaches tends to rise across the CLO universe as underlying borrowers begin to face business or financing difficulties. To outperform, managers must avoid failing CLO collateral coverage tests, interest coverage tests, and interest diversion tests. If a failure occurs, a manager must cure the violation as quickly as possible.

At Clarion Capital Partners, we place a high significance on identifying managers who maintain the quality of their loan portfolios and avoid failing the required tests and suspending cash flows to CLO equity. We seek to avoid managers who stretch for yield by buying low-rated or low-quality loans; the extra income is at risk of being lost amidst a test failure and suspended CLO equity cash flows.

4. Weighted Average Spread

As noted above, this spread is the difference between the interest income from the loan portfolio and the interest costs of the CLO debt tranches. The spread is then magnified through leverage for the benefit of the CLO equity. A CLO manager must optimize spreads not just at inception but across the life of the CLO. Once again, active management is critical.

5. Information Ratio

Manager alpha can make a significant difference for CLOs, which have actively managed loan portfolios. The leveraged loan universe offers a robust and widely recognized index for comparison: the Morningstar/LSTA Leveraged Loan Total Return Index. The average full-term CLO reflected 5 basis points per month of excess returns and a monthly information ratio (a measure of excess manager returns adjusted for risk) of 0.13.6 Leveraging this excess return over the life of a CLO can add significantly to the returns of CLO equity.

These five important contributions to CLO equity returns by CLO managers reveal how CLO equity can demonstrate an edge in a changing interest rate environment.

50 Year Storm: 2022 Interest Rate Mismatch

The drivers of CLO equity returns are generally independent of changing interest rates. However, there may be periods when changing interest rates have an impact. In 2022, Fed rate hikes had an unexpected but temporary impact on CLO equity cash yields. The phenomenon was driven by the inherent mismatch between the leveraged loans that serve as CLO assets and the CLO debt tranches which comprise CLO liabilities. CLO assets (portfolios of leveraged loans) generally use 1-month base rates, while CLO debt tranches generally use 3-month base rates and reset at different times.

When the Fed raised rates rapidly, the spread gap between 1-month and 3-month rates widened to 76 basis points from the long-term average of 13 basis points. The quarter-over-quarter shift in base rate curves in 2022 was greater than any level witnessed over the last 50 years. This widening reduced cash yields on CLO equity from approximately 23% to 14% in 2022—a high cash yield regardless. This widening proved to be temporary as gross cash yields on CLO equity exceeded 20% once again in 2023 as the short-term interest rates narrowed back to historical levels.7

Learn More

CLO equity provides a differentiated investment opportunity for investors seeking an edge amidst fluctuating interest rates. However, CLO manager selection is paramount. Reach out to Clarion Capital Partners to learn more about our CLO manager selection process and results.

1. Steven Abrahams and Caroline Chen, “A Quick Guide to CLO Debt and Equity: Chapter V, Evaluating CLO Equity”, Santander, 2023. https://portfolio-strategy.apsec.com/a-quick-guide-to-clo-debt-and-equity/chapter-v/

2. Abrahams and Chen

3. Abrahams and Chen

4. Abrahams and Chen

5. Abrahams and Chen

6. Abrahams and Chen

7. “CLO Base Rate Mismatches,” internal analysis, Clarion Capital Partners; JPM Research and St. Louis Fed (FRED), as of July 7, 2023

Tags:

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

Introduction Marc Utay, Founder and Managing Partner at Clarion Capital Partners, sat down with ION ...

“In the beginning … there were potential profits.” While “warehouse” may be a metaphor, the potentia...

CLO mezzanine investments offer some of the highest yields within the Collateralized Loan Obligation...