Part 3: Explore 3 Ways to Increase Potential Yields Through CLOs | CLO Warehouse Investments

“In the beginning … there were potential profits.”

While “warehouse” may be a metaphor, the potential profits from investing in a CLO warehouse can be significant.

The CLO warehouse is where the CLO manager begins to build the CLO’s loan portfolio. CLO investors who participate in warehouse investments are compensated for getting in on the ground floor of the CLO creation process.

These initial investors seek net double-digit rates of return.

Financing CLO Formation for High Potential Yields

The CLO manager typically secures two types of financing to acquire the leveraged loan portfolio for a new CLO. Most of the funding generally comes in the form of a revolving loan from a bank, which generally provides 80% to 85% of the financing. To secure this line of credit, one or more anchor warehouse equity investors provide the balance in the form of equity capital. Equity capital and debt financing are drawn as the CLO manager purchases or “ramps” the portfolio of loans.

Warehouse equity investors seek gross returns in the mid-to-upper teens (net low-to-mid teens). In exchange for the risk, the investor receives a leveraged return, typically 4x debt-to-equity (or higher), on the ramping portfolio of loans. Customarily, warehouse investors will have the option to roll their equity capital in the completed CLO (with 10x leverage) after the deal has closed. While less common in recent years, some warehouse equity investors will choose to exit the deal upon the issuance of the CLO.

Chapter 1: A CLO is Born

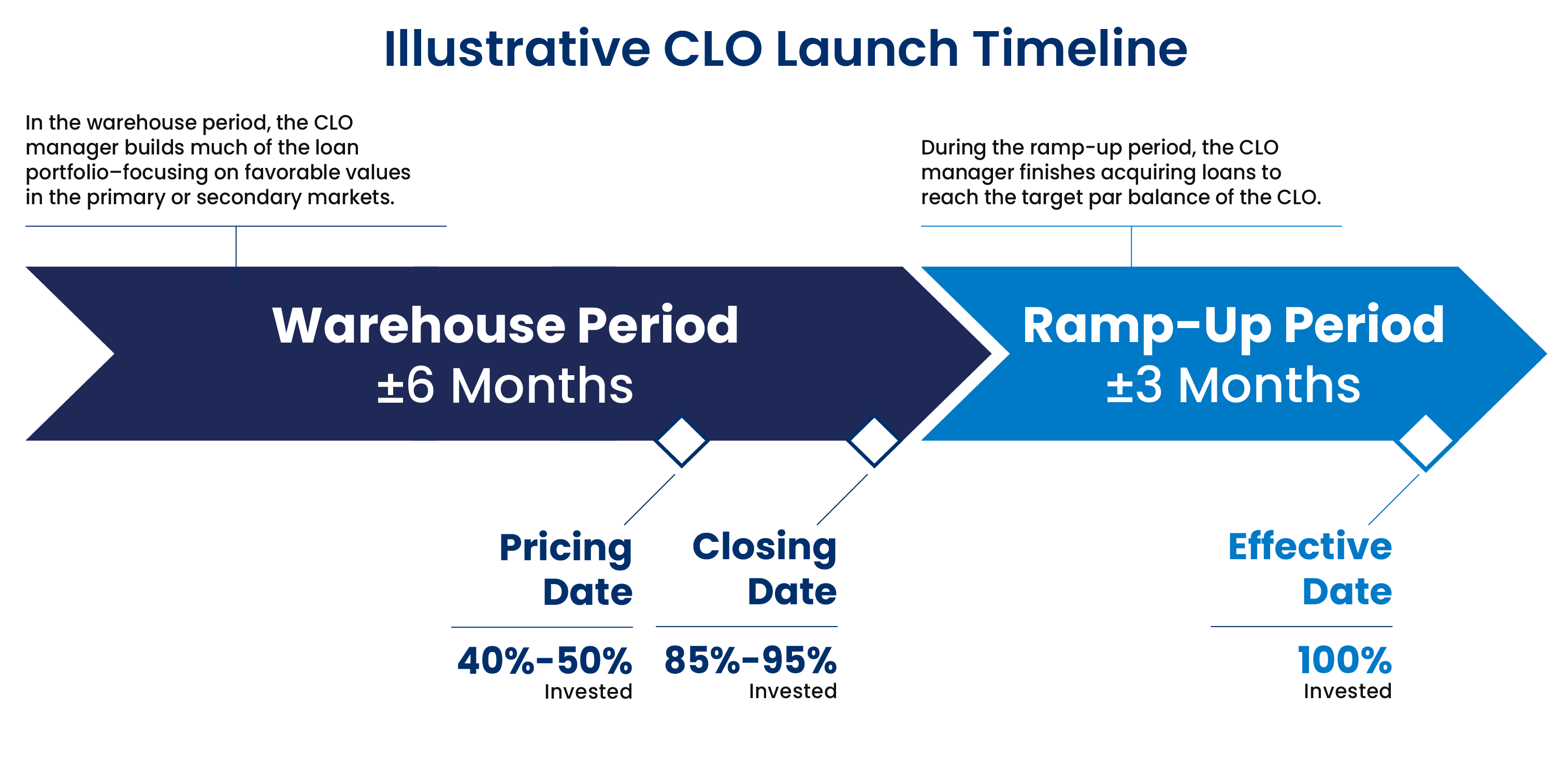

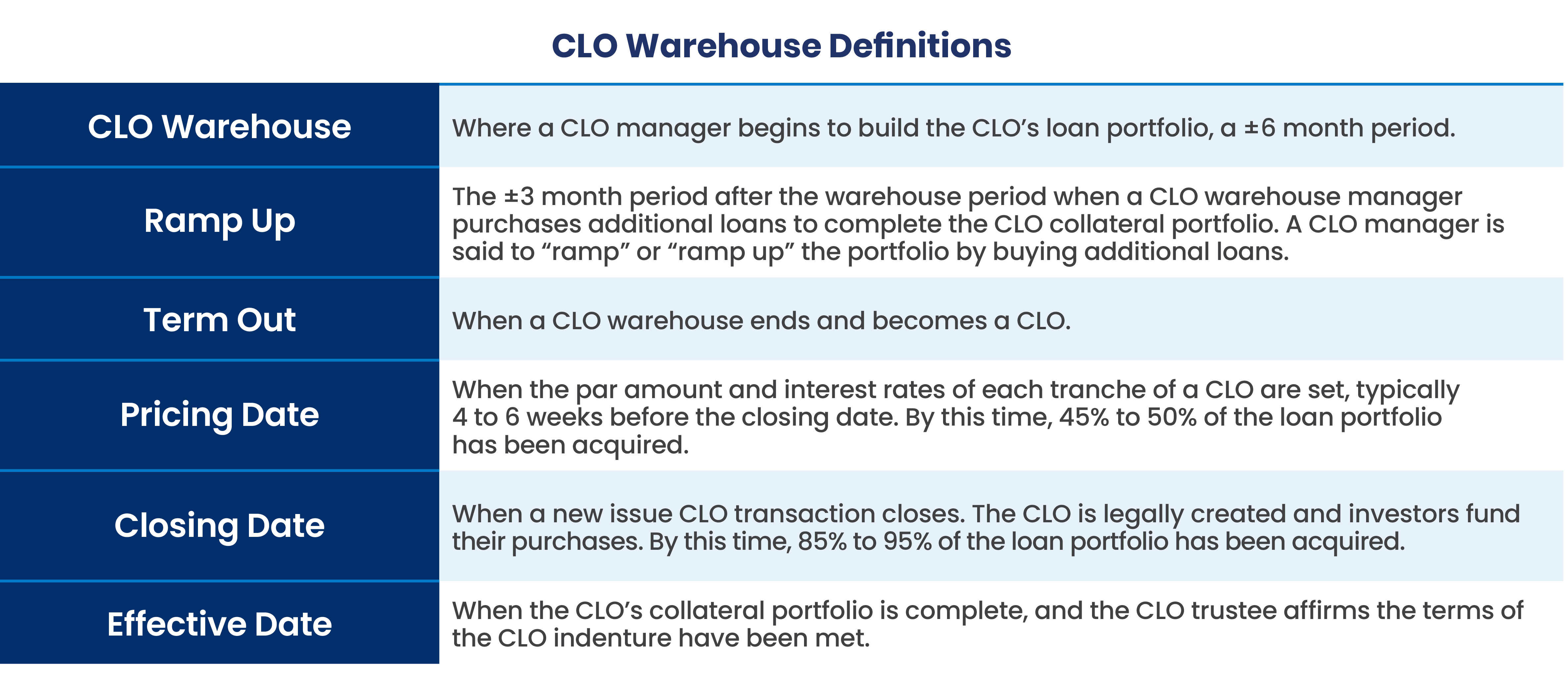

Understanding the lifecycle of a CLO is fundamental to understanding CLO warehouse investing. CLOs generally start with the opening of a warehouse, during which the CLO manager begins acquiring loans. The CLO manager builds the warehouse portfolio up to a target total value.

Warehouse Period—6 Months (Range: 3 to 9+ Months)

During the warehouse period, commonly six months but potentially shorter or longer, the CLO manager acquires a significant portion of the loans to be used in a new issue CLO’s portfolio. The CLO manager will often navigate the current credit markets to acquire what they believe to be the best loans across the primary (new issue) market, the secondary market, or a mix of both. A methodical approach to portfolio construction during the warehouse period enables a CLO manager to build a well-diversified loan portfolio. A methodical approach also helps the manager achieve the desired loan portfolio characteristics and meet the required collateral quality criteria of a CLO. Although the intended warehouse period is generally six months, a prudent CLO manager may extend the timeframe in response to market conditions.

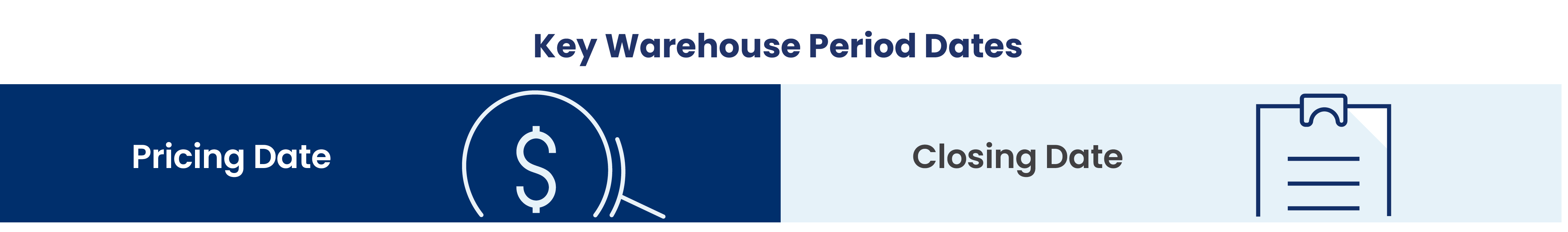

There are two key dates in the warehouse period:

Pricing Date

The pricing date typically occurs four to six weeks before a new issue CLO is issued. On the pricing date, the CLO manager and the CLO investors agree to several key provisions:

At the pricing stage, the CLO arranger will also obtain ratings for the notes in each tranche from one or multiple rating agencies. (The CLO arranger is typically a large investment bank that is selling the CLO tranches to investors and structuring the offering. The arranger will also provide financing for the warehouse and work with the CLO manager who builds and manages the portfolio of loans within the warehouse.)

Closing Date

Four to six weeks after the pricing date, the transaction closes and the CLO is legally created on the closing date. Investors fund the purchase of their CLO notes. The CLO manager will utilize those funds to purchase the specified loans from the warehouse at cost. After the closing date, CLO investors begin to receive their interest payments starting on the CLO’s first scheduled payment date, typically 6 to 9 months from the closing date.

Ramp-Up Period—3 Months (Range: 1 to 4+ Months)

A CLO ordinarily does not close with a “fully ramped” loan portfolio at the end of the warehouse period. After the closing date, the CLO manager will continue to purchase loans to reach the targeted loan portfolio par value of the transaction and achieve a “fully ramped” portfolio.

The ramp-up period gives the CLO manager more time to purchase remaining loans. This flexibility enables the CLO manager to construct a diversified loan portfolio that meets their investment strategy and style. Depending on market conditions, the CLO manager may have opportunities to acquire loans at a discount. This can potentially build par value within the CLO portfolio (“par build”) and increase the interest-earning potential of the CLO loan portfolio through additional assets.

Once the loan portfolio reaches its target size, the CLO is said to be “fully ramped.” After the ramp-up is complete, the CLO manager also begins the monthly tests that monitor and ensure the portfolio's ability to cover its interest and principal payments.

The conclusion of the Warehouse and Ramp-Up periods bring the CLO to another key date:

Effective Date

The CLO’s collateral portfolio is complete. Any remaining purchases required to reach full deployment of the cash must be completed prior to the effective date, which typically occurs within several months of the closing date. At this time, the CLO trustee will report the underlying metrics of the loan portfolio along with a full list of holdings to all CLO investors. Additionally, the Trustee will test and affirm that the underlying loan portfolio metrics and concentrations meet all the collateral requirements as governed by the CLO’s indenture.

Life After Launch

Once a CLO is launched, the reinvestment period continues for three to five years. During this time, the CLO manager actively manages the portfolio. The trustee also pays interest to the debt tranches according to their stated spread, using the cash flow generated by the loan portfolio.

Chapter 2: Risks of a CLO Warehouse Investment

Default Risk

Any loan default would be a significant risk. If a loan held in the warehouse were to default, it would no longer be eligible for the new issue CLO; a defaulted loan cannot be transferred into the CLO at the closing date. Any losses from a loan default in the warehouse will result in losses to the warehouse equity investors – the first loss capital of the facility.

Loan defaults during the warehouse period are a low probability, however. The short-term nature of the warehouse and the desire for collateral managers to maintain a higher quality loan portfolio during this phase help mitigate the risk. Managers will typically hold higher-rated, single-B loans and no low-rated, triple-CCC loans. Moreover, CLO managers perform thorough research and due diligence prior to acquiring any loan to reduce default risk.

Timing Risk

Timing is another risk for CLO warehouse investors. While the CLO manager is purchasing leveraged loans, the actual date of the CLO’s formation is unknown. The CLO manager must work with the CLO arranger (also the warehouse financing provider) and the warehouse equity investors to determine when to create the CLO. Most of the time, the interests of the parties are aligned. However, in more volatile credit markets, the interests of these parties may diverge. In challenging credit markets, CLO debt may be priced at high interest rates (spreads), and warehouse equity investors may find better economics by remaining in the warehouse until rates and CLO liability costs are more favorable.

The cost of delaying a CLO “term out” can potentially compound, forcing the liquidation of the CLO portfolio at the end of the warehouse period. This can lead to the risk of lower than anticipated returns in the warehouse investment.

Case Study: Challenging Times in 2022

Periodically, a challenging investment environment can delay the launch of CLOs with open warehouses.The volatile markets of 2022 illustrate what may happen. By the third quarter of 2022, a high number of CLO warehouses that began acquiring loans in 2021 and early 2022 were facing delays. At the end of that period, over 50% of warehouses had been open for more than nine months, compared to 9% at the beginning of the year.1 These delays occurred in tandem with the Fed’s aggressive rate hike, an increase in market volatility, the war in Ukraine, the impact of inflation, and mounting U.S. recession fears. The consequence: CLO debt had to offer higher yields to compensate investors. Higher CLO debt costs inevitably reduce the yields to the underlying CLO equity.

Warehouse equity investors faced difficult choices due to the market headwinds of that time:

- “Term out” into a new issue CLO with lower-than-expected CLO equity returns

- Extend the warehouse financing facility at a higher rate and wait for a more accommodating CLO new issue market

- Liquidate the warehouse with mark-to-market losses from the loans which were now trading at lower prices2

Since the trough of 2022, the loan and CLO markets have stabilized and CLO warehouses have since returned to more normalized timeframes.

Chapter 3: Accessing and Optimizing CLO Warehouse Investments

CLO warehouse equity investing is accessible only to select industry participants with deep relationships in this specialized sector. This elite group seeks a variety of benefits:

Exclusive Access

Typically, a professional CLO equity investor, such as a structured credit fund, provides capital to one of their preferred CLO managers. These CLO managers work with a limited group of knowledgeable industry participants. In turn, those who invest with the professional CLO equity investors have the opportunity to share in the benefits.

Optimizing a Warehouse Investment

CLO managers will communicate and collaborate with their sophisticated warehouse equity partners. They will discuss what strategies to deploy in the current market environment. They will share their insights on future market developments. This dialogue helps to align all parties in the process of creating a diversified loan portfolio for the long term. This process also sets the stage for a successful “term out” of the CLO warehouse and launch of the CLO.

Based on market conditions, CLO managers will be opportunistic and strategic with purchases for the warehouse loan portfolio. They will often pivot between new issue loans and opportunities in the secondary loan markets.

Source of Potential Value

Primary Market Focus

Usually, CLO managers prefer to purchase leveraged loans methodically in the primary market. New issues are often offered with an original issue discount (OID) as an inducement to buyers. New issue loans are also typically higher in credit quality with potentially fewer problems or issues than secondary market loans. The primary market also allows collateral managers to ramp up their warehouses more efficiently with access to larger allocations.

Secondary Market Focus

There are times when the secondary loan market may offer significant value, particularly during bouts of market volatility or distress. At such times, CLO managers may find a window of opportunity to ramp up new CLO warehouses by buying discounted loans in the secondary market. The CLO manager may be able to buy high-quality loans well below par value with the potential for both higher yields and price appreciation. The higher yields result from buying at a discount. Capital appreciation can follow when loan prices move back towards par.

If the secondary market opportunity is strong (and loans are trading below their par value), the CLO manager may have the option to move fast and form a CLO without having ramped a loan portfolio ahead of time in a warehouse. In this case, the CLO manager may use a “print and sprint” approach. “Print” refers to pricing and placing all of the CLO’s debt tranches. “Sprint” means buying and ramping up a full loan portfolio quickly. The market conditions allow the manager to form a CLO, then seize the opportunity to quickly assemble its loan portfolio and limit the drag of uninvested cash on the results for the CLO equity investor.3

Accessing CLO Warehouse Investments

CLO warehouses are an interesting way for CLO equity investors to enhance their portfolios, but such investment opportunities are limited. While institutional investors and fund managers can invest in a wide range of CLO equity new issues or secondary market purchases, warehouse opportunities are available to few CLO investors.

Only a small number of sophisticated CLO market participants have access to CLO warehouse investments. Fund investors can participate by investing alongside these long-tenured industry players.

Learn More

To learn more about how to access CLO warehouse investments, as well as Clarion Capital Partners’ approach to CLO warehouse investing, please contact us.

1. Caroline Chen, “An overhang of aging warehouse should leave CLO spreads soft,” Santander US Portfolio Strategy, October 28, 2022. https://portfolio-strategy.apsec.com/2022/10/28/an-overhang-of-aging-warehouses-should-leave-clo-spreads-soft/

2. Chen

3. Bates, p. 108

Tags:

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

Introduction Marc Utay, Founder and Managing Partner at Clarion Capital Partners, sat down with ION ...

CLO mezzanine investments offer some of the highest yields within the Collateralized Loan Obligation...

Why have Collateralized Loan Obligations (CLOs) grown into a trillion-dollar asset class?