Why Now? How CLO Equity May Benefit From Volatility and Macro Uncertainty (But Mind the Risks)

Warren Buffet said it best:

"Look at market fluctuations as your friend.”

Paradoxically, rising rates, rising volatility, and declining markets may offer a variety of “friendly” benefits, in the spirit of Mr. Buffet’s adage:

- Increasing yields

- Better valuations

- Potential bargains

We believe that nimble CLO equity investors can capitalize on this trio of benefits.

Today’s Market Challenges and the Opportunity for CLO Equity

Today’s market environment presents many challenges:

|

|

These challenges may pose a headwind for many asset classes. However, we believe the current market environment enhances the opportunities for CLO equity investments, which can benefit from volatility. As detailed below, CLO equity can provide favorable upside optionality on volatility. Savvy investors should seek assets that can benefit from volatility, especially today.

5 Key Benefits of CLO Equity

We believe that CLO equity offers five key benefits of significant value in the current environment:

- Structural Advantages

- Active Credit Management

- Attractive Cash Yields

- Embedded Risk Management

- Longer-Term Opportunity Potential

1. Structural Advantages

CLO equity offers a variety of structural advantages. The underlying bank loans are floating rate. Thus, yields can increase while duration risk is limited. CLO equity also benefits from low-cost financing, as the interest required to pay high-rated tranches is generally locked in at lower spreads.

Plus, the CLO structure offers embedded risk management as detailed below.

2. Active Credit Management

CLOs benefit from active credit and portfolio management. CLOs’ underlying portfolios are actively managed for much of the life of the structure. Through active oversight and trading, CLO managers can steer the underlying portfolio away from deteriorating credits.

Also, if and when spreads widen and loans cheapen, CLO collateral managers can acquire bargains and add significant yield for the life of the CLO. CLOs with longer investment periods can more fully capture the benefit from wider-spread environments. This is one of the idiosyncratic ways that CLO equity benefits from volatility.

3. Attractive Cash Yields

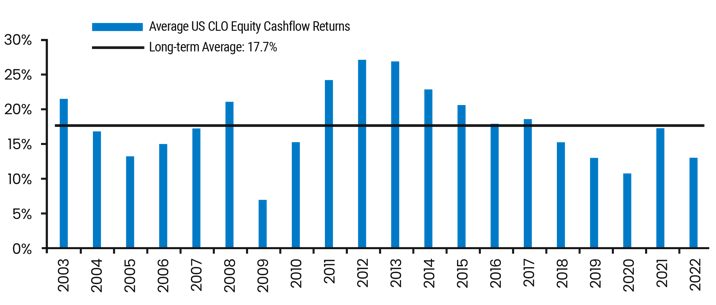

Of significant appeal to investors, CLO equity can produce attractive current cash yields across multiple market environments, and current markets are no exception. As of November 2022, the historical long-term average cash yield on CLO equity as a percentage of par was 17.7%.

|

Average Annual and Long-Term CLO Equity Cash Flow Returns 2003 to 2022 |

|

| Source: J.P. Morgan, November 2022 |

4. Embedded Risk Management

CLOs benefit from their unique non-mark-to-market financing structures. This insulates investors from short-lived swings in market price volatility for underlying assets. As a result, CLOs can take advantage of volatility during times of market distress. During periods of spread widening, CLO collateral managers can acquire cheaper assets with favorable locked-in loan terms.

CLOs also offer a self-healing structure that actively manages any credit deterioration, if it occurs.

CLOs test the strength of their collateral quarterly. The tests are based on par, without any mark-to-market impact from the underlying loans (except for defaults or excessive amounts of low-rated loans). If the collateral test is breached, interest is diverted from subordinated tranches, like CLO equity, and is used to redeem the most senior tranches. Once the collateral tests are back in compliance, interest payments resume to all tranches, including the CLO equity.

Thus, the risk faced by CLO equity is the temporary reduction or suspension of interest payments until equilibrium is restored. When interest payments resume, less interest is needed to pay the reduced amount of senior tranches, and the CLO equity benefits from the continued claim on the interest from the underlying pool.

5. Longer-Term Opportunity Potential

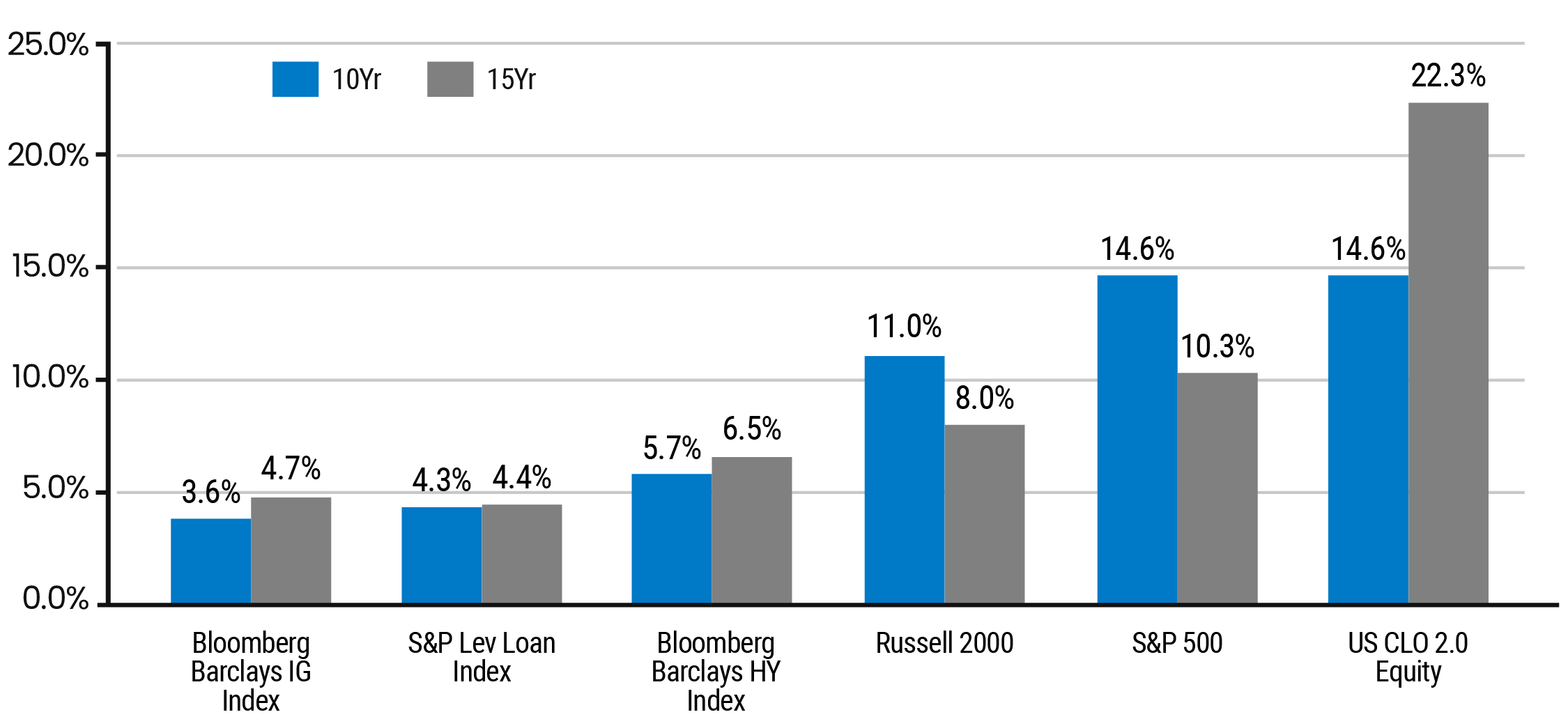

It is also important to think beyond near-term volatility and reflect on the longer-term opportunity potential for CLOs. According to Citibank Research, CLO Equity has provided better returns than other asset classes over long time horizons, including periods of market turmoil.

|

CLO 2.0 Equity Returns versus Stock and Bond Indices 10-Year and 15-Year Compound Returns as of Q1 2022 |

|

| Source: Citi Research, Intex, as of 3/31/2022 |

US CLO 2.0 Equity IRR sample includes 279 US CLO equity tranches from the 2012 to 2021 original vintages. 10-Year CLO Equity IRR is calculated using an average of 2012 original vintage running IRRs as a proxy; 15-Year CLO Equity IRR is calculated using an average of 2006 and 2007 original vintage IRRs. “CLO 2.0” refers to CLOs issued after the financial crisis, which includes greater credit protections than “CLO 1.0” securities issued previously.

Mind the Risks

CLO equity investors must be mindful of the risks that may arise during challenging periods for the markets and economy.

Volatile markets can create forced selling by anxious investors that drives down prices of CLO equity securities. While these downdrafts can create buying opportunities, the volatility can also create significant and painful markdowns in value for existing owners.

Corporate borrowers may also face challenges in economic downturns, and rising rates can increase financing costs. Some issuers may default, leading to a suspension or reduction of interest payments to CLO equity investors and even loss of principal. Nevertheless, CLO equity is generally structured to withstand a modest level of defaults over time. However, a prolonged and severe downturn can produce unexpected negative results.

Navigating these risks and capitalizing on adversity requires an experienced manager.

Benefitting From Volatility and Macro Uncertainty

As discussed above, we believe that CLO equity can benefit from anxious markets. The financial turmoil triggered by the pandemic early in 2020 was a case in point. Market volatility provided extraordinary potential for subsequent outperformance for nimble CLO equity investors.

We believe the current environment is offering timely opportunities for CLO equity investors once again.

To learn more, visit our website or set up a time to speak with our team.

Definitions:

S&P 500 is a capitalization-weighted index of 500 widely-followed US large cap stocks.

Russell 2000 is a capitalization-weighted index of 2000 US small cap stocks.

Bloomberg Barclays Investment Grade Index measures the US dollar-denominated investment grade, fixed-rate corporate bond market.

S&P Leveraged Loan Index is a capitalization-weighted index of the syndicated loan market.

Bloomberg Barclays High Yield Index measures the US dollar-denominated high yield, fixed-rate corporate bond market.

Tags:

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

Introduction Marc Utay, Founder and Managing Partner at Clarion Capital Partners, sat down with ION ...

“In the beginning … there were potential profits.” While “warehouse” may be a metaphor, the potentia...

CLO mezzanine investments offer some of the highest yields within the Collateralized Loan Obligation...