Which is Right for Your Clients: Private Placement Life Insurance or Variable Annuities?

Private Placement Life Insurance and Variable Annuities (PPLI and PPVA) are insurance solutions for wealthy investors. PPLI and PPVA can enhance the after-tax returns of alternative strategies and other investments that generate substantial taxable income.

PPLI and PPVA also offer lower-cost institutional pricing compared to retail insurance products. To utilize PPLI or PPVA, an investor must meet the SEC definitions for Accredited Investor ($1+ million net worth) and Qualified Purchaser ($5+ million of investable assets).

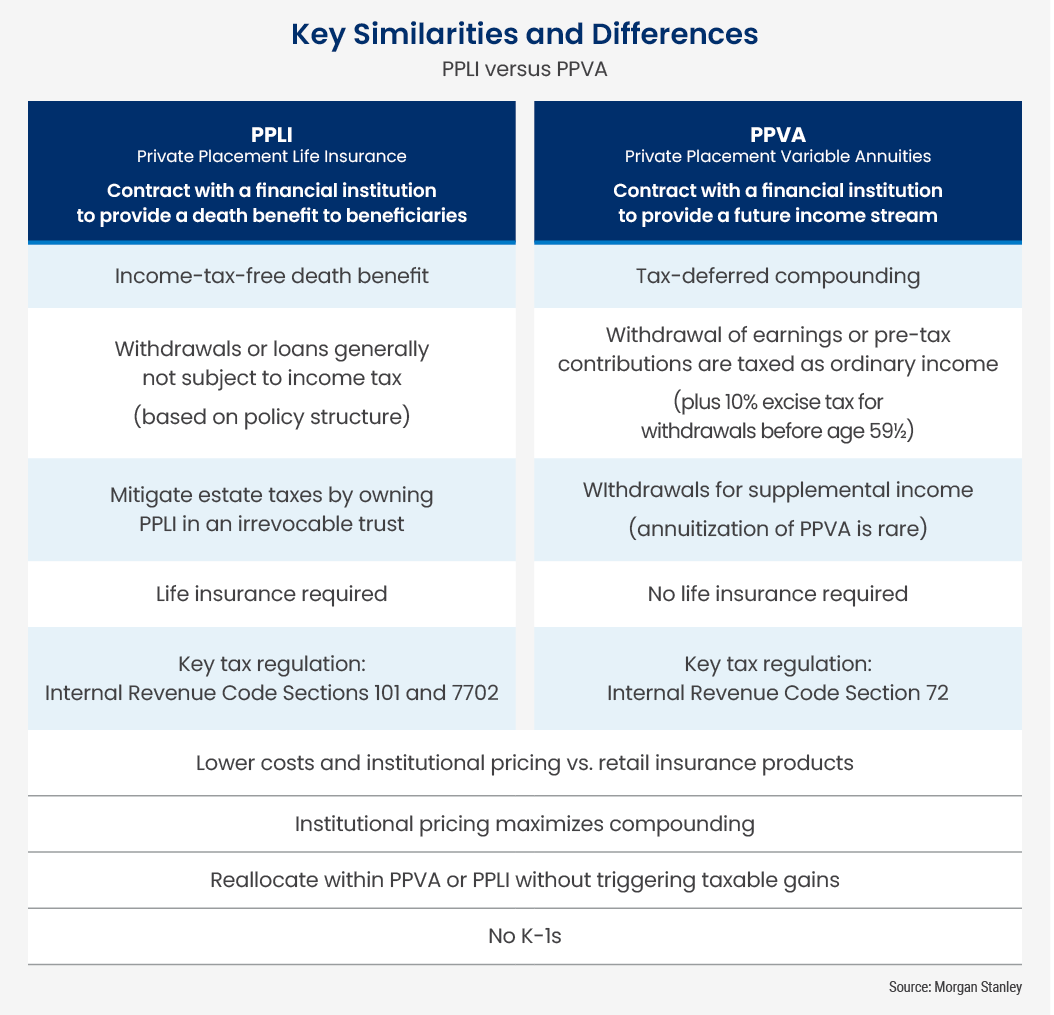

PPLI and PPVA can be powerful planning tools to maximize the growth of capital by reducing “tax drag.” They can also enhance estate planning outcomes to optimize the compounding of assets and the transfer of generational wealth. As background, it’s helpful to understand the key similarities and differences between PPLI versus PPVA:

PPLI and PPVA have numerous practical applications, which can be customized by advisors and investors for their clients, as discussed below.

Using PPVA With Clients: Tax-Deferred Investing

PPVA allows investors to defer income tax on investment gains. For simplicity, consider PPVA to be another type of tax-deferred investment account. Below are a few applications for PPVA. Advisors and clients can explore other custom applications.

- Investors in Private Credit and Strategies With High Taxable Interest Income

- Investors in Hedge Funds, Trading Strategies, and Alternative Investments

- Relocating from a High Tax State to a Low Tax State for Retirement

- Maximize Charitable Giving

- Reduce Costs

1. Investors in Private Credit and Strategies With High Taxable Interest Income

Affluent investors have been increasing their allocations to private credit and other strategies that provide high levels of interest income. However, the high yields from these investments are subject to high tax rates, which erode returns. Investors can defer their income by investing in these strategies within a Private Placement Variable Annuity. Moreover, the investor will receive no K-1s from these investments, if implemented within the annuity wrapper.

2. Investors in Hedge Funds, Trading Strategies, and Alternative Investments

Wealthy investors may invest in hedge funds, trading-oriented, and alternative strategies seeking uncorrelated returns. However, many of these strategies generate a high level of short-term gains, which can be taxed at high rates. Investors can defer these gains by investing through a Private Placement Variable Annuity. Moreover, the investor will receive no K-1s from these investments, once implemented within the annuity wrapper.

3. Relocating from a High Tax State to a Low Tax State for Retirement

Business owners and executives in states with high tax rates (such as New York, New Jersey, or California) can place their excess capital in a PPVA for tax-deferred growth. PPVA allows pre-retirees to deposit savings above and beyond their typical retirement plan contributions. Upon retirement, they may relocate to a low-tax state (such as Florida, Texas, or Wyoming). Once they relocate, they can consider retirement income withdrawals with low local taxation. (It is important to defer withdrawals until after age 59 ½ to avoid the 10% federal excise tax.)

4. Maximize Charitable Giving

PPVAs offer two significant benefits to philanthropic investors. First, investments within the PPVA compound tax-deferred, allowing for greater growth over time. Then, the accumulated earnings can pass without income or estate taxes to a charity or family foundation. By eliminating income and estate taxes, PPVAs can be a powerful tool to maximize a bequest. Moreover, PPVA holders retain the flexibility to make withdrawals during their lifetime, though withdrawals may trigger taxable income.

5. Reduce Costs

Some investors may have one or more high-cost retail annuities with limited investment options. Through a tax-deferred Section 1035 Exchange, the investor can transfer the underlying assets into a lower-cost PPVA with institutional pricing, greater investment flexibility, and access to alternative strategies via Insurance Dedicated Funds (IDFs).

Using PPLI With Clients: Tax Mitigation

While PPVAs provide for tax-deferral, PPLI can also provide income-tax-deferred payments to beneficiaries upon the death of an insured. PPLI entails added life insurance costs, but tax savings can more than offset the insurance costs over time. Below are a few applications for PPLI. In combination with estate planning, the range of applications are many.

- Create a Legacy for Grandchildren and Future Generations

- Tax-Deferred Distributions for Income

- Supplemental Retirement Income

- Preserve a Family Business

1. Create a Legacy for Grandchildren and Future Generations

Wealthy investors can consider PPLI for their estate plans to maximize wealth for future generations. Investment returns compound on a tax-deferred basis within the policy. Estate planners can also consider PPLI as tool to use within a variety of trust types, including Family Trusts, as a key element of multi-generational estate planning. Upon death, the value of the PPLI is not subject to income tax via the stepped-up basis of policy assets. Plus, proceeds from PPLI may also be exempt from estate tax if owned within a properly structured Irrevocable Life Insurance Trust (ILIT).

2. Tax-Deferred Distributions for Income

Policyholders can make distributions from PPLI without current taxes via a carefully structured policy loan that meets tax law requirements. Trustees can make tax-deferred distributions to beneficiaries in a similar fashion.

3. Supplemental Retirement Income

Investors can also use PPLI as part of their retirement income planning. The policyholder can deposit savings into PPLI for tax-efficient growth. Then, at retirement, the policyholder can consider taking tax-deferred distributions from the policy at a consistent rate, such as 5% per year, to maximize after-tax income.

4. Preserve a Family Business

Family businesses can use PPLI for a variety of continuity situations. Consider the case of a family enterprise passed down to a new generation. One member of the family may want to continue in the business. Others may not. To avoid having to sell the business, the family can purchase PPLI (owned by a properly organized trust) to provide a legacy to the family members who will not be continuing with the business. The business can then pass to the new generation family member continuing with the operation without having to sell a partial and likely illiquid interest in the enterprise. The other members of the family receive assets equal to the value of the business via the PPLI and trust structure. This type of approach can be applied to a wide variety of illiquid family assets.

Tax-Optimized Investing by Multifamily Offices and RIAs

An increasing number of wealth advisors consider PPLI as an important instrument in the repertoire of client solutions. These advisors use PPLI to optimize the tax-efficiency of client investment programs. Investment strategies generating a high level of ordinary income or short-term gains are located within the PPLI to maximize after-tax returns. Wealth planners use three general approaches to investing within PPLI:

- Select from a Roster of IDFs

- Create a Proprietary, Commingled IDF

- Create a Custom Account

1. Select From a Roster of IDFs

The universe of Insurance Dedicated Funds has grown in recent years to 400+ registered funds, investing primarily in traditional assets, and 200+ unregistered funds, investing in alternative strategies. The advisor can recommend a single IDF or can actively allocate among multiple IDFs.

2. Create a Proprietary, Commingled IDF

An RIA may wish to implement consistent allocations across client investment programs. The RIA can establish a proprietary IDF or series of IDFs to centrally manage client allocations.

3. Create a Custom Account

RIAs can create custom solutions for their largest clients. The RIA will work with an insurance company to create a separately managed account. The RIA manages this insurance company-segregated account on a discretionary basis. To comply with the investor control provisions of insurance tax law, policyholders may not participate in portfolio management.

Which is Right for Your Clients?

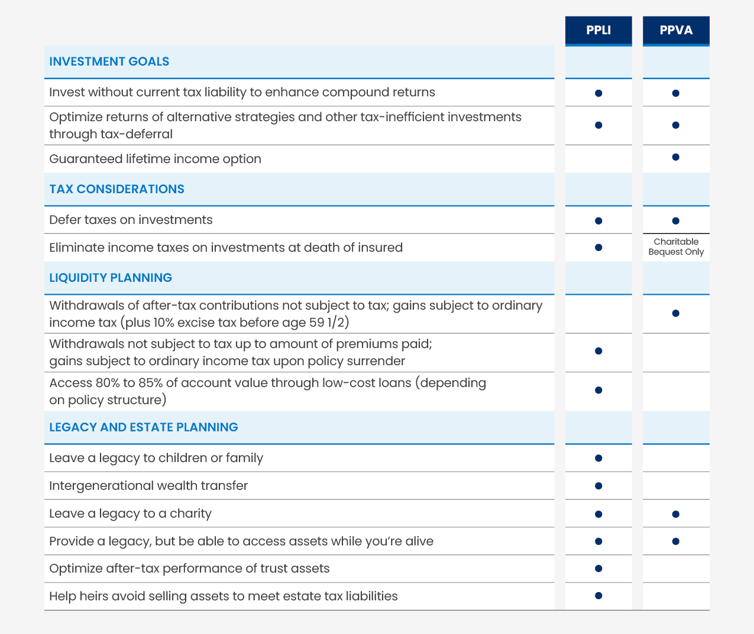

Your clients who are Qualified Purchasers can use PPLI and PPVA to meet a variety of objectives, as summarized below.

Transform Your Client Experience

As you learned from the overview and examples above, PPLI and PPVA are flexible tools. Advisors can utilize these instruments to enhance financial and estate planning outcomes, client portfolios, and after-tax returns.

To learn more, download our free eBook: Harness the Power: Private Placement Life Insurance and Variable Annuities.

Clarion does not offer tax advice or tax accounting matters to clients. The recipient should not construe the contents of this presentation as legal or tax advice and contact their own professionals for legal and tax advice and other matters relevant to the suitability of an investment for the recipient. Calculations that appear throughout this presentation are for demonstration purposes only. In addition, different assumptions will lead to different results. Any charts discussed in this presentation and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. No system or methodology has ever been developed that can guarantee profits or ensure freedom from losses. No representation or implication is being made that using the methodology or system discussed in this presentation will generate profits or ensure freedom from losses. There is no guarantee that the investment objectives will be achieved. The results shown do not include the deduction of advisory fees or other expenses which will reduce returns.

Tags:

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

Part 2: Case Studies In Part 1 of our blog series on the power of Section 1035 exchanges, we explore...

Part 1: Fundamentals High net worth investors and their advisors frequently encounter legacy life in...

Navigating the investment landscape as an institutional investor comes with particular challenges an...