How Institutional Investors Gain Tax-Sheltered Access to Alternatives With COLI, BOLI, and ICOLI

Navigating the investment landscape as an institutional investor comes with particular challenges and opportunities. Among these opportunities lies the potential to access alternative investments — tax-efficiently — through Insurance Dedicated Funds (IDFs) within Private Placement Life Insurance (PPLI) structures. Importantly, PPLI offers lower-cost institutional pricing compared to other insurance products.

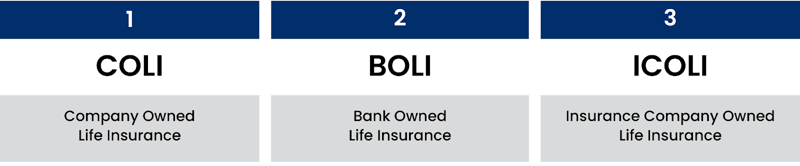

In this article, we'll explore three key types of Institutional PPLI:

We’ll also discover the multitude of benefits that COLI, BOLI, and ICOLI can provide for institutional investors—including tax-sheltered access to alternative strategies.

1. Company Owned Life Insurance (COLI)

COLI is a type of life insurance policy taken out by a company on the lives of its employees. The company is the policy owner and beneficiary, pays the premiums, and receives any death benefits. COLI policies offer several benefits for institutional investors:

- Enhancing After-Tax Returns: The income and gains within a COLI policy grow tax-deferred. This can significantly enhance the after-tax returns on the company's surplus assets, making COLI a highly effective investment tool.

- Offsetting Liabilities: Many companies have significant liabilities associated with deferred compensation plans. The tax-deferred growth within a COLI policy can be used to offset these liabilities on the company's balance sheet, thus enhancing financial stability.

- Executive Recruitment and Retention: IDFs within COLI can offer executives access to a myriad of value-added alternative investment strategies, providing an attractive benefit to help recruit and retain executive talent. Some deferred compensation plans allow an executive to grow their balances with traditional and alternative investments held within the company’s COLI policy as an “informal” funding vehicle.

-

*Executive deferred compensation plan allows employees to defer their income and taxes beyond the limits of traditional retirement plans and enjoy additional tax-deferred growth on the deferral. Taxes are not due until the cash is withdrawn, sometimes in a lower tax bracket after the employee retires. For withdrawals, executives can choose between receiving a lump sum or equal installments over multiple years. The cash value of the insurance policy serves to “informally” fund these future payments. Payments can also be made to an employee’s beneficiaries or estate in the event of death. Keep in mind that deferred compensation plans are subject to potential loss. Funds set aside for deferred compensation plans are part of the employer’s general assets and are subject to creditors’ claim in the event of bankruptcy. Tax law and regulation requires this as a condition of the tax deferral.

Each year, companies of various sizes collectively commit approximately $500 million to over $1 billion to new COLI policies.

2. Bank Owned Life Insurance (BOLI)

BOLI is similar to COLI but is owned by a bank. Banks use BOLI policies as an efficient way to finance employee benefits overall and offset the associated liabilities. In contrast, COLI is generally used to fund executive deferred compensation plans.

Over 3,000 banks across the U.S. have committed nearly $200 billion to BOLI.2 BOLI is considered to be Tier 1 capital for banks,3 and thus BOLI can serve as an important element of bank investment portfolios.

BOLI provides three primary benefits:

- Enhanced, Tax-Deferred Yields: BOLI policies often provide yields that are significantly higher than those on other fixed-income investments, and the gains within the policy are tax-deferred. This can help enhance the bank’s after-tax investment income.

- Liability Offset: Similar to COLI, BOLI can be used to offset the liabilities associated with deferred compensation plans and post-retirement benefits on the bank’s balance sheet.

- Employee Recruitment and Retention: Similar to COLI, BOLI can enable banks to offer executives board members access to value-added alternative strategies, providing an attractive benefit to help recruit and retain talent. Some deferred compensation plans allow an executive to grow their balances with traditional and alternative investments held within the the bank’s BOLI policy as an “informal” funding vehicle.

For banks, the credit quality of the insurance company is key for regulatory reasons. Banks will often tap large, highly rated insurance companies for their BOLI commitments. Similarly, banks may also emphasize investments in insurance company general accounts as their BOLI investment option and use IDFs and alternative strategies more selectively. Whatever the approach, BOLI enables banks to diversify their investment portfolios.

3. Insurance Company Owned Life Insurance (ICOLI)

ICOLI, as the name implies, is owned by an insurance company. Insurance companies own more than $30 billion of ICOLI.4

ICOLI policies can provide a host of benefits:

- Reduced RBC Charges: By structuring investments through ICOLI, insurance companies can mitigate some of the Risk-Based Capital (RBC) charges associated with direct investment in alternative assets. This can free up capital for further investment and enhance returns.

- Stable Value Wrap Accounting: Insurance companies often use ICOLI to achieve stable value wrap accounting treatment. This can provide insurance companies with a more predictable, stable income stream, enhancing their financial stability.

- Offsetting Liabilities: Like COLI and BOLI, ICOLI can be used to offset the liabilities associated with deferred compensation plans on an insurance company's balance sheet.

Digging Deeper: The Basics of IDFs and PPLI

To truly understand the power of COLI, BOLI, and ICOLI, one must understand the structures that make these strategies possible: Insurance Dedicated Funds (IDFs) within Private Placement Life Insurance (PPLI).

Understanding Insurance Dedicated Funds

IDFs are specialized investment funds that accept allocations exclusively from the separate accounts of life insurance companies. These funds can hold a wide array of assets, including alternative investments like private credit, private equity, and hedge funds. They are commingled vehicles, meaning they can accept allocations from multiple PPVA and PPLI contracts issued by various insurance companies.

IDFs offer a unique opportunity for institutional investors to gain access to tax-inefficient investment strategies in a tax-deferred or even tax-eliminated manner. The potential for tax deferral or elimination is made possible through the tax-advantaged structure of life insurance contracts. Moreover, policyholders can reallocate among IDFs without tax implications. Plus, IDFs eliminate the need for K-1s to end investors, simplifying tax reporting.

The Role of Private Placement Life Insurance

PPLI contracts are specially designed life insurance contracts. These contracts are private placements, which means they are not publicly traded and are available only to Qualified Purchasers (per regulation), including institutional investors.

These contracts are flexible and can be customized to meet the investor’s specific needs. They are structured so that the gains and income within the contract grow tax-deferred. In addition, death benefits may be received income-tax-free by the beneficiaries.

PPLI contracts are distinctive in that they are linked to separate accounts that are legally segregated from the insurance company’s general account. This provides an extra layer of security for the contract owner, as these assets are shielded from the claims of the insurance company’s creditors.

The marriage of IDFs with PPLI is what gives institutional investors, like those using COLI, BOLI, and ICOLI, the ability to gain tax-efficient access to a broad range of investment strategies, including alternatives, and manage their liabilities effectively.

Back to the Benefits

Now that we've examined the foundation of COLI, BOLI, and ICOLI, it's easier to see how these tools provide a powerful combination of tax efficiency, liability management, and access to alternative investments.

“These tools provide a powerful combination of tax efficiency, liability management, and access to alternative investments."

Conclusion: The Power of Institutional PPLI

By leveraging the tax-deferred benefits of COLI, BOLI, and ICOLI, institutional investors can achieve a variety of objectives:

Tax Benefits

- Enhance after-tax returns and yields

- Gain tax-efficient access to alternative strategies and other tax-inefficient investments

- Simplify tax reporting for alternative investing by eliminating the need for K-1s

- Re-allocate among alternative investments without current taxation

Institutional Pricing

- Access lower-cost, institutional pricing for life insurance structures

Enhanced Executive and Employee Compensation Programs

- Attract and retain executives and employees with enhanced benefits

- Offset balance sheet liabilities associated with deferred compensation plans

Favorable Financial Accounting

- Reduce risk-based capital (RBC) charges associated with direct investments in alternative assets and strategies

- Achieve stable value wrap accounting treatment

Keep in mind that these strategies also come with their own considerations, such as the cost and terms of the insurance contract, the financial strength of the issuing insurance company, and the need for professional risk management.

Please note that Clarion Capital does not provide insurance, tax, or legal advice. Investors and advisors must consult their own insurance, tax, and legal counsel.

—

Sources:

*Executive deferred compensation plan allows employees to defer their income and taxes beyond the limits of traditional retirement plans and enjoy additional tax-deferred growth on the deferral. Taxes are not due until the cash is withdrawn, sometimes in a lower tax bracket after the employee retires. For withdrawals, executives can choose between receiving a lump sum or equal installments over multiple years. The cash value of the insurance policy serves to “informally” fund these future payments. Payments can also be made to an employee’s beneficiaries or estate in the event of death. Keep in mind that deferred compensation plans are subject to potential loss. Funds set aside for deferred compensation plans are part of the employer’s general assets and are subject to creditors’ claim in the event of bankruptcy. Tax law and regulation requires this as a condition of the tax deferral.

- Ron Sheese, Andesa Solutions, “New Year – an Outlook for the COLI-BOLI Market in 2018,” 2017. https://andesaservices.com/blog/new-year-an-outlook-for-the-coli-boli-market-in-2018/

- BoliColi.com, “Bank Owned Life Insurance Facts and Figures,” as of December 31, 2020. https://www.bolicoli.com/bank-owned-life-insurance-facts-and-figures/

- OneDigital, “BOLI: Bank Owned Life Insurance, the What and the Why,” February 12, 2019.https://onedigitalexecutivebenefits.com/boli-bank-owned-life-insurance/

- MBS Financial, “The Fundamentals of Insurance Company Owned Life Insurance,” March 12, 2022. https://mbsfin.com/fundamentals-icoli/

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

Sophisticated investors have increased their allocations to alternative investments in recent years ...

When it comes to executive compensation, striking a balance between a company’s goals and an executi...

Private and institutional investors have shown growing interest in alternative investments, attracte...