How to Gain Tax-Efficient Access to Alternative Investments with Insurance-Dedicated Funds

Private and institutional investors have shown growing interest in alternative investments, attracted by potentially higher yields and total returns, as well as reduced correlations to traditional assets.1

However, some alternative strategies are not tax efficient. Credit and trading strategies are notable examples.

High Yields and Returns, but High Taxes

Currently, double-digit yields drive the appeal of a variety of private credit strategies amidst today’s higher interest rates.2 Unfortunately, the generous interest income can be subject to the highest marginal tax rates.

Trading strategies, too, can exhibit high returns but may be subject to high short-term capital gains tax rates. For example, the SG Trend Index, Société Generale’s index of leading trend-following funds,3 rose 27.3% in 2022.4 Such performance was welcome in a year of double-digit declines for stocks and bonds. However, taxable investors in trend-following trading strategies incurred significant taxes on short-term trading profits.

IDFs for Tax-Efficient Alternatives

For certain sophisticated investors, Insurance Dedicated Funds (“IDFs”) provide tax-efficient access to alternative strategies such as private credit, hedge funds, and other high-yield or high-turnover investment products. IDFs also offer simplified tax reporting without the need for complicated K-1s.

Notably, IDFs are only available through Private Placement Life Insurance (“PPLI”) and Private Placement Variable Annuities (“PPVA”) offered by insurance companies.

As insurance-related products, PPLI and PPVA are not widely understood, and require thoughtful analysis to determine how they may fit the long-term financial needs of an individual, family, business, or institution.

Implemented correctly, PPLI and PPVA offer tax-efficient access to alternative investments via IDFs, which can be a powerful tool for sophisticated investors and advisors to reduce or defer taxes, simplify tax reporting, and increase compound returns.

Long History of Tax Benefits

Over $2 trillion5 of variable life insurance and variable annuities receive tax-efficient treatment under U.S. tax law. This status has a long legislative and regulatory history. Earnings within these insurance-related products are generally not subject to current tax. Moreover, life insurance benefits payable to beneficiaries are not subject to estate tax. To receive these tax benefits, policies must be properly structured and implemented.

According to a press release from the U.S. Treasury:

“Life insurance and annuity contracts receive favorable tax treatment in recognition of the importance of protecting loved ones against the potentially devastating financial consequences of death or the risk of exhausting savings while in retirement.” 6

Clients can access alternative investments and other tax-inefficient investments within a life insurance policy or an annuity, and allocate to an IDF to benefit from tax-deferred growth or tax-free insurance proceeds. However, strict adherence to the rules is required.

The Key: Insurance Dedicated Funds

Insurance Dedicated Funds provide the key.

IDFs are commingled investment vehicles open only to the separate accounts of insurance carriers and annuity providers. Individuals, businesses, and institutions can access IDFs only through PPLI or PPVA. As commingled vehicles, IDFs can only accept subscriptions from life insurance companies.

Individuals and institutions who are Qualified Purchasers (generally with $5 million or more of investable assets to comply with securities law) can access IDFs through PPLI and PPVA. IDFs within PPLI or PPVA policies allow policyowners to access private alternative funds and compound income and growth on a tax-deferred basis.

Importantly, PPLI and PPVA provide low-cost institutional pricing compared to retail insurance products, leading to even greater compounding.

Growing Tax Burden on Investors

Over the years, changing tax laws have had a negative impact on affluent investors. In 2017, the Tax Cuts and Jobs Act (TCJA) eliminated or reduced many deductions:7

- Interest on new mortgages was no longer deductible for mortgage balances above $750,000.

- The SALT (state and local tax) deduction was capped at $10,000 per couple. Affluent investors in populous, high-tax states such as California and New York were particularly affected.

- Investment management fees were deemed non-deductible for tax years 2018 to 2025.8

The non-deductibility of investment management fees “created a perfect storm for investors in hedge funds”9 and many other flow-through vehicles. As a consequence, such investors pay taxes on gross rather than net returns. The resulting “phantom income” can create significant tax liabilities.

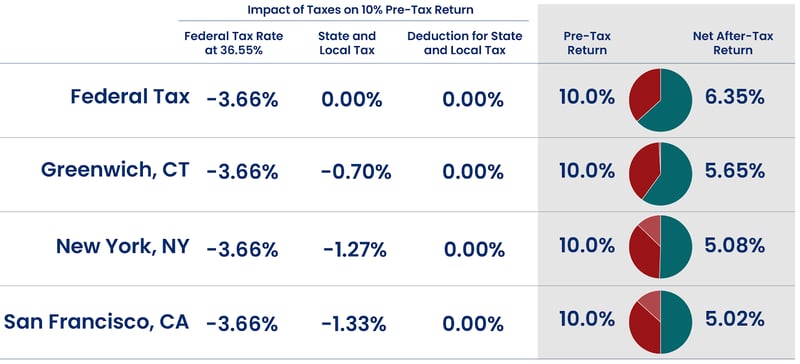

As a result of these tax changes, high-net-worth investors face potentially draconian tax liabilities on investments that generate significant taxable income or short-term gains, such as alternative strategies. Taxpayers in high-tax cities and states can see their returns cut in half:

Heavy Taxes Can Cut Pre-Tax Returns in Half

Source: Winged Keel

For illustration only. Not an actual investment. See Assumptions below.

Now, investors anxiously await the “Great Sunset”10 of the favorable gift and estate tax provisions of the TJCA, set to expire at year-end 2025. This transition will cut the current estate tax exemption of approximately $12 million per individual in half to about $6 million per individual (adjusted for inflation) unless legislators intervene. This only increases the importance of proactive tax, estate, and investment planning.

Advisors, planners, and clients are looking for solutions. Utilizing PPLI and PPVA can help affluent investors access alternative investment strategies through IDFs and receive tax-efficient returns.

Tax, Estate, and Investment Planning Strategies

PPLI and PPVA allow clients to access tax-inefficient investment strategies in a tax-deferred environment. This enables sophisticated investment planning as well as sophisticated income and estate tax mitigation.

Tax Relief, Higher Returns, and Generational Wealth

PPLI and PPVA are not subject to current income tax. This enables investors to compound the value of assets allocated to IDFs at much higher rates of return—without tax friction—potentially creating substantial generational wealth.

Withdrawals or Policy Loans

With PPLI, policyholders can access approximately 85%-90% of the policy cash value via policy loans without incurring ordinary income tax. Withdrawals are not subject to tax up to the amount of premiums paid.

For PPVA, withdrawals of after-tax contributions are not subject to tax. The withdrawal of any income or gains will be subject to ordinary income tax plus a 10% excise tax for withdrawals before age 59½.

Estate Planning Applications

PPLI also provides estate planning applications, as death benefits are not taxable income to a beneficiary. Estate tax mitigation is possible if life insurance is held within an appropriately structured irrevocable life insurance trust (ILIT).

For PPVA, death benefits are not taxable to charitable beneficiaries, such as a public charity or private foundation. However, annuity payouts to taxable beneficiaries from an estate are subject to income tax.

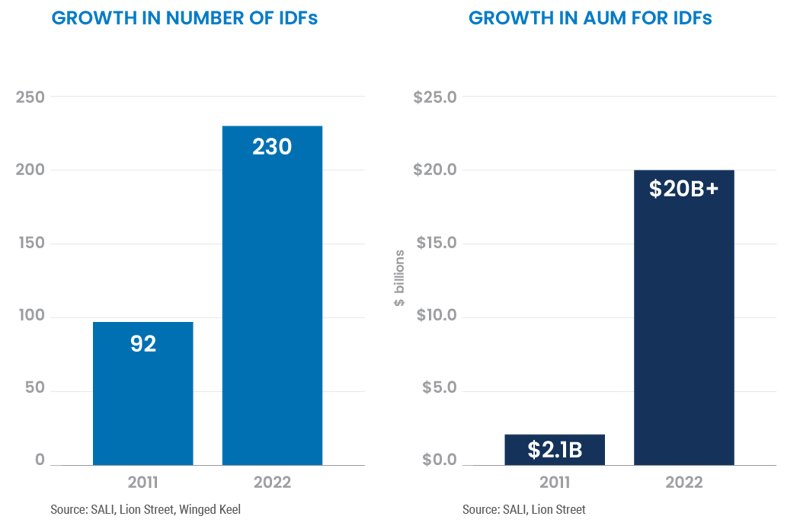

Growth of IDFs

Based on the increasing need for tax solutions, IDFs have grown in variety, number, and assets. In 2011, there were fewer than 100 IDFs. There are now over 200 IDFs available for allocation for PPLI and PPVA policyowners.

While the rate of growth is impressive, IDF assets are small relative to the alternative investment universe. For comparison, private markets account for $11.7 trillion in assets, according to McKinsey.11 According to Hedge Fund Research, the hedge fund industry alone is about $4 trillion.12

The IDF universe is expected to grow as more investors discover the benefits. The growth to date has provided multiple benefits to investors, who have access to more diverse strategies than ever before through IDFs.

IDF Tax Criteria

To be eligible for favorable life insurance or annuity tax treatment, IDF assets must reside within insurance company segregated accounts and can only receive deposits from insurance companies.

The preservation of IDF tax benefits depends on complying with two principal requirements:

- Investor Control Doctrine

- Diversification Rules

Let Go of Control

If an investor has too much control over the assets in an IDF, they will be treated as the taxable owner of the assets. The doctrine is the result of court cases and IRS revenue rulings over the past 40+ years. The doctrine is very specific on what is not allowable.

IDF Prohibitions

- Policyowners may not trade, select, or recommend investments or securities within an IDF.

- Policyowners may not communicate with investment officers about investment selection or strategies within the IDF.

- Policyowners may not have a direct or indirect legal interest in the underlying assets of the IDF.

- Policyowner may not vote shares or proxies or exercise rights related to IDF assets.

- Policyowners may not withdraw cash directly from the IDF for their own purposes

Violating these “no no’s” can create dire tax consequences for policyowners and issuers. Thus, IDFs and related insurance products require comprehensive documentation and rigorous compliance procedures.

Flexibility for IDF Investors

PPLI policyowners retain the flexibility to reallocate among IDFs. Policy values can be reallocated from one IDF to another without triggering a taxable event. Thus, PPLI and PPVA policyowners can deploy a diversified alternative investment program and dynamically re-allocate as opportunities, risks, and objectives evolve.

“PPLI and PPVA policyowners investors can create a diversified alternative investment program and dynamically re-allocate as opportunities, risks, and objectives evolve.”

Diversification Rules

The diversification rules related to IDFs are straightforward. Under Rule 817(h) of the Internal Revenue Code, each IDF or insurance company separate account will be considered adequately diversified if no more than:

- 55% of IDF or account assets are represented by any one investment, and

- 70% of IDF or account assets are represented by any two investments, and

- 80% of IDF or account assets are represented by any three investments, and

- 90% of IDF or account assets are represented by any four investments.

Exceptions apply during the launch or liquidation of an IDF.

Compound Results

PPLI and PPVA enable investors to increase the long-term compound returns on their alternative allocations, resulting in greater wealth over time.

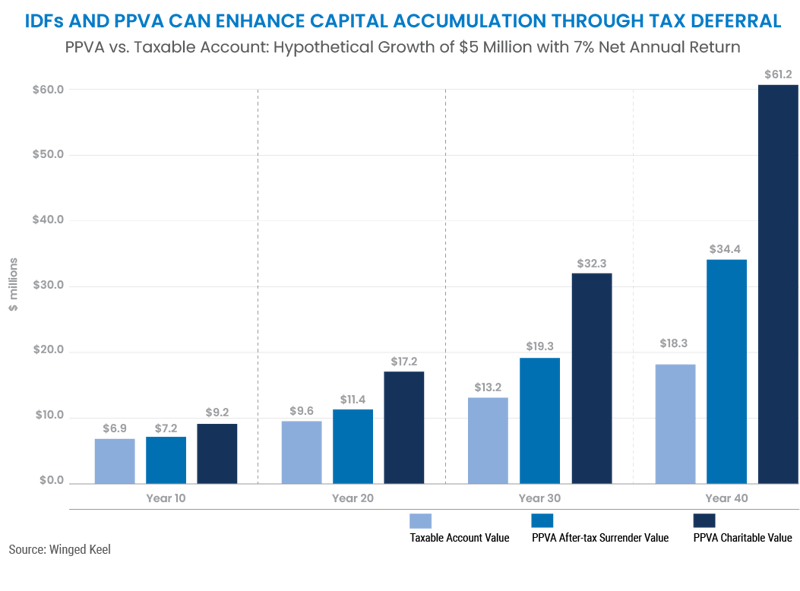

The chart below illustrates the power of tax-deferred compounding when allocating to a tax-inefficient strategy within a Private Placement Variable Annuity. Over a 40-year period, investors can nearly double their after-tax value through tax-deferred compounding. Investors can more than triple their after-tax capital if they bequest their assets to a charity or family foundation.

Hypothetical illustration only. Not actual results. Not indicative of the performance of any investment. PPVA returns will vary and you may receive more or less than the amount invested. Assumptions: Hypothetical Connecticut resident with $25 million net worth , $5 million initial contribution, 7.00% net rate of return.

M&E expenses: 65 basis points <$10 million, 55 basis points $10-$20 million, 45 basis points $20-40 million, 37 basis points $40+ million

Based on 2022 maximum marginal tax rates: 37.00% federal income tax, 20.00% long-term capital gains tax, 3.80% Medicare surtax, 6.99% Connecticut income tax. Assumes 47.79% combined tax rate for short-term capital gains and ordinary income, and 30.79% combined tax rate for long-term capital gains

Source: Winged Keel

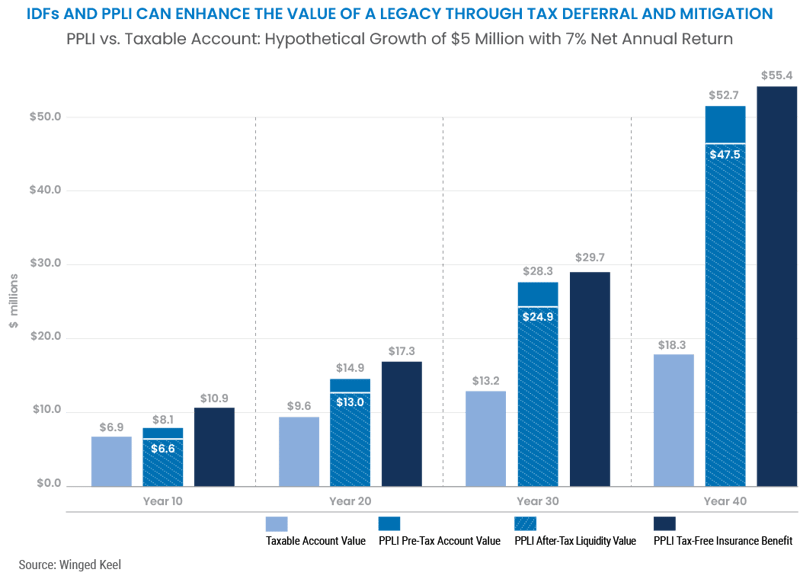

In addition to offering enhanced after-tax returns, PPLI provides an insurance benefit for beneficiaries that is not subject to income tax. Moreover, owning PPLI within a properly structured irrevocable trust can mitigate estate taxes.

The chart below illustrates the power of tax-deferred compounding of a tax-inefficient strategy within a Private Placement Life Insurance policy. Over a 40-year period, investors can triple their after-tax legacy to beneficiaries. Investors must keep in mind that investors must pay sufficient insurance premiums, particularly in the early years of a policy, to comply with applicable tax law.

Hypothetical illustration only. Not actual results. Not indicative of the performance of any investment. PPLI returns will vary and you may receive more or less than the amount invested. Assumptions: Hypothetical Connecticut resident with $50 million net worth, Funding of $1.25 million per year for 4 years, 7.00% net rate of return

M&E expense: years 1-20 = 55 bps; years 21+ = 30 bps, Cost of insurance assumes preferred health rating

Based on 2022 maximum marginal tax rates: 37.00% federal income tax, 20.00% long-term capital gains tax, 3.80% Medicare surtax, 6.99% Connecticut income tax. Assumes 47.79% combined tax rate for short-term capital gains and ordinary income, and 30.79% combined tax rate for long-term capital gains

Source: Winged Keel

Learn More

IDFs, available through PPLI and PPVA, can be great tools for taxable investors interested in a tax-efficient approach to alternative strategies. Portfolio construction and investment planning with IDFs also provide a way for advisors to add value and distinguish their practice.

To learn more, download our newest advisors' guide: “Tax-Efficient Access to Alternative Investments”

This article is not intended as tax, accounting, insurance, or legal advice. Investors must consult with their own qualified professional advisors about their particular circumstances and the suitability of any investment.

1. “Study Finds Increasing Interest in Alternatives Among Family Offices,” DiWire, April 20, 2023, https://thediwire.com/study-finds-increasing-interest-in-alternatives-among-family-offices/

“Private Markets Rally to New Heights,” McKinsey & Company, March 2022, https://www.mckinsey.com/industries/private-equity-and-principal-investors/our-insights/mckinseys-private-markets-annual-review-archive

2. “How double-digit returns push family offices to invest in private credit,” CNBC, May 8, 2023, https://www.cnbc.com/video/2023/05/08/how-double-digit-returns-push-family-offices-to-invest-in-private-credit.html

Bill Sacher and Fred Chung, “Signs Indicate Potential Attractive Vintage Era for Private Credit,” Adams Street, January 23, 2023, https://www.adamsstreetpartners.com/insights/vintage-era-private-credit/

3. “Overview of CTA Indices,” Red Rock, 2016, http://www.ctaindexes.com/List_SGCTATrend.html

4. “Trend followers turn leaders as CTAs deliver record returns in 2022,” HedgeWeek, January 27, 2023, https://www.hedgeweek.com/2023/01/27/319266/trend-followers-turn-leaders-ctas-deliver-record-returns-2022

5. Jonas Katz, “Insurance-Dedicated Funds 101: Growth, Trends and Next Steps,” SALI Fund Services, 2022, https://www.sali.com/uploads/2022/09/8456cb74485c7aa7d4123ea20e2a4da4/sali-fund-services-insurance-dedicated-funds-101.pdf

6. “Treasury and IRS Continue Crackdown on Abuse of Life Insurance and Annuity Contracts,” U.S. Department of the Treasury, July 29, 2003, https://home.treasury.gov/news/press-releases/js605

7. “How did the TCJA change the standard deduction and itemized deductions?” Tax Policy Center Briefing Book, 2022, https://www.taxpolicycenter.org/briefing-book/how-did-tcja-change-standard-deduction-and-itemized-deductions

8. Ebony J. Howard, CPA, “Are Financial Advisor Fees Tax Deductible?”, Annuity.org, updated April 27, 2023, https://www.annuity.org/financial-advisors/are-financial-advisor-fees-tax-deductible/

9. Robert Gordon, “Hedge Funds Taxation: A Perfect Storm Ahead,” Investments and Wealth Monitor, May/June 2019, https://investmentsandwealth.org/getattachment/1abddef5-5e4e-4468-8e3e-3d38ff107013/IWM19MayJun-HedgeFundsTaxation.pdf

10. Angie O’Leary and Bill Ringham, “The great tax sunset is coming. Are you prepared?”, RBC Wealth Management Tax Strategies, accessed May 14, 2023, https://www.rbcwealthmanagement.com/en-us/insights/preparing-for-the-great-sunset-what-you-need-to-know-if-tax-code-provisions-expire

11. “Private markets turn down the volume,” McKinsey Global Private Markets Review, March 21, 2023, https://www.mckinsey.com/industries/private-equity-and-principal-investors/our-insights/mckinseys-private-markets-annual-review#at-a-glance

12. “Global Hedge Fund Capital Surpasses Historic Milestone to Begin 2022,” Hedge Fund Research, January 20, 2022, https://www.hfr.com/news/global-hedge-fund-capital-surpasses-historic-milestone-to-begin-2022

Tags:

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

Sophisticated investors have increased their allocations to alternative investments in recent years ...

Navigating the investment landscape as an institutional investor comes with particular challenges an...

When it comes to executive compensation, striking a balance between a company’s goals and an executi...