How Tax-Exempt Institutions Can Access Alts Without the Dread of UBTI

Tax-exempt institutions have produced headline investment results by allocating to alternative investments.1

However, tax-exempt investors must guard against the unexpected tax consequences of some alternative strategies.

How can institutions capitalize on the differentiated investment performance of alternatives while avoiding potential tax pitfalls?

Institutions as Alternative Investment Leaders

Tax-exempt institutions are dedicated users of alternative investments.

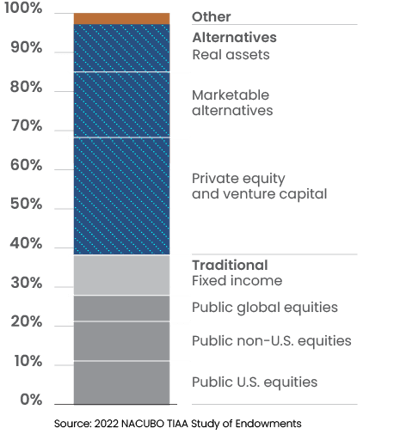

University endowments have allocated over half of their assets to alternatives—private equity, venture capital, marketable alternatives (e.g., hedge funds) and real assets—according the 2022 NACUBO-TIAA study.2

Endowment Allocations to Alternative and Traditional Assets, 2022

Universities were early advocates for alts, and other institutional investors have followed suit. “Over the last two decades, state and local government pension funds significantly increased allocations to alternative investments … while reducing exposure to more traditional asset classes like public equities and fixed income.”3

Public Pensions Increase Allocations to Alternative Investments, 2001-2022

Institutions allocate to alternative strategies in pursuit of superior gains, differentiated sources of income, enhanced risk-adjusted results, and reduced correlations to stocks and bonds. Recently, institutions have increased their allocations to alternatives to combat inflation, volatility, and challenging financial market conditions, particularly after the difficult drawdowns for public markets in 2022.4 Alternative assets and strategies help tax-exempt investors “achieve the return thresholds needed to satisfy obligations and/or to optimize the value put to work in the philanthropic community.”5

More recently, private credit investments have been gaining traction with institutions. “As traditional fixed income assets have struggled during a period of rising rates, institutional investors of all types are dedicating more capital to non-traditional asset classes such as direct lending, high yield bonds, leveraged loans and private credit to diversify their fixed income exposures,” according to Jill Popovich, Senior Managing Director at TIAA.6

Alternative Investing—Yes. Unwanted Tax Bills—No.

Despite the positive attributes and growing use of alternative investments, tax-exempt institutions must exercise caution when investing in alternatives. Some alternative investments and structures can produce unwanted tax bills and tax reporting obligations for tax-exempt investors.

Some alternative investments can generate unwanted Unrelated Business Taxable Income (UBTI). UBTI can require payment of Unrelated Business Income Tax (UBIT). Tax-exempt institutions must employ careful planning and structuring to avoid the dreaded UBTI and UBIT that may result from alternative investing activity.

UBTI: 2 Triggers

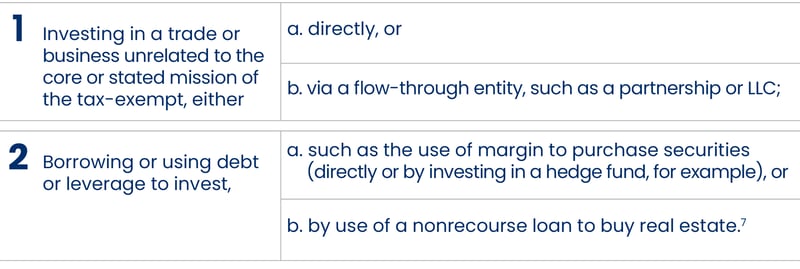

Two types of investment activities have the potential to trigger UBTI for tax-exempt investors:

UBTI from Trade or Business

UBTI (and UBIT) can be a significant stumbling block for tax-exempt institutional investors like pension funds, foundations, and endowments. UBTI is income that these tax-exempt entities earn from a trade or business that's not directly related to their tax-exempt purpose. According to the Internal Revenue Service, “the term trade or business generally includes any activity carried on for the production of income from selling goods or performing services.”7

For instance, a university endowment might earn UBTI from a retail complex it owns which is outside its core mission of education. Even though the university is tax-exempt, this income is taxable. “Congress instituted this tax to prevent tax-exempt organizations from having an unfair advantage over taxable organizations,” according to Gerald R. Nowotny, LLM, writing in the Journal of Taxation of Investments.8

UBTI from Investment Debt

UBTI also includes income from debt-financed property. Thus, tax-exempt institutions are subject to tax on investment property purchased with a mortgage. (Property dedicated to the mission of the tax-exempt, such as university facilities, are not subject to UBTI.) Investments in hedge funds that trade on margin can also trigger UBTI for tax-exempt institutions if the investment is made through a pass-through entity.

Consequences of UBTI

Why is UBTI of major concern for tax-exempt investors such as pension plans? Generating too much UBTI can have serious consequences for tax-exempt institutions. First, UBTI converts otherwise tax-exempt income into taxable income. Second, UBTI also requires additional tax filings and returns for a tax-exempt institution. Third, UBTI may also increase audit exposure to the organization’s other activities. Fourth and worst, excess UBTI may cause an institution to lose its tax-exempt status.

UBTI: Potential Consequences

Tax Bills

A formerly tax-exempt institution might face a tax bill if it generates too much UBTI. UBTI is subject to federal and possibly state income taxes, which can take a substantial bite out of investment returns.

A tax-exempt entity subject to UBTI pays taxes at the full corporate rate (less a $1,000 exemption) after any allowable deductions.9 The current federal corporate tax rate is 21%, before including any state or local corporate income taxes. If the tax-exempt entity is a trust, the federal tax rate may be as high as 37%.

Filings

The tax-exempt institution must also file an income tax return, Form 990-T. Tax-exempt institutions with more than $1,000 of Unrelated Business Income in a tax year must file this form. Filing the form may prove to be an unwanted task that invites unwelcome scrutiny from authorities.

Audit Exposure

UBTI tax filings may trigger audit exposure from the IRS.10 “The IRS seriously reviews organizations with a history of substantial UBI (income unrelated to exempt function),” according to Carr, Riggs & Ingram, a top-25 U.S. accounting firm.

Losing Tax-Exempt Status

Last, and more worryingly, if a significant portion of a tax-exempt institution's income is classified as UBTI, the institution risks losing its tax-exempt status altogether. The IRS stipulates that if more than an insubstantial part of a tax-exempt organization’s activities is not in furtherance of its exempt purpose, it could lose its tax-exempt status.11 While the definition of “insubstantial” is subjective and decided on a case-by-case basis, it’s a risk that institutions prefer to avoid.

Understanding UBTI and Alternative Investments

Alternative investments, despite offering potentially higher returns and diversification benefits, can entail involvement in businesses unrelated to the institution’s core purpose, thereby triggering UBTI.

The diverse nature of alternative investments can lead to a potential tax liability, somewhat dampening the attractiveness of their excess returns or favorable risk/return characteristics. If a tax-exempt institutional investor directly invests in alternative assets like infrastructure, direct lending, private equity, private credit, hedge funds, and others, the income generated might be considered UBTI and hence be taxable.

As a result, alternative asset managers and their tax-exempt investors carefully structure their alternative strategies and delivery vehicles to steer clear of UBTI.

Delving Deeper: Why Alternative Investments Generate UBTI

Understanding why alternative investments may generate UBTI requires looking at the nature of these investments and the unique structures and strategies they employ.

Operating Businesses

Alternative investments like private equity and direct lending often involve operational businesses unrelated to the core exempt purposes of tax-exempt institutional investors. When these businesses generate income, that income can be classified as UBTI.

The Role of Leverage and Borrowing

Leverage and borrowing can further amplify the UBTI issue. Alternative investments may use leverage (debt-financing or borrowing) to amplify their returns. When an investment is partially financed through leverage, a portion of the income it generates can be classified as “debt-financed income,” which is included in UBTI.

For example, if a hedge fund uses leverage, a portion of the trading profits can be considered debt-financed and thus contribute to UBTI. Moreover, the trading activity of some hedge funds may be considered a “trade or business” rather than an investment activity.

What Investment Income Does NOT Generate UBTI?

Certain types of investment income, exempt under regulation,12 do not generate UBIT, including:

- Interest

- Dividends

- Capital gains (from capital assets, not stock in trade or inventory)

- Option income

- Annuity Income

The latter option—annuity income—is one of the ways institutions gain access to alternatives and still avoid UBTI.

A Tax Solution for Alternatives: Private Placement Group Variable Annuities

Fortunately, there are a number of ways for institutional investors to access alternatives without triggering UBTI. Implementing alternatives within a Group Variable Annuity (GVA), a form of private placement variable annuity, may prove to be an advantageous structure for a variety of tax-exempt investors.

Notably, GVAs offer lower-cost institutional pricing as well as the flexibility to implement multiple alternatives strategies.

The History of GVAs

GVAs were originally designed for use by the wholly-owned real estate advisory affiliates of major U.S. life insurers, including:

These “exclusive” GVAs served as conduits for more than $50 billion of investor capital.13

GVAs and UBTI: The Tax Shield

By using GVAs as an investment vehicle, tax-exempt institutional investors can avoid generating UBTI. The GVA structure and applicable regulations are key.

To start, Section 512(b)(1) of the Internal Revenue Code specifically exempts annuity income from UBTI treatment. Thus, GVA distributions of alternative investment profits are not subject to UBTI.

Moreover, the insurance company issuing the GVA is the actual owner of the investments within the policy. Thus, any income generated is technically earned by the insurance company, not the policyholder.

Furthermore, the “investor control” doctrine, integral to tax compliance within insurance structures, prevents the active role of policyholders in the investing activity within the annuity structure, assuring that the institution remains a passive investor.

When considering the above factors together, this provides an attractive opportunity for tax-exempt institutional investors to invest in alternative strategies through GVAs without worrying about potential tax implications.

Other Tax-Favored Structures for UBTI-Sensitive Investors

In addition to private placement group variable annuities, other structures may be utilized by tax-exempt investors seeking to invest in alternatives without adverse tax consequences.

Real Estate Investment Trusts (REITs)

For tax-exempt institutions seeking to invest in real estate, the REIT structure can be a solution, since REITs are taxable as corporations. “REIT dividends paid to shareholders, including tax-exempt entities, are not subject to UBTI,” according to EisnerAmper, the international accounting firm.14

Fund Covenants to Avoid UBTI

Investment managers may also offer covenants in their fund documents to avoid UBTI for their tax-exempt investors. “Fund sponsors commonly accommodate tax-exempt entities by covenanting not to incur, or to limit or minimize, UBTI. Practically speaking, a covenant to avoid UBTI means that the fund cannot incur indebtedness and cannot invest in flow-through operating entities, except through “blocker” structures,”15 according to global law firm, Morgan Lewis.

Corporate Blockers

Investing through a corporate structure rather than directly or through a flow-through entity is often a UBTI solution for tax-exempt investors. The corporation, not the tax-exempt institution, operates the trade or business or takes on the investment borrowing. Corporate profits are paid out as a dividend, which are excluded by statute from UBTI. The corporation serves as a tax “blocker.”

Offshore Blocker Corporations

Depending on the requirements of the investment structure and the investor, U.S. or non-U.S. blocker corporations may be utilized. An offshore jurisdiction with little or no corporate tax is often selected, since a U.S. corporation could face significant federal, state, or local taxes.16 Alternative fund sponsors frequently offer offshore funds to tax-exempt clients, who favor offshore jurisdictions and structures with high standards of corporate governance and regulatory oversight.17

The tax issues associated with blocker corporations are complex, and a specialized tax adviser is recommended.

Offshore Funds Versus Private Placement Group Variable Annuities

By setting up a blocking entity (usually a corporation set-up in an offshore jurisdiction) taxation can be blocked. However, there are multiple negatives to this approach:

- Offshore “blocker” structures may be expensive or complex to establish and administer.

- The public perception of implementing offshore entities to lower taxes may be unfavorable. Certain tax-exempt entities, like state university endowments or pensions or U.S. union retirement plans, may seek to avoid offshore corporate blockers. Such investors may prefer a tax-favored annuity structure offered by a U.S. insurance company.

There are significant additional benefits in using private placement GVAs to implement alternative investments:

- Lower Costs: Favorable institutional pricing for GVAs may be less than the cost of blocker entities.

- Reduced Tax Reporting: The GVA facilitates investing without the need to file Form 990T. Also, K-1 forms are not issued to policyholders (which are received by the insurer instead).

- Investment Flexibility: Insurance companies may offer open architecture GVAs with the flexibility to onboard a variety of alternative investments from multiple investment managers.18

Learn More

Do you advise or invest on behalf of a tax-exempt institutional investor? To learn more about the private placement group variable annuity structure, download our free eBook:

Advisor’s Guide to Private Placement Life Insurance and Variable Annuities

1. For example, see Mary Romano, How Alternative Investments Saved the Day for Big University Endowments,” Barron’s, October 14, 2022.

2. 2022 NACUBO-TIAA Study of Endowments, p. 7.

https://www.nacubo.org/Research/2022/NACUBO-TIAA-Study-of-Endowments

3. UBS Editorial Team, “Public pension plans tilt toward alternatives,” January 12, 2023

https://www.ubs.com/us/en/wealth-management/insights/market-news/article.1582725.html

4. Andrew Welsch, Barron’s, “Institutional Investors Want More Alts Amid Inflation, Lower Expected Market Returns,” December 8, 2022.

https://www.barrons.com/advisor/articles/institutional-investors-alternative-investments-51670532976

Jennifer Reardon, AltExchange, “44% of Institutional Investors Want Increased Allocation to Alts,” December, 22, 2022

https://www.altexchange.com/blog/44-of-institutional-investors-want-increased-allocation-to-alts/

5. Jonas Katz, “Insurance Dedicated Funds 101: Growth, Trends and Next Steps”, SALI Fund Services, July 2022.

https://www.sali.com/publications/

6. NACUBO, “In Challenging Year, Higher Education Endowments See Declines in Returns and Values but Boost Overall Spending, NACUBO-TIAA Study Finds,” February 17, 2023.

7. “ ‘Trade or Business’ Defined,” Internal Revenue Service, retrieved June 20, 2023.

https://www.irs.gov/charities-non-profits/trade-or-business-defined

8. Gerald R. Nowotny, “ Private Placement Variable Annuity Contracts—A Market Overview for Tax-Exempt and Foreign Investors”, Journal of Taxation of Investments, Winter 2012, p. 53.

https://www.jdsupra.com/legalnews/private-placement-group-variable-annuity-45635/

9. “Who must file form 990-T?”, expresstaxexempt.com, retrieved June 20, 2023.

https://www.expresstaxexempt.com/form-990-t/what-is-form-990-t/

10. Carr, Riggs & Ingram, CPAs, “Six Common Nonprofit IRS Audit Triggers,” May 30, 2023.

https://cricpa.com/insight/six-common-nonprofit-irs-audit-triggers/

11. “How to lose your 501(c)(3) tax-exempt status (without really trying),” Internal Revenue Service, retrieved June 20, 2023.

https://www.irs.gov/pub/irs-tege/How%20to%20Lose%20Your%20Tax%20Exempt%20Status.pdf

Publication 598: Tax on Unrelated Business Income of Exempt Organizations, Internal Revenue Service, revised March 2021.

https://www.irs.gov/pub/irs-pdf/p598.pdf

12. Gerald R. Nowotny, “ Private Placement Variable Annuity Contracts—A Market Overview for Tax-Exempt and Foreign Investors”, Journal of Taxation of Investments, Winter 2012, p. 55. See Internal Revenue Code, Section 512(b)(1).

https://www.jdsupra.com/legalnews/private-placement-group-variable-annuity-45635/

13. Gerald R. Nowotny, “ Private Placement Variable Annuity Contracts—A Market Overview for Tax-Exempt and Foreign Investors”, Journal of Taxation of Investments, Winter 2012, pp. 49-52.

https://www.jdsupra.com/legalnews/private-placement-group-variable-annuity-45635/

Tags:

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

Part 2: Case Studies In Part 1 of our blog series on the power of Section 1035 exchanges, we explore...

Part 1: Fundamentals High net worth investors and their advisors frequently encounter legacy life in...

Navigating the investment landscape as an institutional investor comes with particular challenges an...