1035 Exchange Series Part 1: The Basics—Cut Costs and Grow Wealth: Transform Old Life Insurance and Annuities With a 1035 Exchange

Part 1: Fundamentals

High net worth investors and their advisors frequently encounter legacy life insurance policies and annuities when managing family assets. These policies were often acquired years ago and may no longer be a right fit.

These investors likely now have different financial needs. Their personal and family situation may have evolved.

High expenses and out-of-date features may weigh on some legacy policies. Nevertheless, they may also represent significant investment value or insurance benefits.

“What do we do with the policies?” is a common question. A tax-free 1035 exchange into a more suitable or superior policy may be the answer.

A. The Problem of Old Policies

Terminating these old policies is problematic: policy withdrawals can trigger significant taxable income and a large tax bill. Some policies may still be subject to withdrawal charges.

Moreover, legacy policies may have limited investment options, or may not provide access to the benefits of more modern products or vehicles better suited to the clients’ current needs.

As a result, numerous affluent households may be beholden to inefficient insurance coverage, high expenses, and minimal or restricted investment options with these instruments.

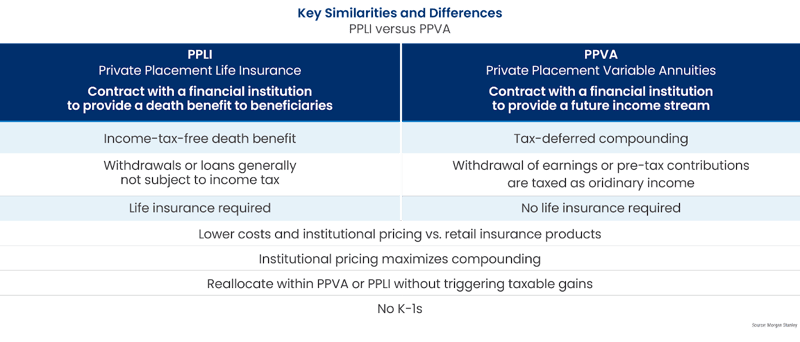

These legacy assets, however, present an opportunity. With a tax-free 1035 exchange, policyholders can switch from outdated insurance and annuity contracts into lower-cost private placement life insurance (PPLI) or private placement variable annuities (PPVA). PPLI and PPVA also can offer more flexible and diverse investment options, and be customized to the specific tax, estate, and investment needs of the client.

The potential for enhanced results should be explored by all holders of out-of-date policies, particularly larger policies.

B. Advantages of Private Placement Life Insurance (PPLI) & Private Placement Variable Annuities (PPVA)

PPLI and PPVA are sophisticated investment vehicles that combine elements of traditional insurance or annuity products with features of institutional investment management. PPLI and PPVA are institutionally-priced insurance contracts that allow investors to direct their premiums into a variety of investment options and enjoy tax-deferred growth. These options include both traditional and alternative investments such as private credit, private equity, hedge funds, and real estate.

PPLI and PPVA are designed for high-net-worth individuals and families who are looking to optimize their investment strategies and minimize their income tax and estate tax liabilities. PPLI and PPVA can enhance the after-tax returns of investments that would otherwise generate substantial taxable income such as alternative strategies. While traditional insurance emphasizes a death benefit, PPLI emphasizes investing and tax-deferred compounding.

Access to PPLI and PPVA is limited to accredited investors and qualified purchasers (with a minimum of $5 million of investment assets). PPLI and PPVA are best utilized as long-term instruments to optimize tax-deferred compounding. A long-term holding period is particularly important for PPLI to overcome the cost of insurance required by IRS regulations in the early years, and to take optimal advantage of income-tax-free death benefits. As life insurance, PPLI requires insurance underwriting, while PPVA does not.

The Distinctive Features & Benefits of PPLI & PPVA

1. Purpose:

- Role of PPLI and PPVA: PPLI and PPVA are designed to offer high-net-worth individuals, trusts, and other entities tax-advantaged investment opportunities, combined with the benefits of life insurance or annuity contracts.

2. Key Characteristics:

- Customization: PPLI and PPVA policies can be tailored to the specific needs and investment goals of the policyholder, usually featuring a broader range of investment options than typical retail insurance or annuity products.

- Tax Benefits: Investment gains within these vehicles grow tax-deferred. Investment reallocations within these vehicles do not generate taxable gains. No K-1s from underlying investments simplifies tax reporting.

- Death Benefits: For PPLI, death benefits are generally income tax-free to beneficiaries. A properly structured Irrevocable Life Insurance Trust (ILIT) may also mitigate estate taxes.

- Institutional Pricing: These products are designed for institutional or high-net-worth investors, with lower fees compared to their retail counterparts due to economies of scale.

3. Eligibility:

- High Net Worth and Institutional Only: These are not mass-market instruments. They're designed for high-net-worth individuals, trusts, or institutional clients, often with minimum investment requirements.

4. Investment Options:

- Traditional Plus Alternative Investments: Unlike traditional policies, PPLI and PPVA often allow for a broader and more diverse range of investment options, including both traditional and alternative investments such as hedge funds, private equity, credit strategies and more.

5. Tax Implications:

- PPLI: Cash values grow tax-deferred. Policyholders may be able to withdraw a significant portion of cash values via properly structured loans across the life of the policy. Upon the death of the insured, the death benefit is typically paid out income tax-free to the beneficiaries.

- PPVA: The investment growth is tax-deferred. Withdrawals of earnings are generally taxable. Earnings are taxable upon the death of the annuity owner, unless proceeds are left to charity.

6. Rationale:

- Optimizing After-Tax Returns: High-net-worth individuals and institutions often seek ways to optimize their investment portfolios, balance risk, and minimize taxes. PPLI and PPVA provide a vehicle to achieve these objectives by melding the benefits of institutional investing with insurance or annuity structures.

7. Caveats:

- Complexity: These are complex products. Proper understanding and guidance are crucial.

- Costs: The costs, while potentially lower than retail products on a relative basis, can still be significant in absolute terms.

- Limitations to Change: Surrendering or withdrawing from these contracts, especially in the early years, might be subject to substantial costs, penalties, or tax implications.

- Risk: As with any investment, there is no guarantee of returns. The value can go up or down depending on the underlying investments.

8. Regulatory Environment:

- Multiple Regulations: Both PPLI and PPVA are subject to state insurance regulations as well as federal and state securities laws, including specific disclosure requirements. Moreover, tax laws and regulations applicable to insurance evolve over time and are subject to change.

As with any complex financial product, those considering PPLI or PPVA should consult with legal, tax, and financial professionals to understand all the implications and ensure the product aligns with their overall financial goals and risk tolerance.

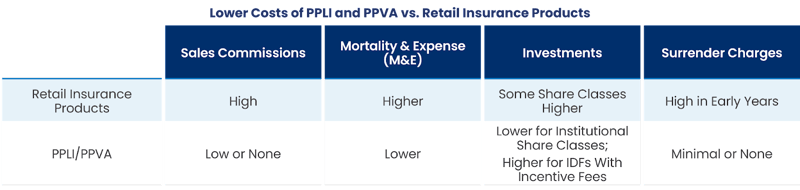

C. Lower Costs: PPLI and PPVA vs. Retail Insurance Products

PPLI and PPVA are noted for their cost-efficiency, particularly when compared to their retail counterparts. PPLI and PPVA expenses are designed to be transparent, while the expenses of comparable retail products are often obscured. Reduced fees and lower insurance costs translate into a higher potential for compound growth.

Below is a detailed breakdown of how and why PPLI and PPVA can offer lower costs:

1. Commissions:

- PPLI vs. Retail Life Insurance: PPLI typically has no or low commissions compared to retail life insurance. In retail policies, commissions can be quite significant, especially in the early years. PPLI, designed for institutions and high-net-worth individuals, often has a fee-based structure, minimizing or eliminating commissions. Commissions on a retail policy may exceed the first-year premium. In contrast, first year fees for PPLI may range from 0.2% to 0.5% for structuring, plus any applicable state premium taxes.1

- PPVA vs. Retail Variable Annuities: Similar to PPLI, PPVAs often have reduced or no commissions when compared to retail variable annuities. Retail variable annuities might charge high upfront commissions, which can significantly affect investment growth potential. Commissions vary based on the type of annuity but can range from 1% to 10% for a retail variable annuity.2

2. Mortality & Expense (M&E) Charges:

- PPLI vs. Retail Life Insurance: Retail life insurance policies typically have M&E charges that cover the insurance company's costs and risks associated with insuring the policyholder. These charges can vary but are often higher in retail products. PPLI policies, given their institutional nature and larger funding amounts, often have reduced M&E expenses.

- PPVA vs. Retail Variable Annuities: Retail variable annuities also incorporate M&E charges. PPVAs, designed for a sophisticated audience with larger investment amounts, usually feature lower M&E charges, translating to potentially significant savings over the life of the annuity.

3. Investment Costs:

- PPLI vs. Retail Life Insurance: PPLI contracts allow access to a broader range of institutional-class investments, which may offer lower fees than the investment options in retail life insurance policies. This is primarily due to the economies of scale and the negotiated fee structures for large investments. However, hedge fund and private market strategies within PPLI may be subject to incentive fees in addition to higher management fees.

- PPVA vs. Retail Variable Annuities: Just as with PPLI, PPVAs provide access to institutional-grade investments, which tend to have lower fee structures than the retail mutual fund sub-accounts typically found in retail variable annuities. Keep in mind that hedge fund and private market strategies investments through PPVA may be subject to incentive fees in addition to higher management fees.

4. Surrender Charges:

- PPLI vs. Retail Life Insurance: Retail life insurance products often have surrender charges that can be quite steep, especially if the policyholder withdraws funds in the early years of the policy. PPLI is generally not subject to surrender charges.

- PPVA vs. Retail Variable Annuities: Retail variable annuities also have surrender charges, which can deter early withdrawals. PPVA are generally not subject to surrender charges.

The cost differences between PPLI, PPVA, and retail insurance products are summarized below:

PPLI and PPVA, designed for high-net-worth individuals and institutional investors, leverage economies of scale and a fee-based model to offer more cost-efficient structures. While these private placement products can offer cost advantages, they also come with their own set of complexities and considerations. Investors should seek guidance from specialized professionals before proceeding.

D. Tax-Free 1035 Exchange Fundamentals

Families with legacy retail insurance and annuities may be able to access the lower costs and added benefits of PPLI or PPVA through a 1035 exchange.

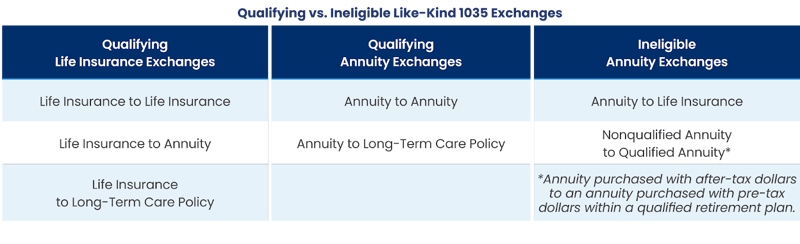

Section 1035 of the Internal Revenue Code (IRC) provides guidelines for a tax-free exchange of certain types of insurance and annuity contracts. The basic premise of a Section 1035 exchange is to allow individuals to replace old contracts with new ones without having to pay taxes on any gains at the time of the exchange.

Below is a summary of Section 1035 exchanges for life insurance and annuities:

1. Purpose:

- Section 1035 exchanges enable policyholders to access insurance products better suited to evolving needs or circumstances without triggering taxes.

2. Eligible Contracts:

- Only certain types of exchanges are permitted under Section 1035. The most notable permitted exchange types include:

- Life insurance policy for another life insurance policy

- Life insurance policy for an annuity contract

- Annuity contract for another annuity contract

- Life insurance policy or annuity contract for a qualified long-term care contract

- Keep in mind that you cannot exchange an annuity contract for a life insurance policy under Section 1035.

3. Tax Implications:

- In a properly executed 1035 exchange, the accumulated gains in the old contract are rolled into the new contract without current taxation. However, the taxpayer would be liable for taxes when funds are eventually withdrawn or when a taxable event occurs in the future. An exchange from an annuity to a long-term care policy may convert otherwise taxable withdrawals into non-taxable long-term care benefits.

4. Requirements for a Valid Exchange:

- The exchange must be a direct transfer between insurance companies. The policyholder should not receive the proceeds from the old contract.

- The policyholder and insured generally must remain the same, especially when exchanging life insurance policies.

5. Rationale:

- Over time, insurance needs can change, or better products might become available. A policyholder might want a life insurance policy with different terms, better investment options, or lower fees. Similarly, someone might want to shift from a life insurance policy to an annuity as their primary concern transitions from life insurance coverage to income generation.

6. Caveats:

- Although the tax implications of the exchange might be neutral, there could be other costs involved, such as surrender charges on the old contract or expenses associated with the new contract.

- Not every exchange will qualify for Section 1035 treatment, even if it seems to fit the criteria. Proper documentation and adherence to procedure are crucial.

- Before executing a 1035 exchange, it's wise to compare the benefits, features, and costs of the old contract to the new one and ensure the exchange is appropriate and effective.

7. Regulations:

- While Section 1035 of the tax code governs these exchanges, state insurance regulations also play a role. It's essential to be aware of any state-specific requirements or restrictions.

As always, when considering a Section 1035 exchange or any other financial move, it's advisable to consult with a tax professional or financial advisor to ensure compliance with the rules and to fully understand the implications of a transaction.

Steps to Success: Implementing a 1035 Exchange

A successful 1035 exchange requires adherence to a strict set of procedures and tax regulations. A lack of compliance can undermine or eliminate the tax benefits. Below is a summary on how to succeed with a tax-free Section 1035 exchange:

1. Requirements for a Successful 1035 Tax-Free Exchange:

- Direct Transfer: The funds should move directly between insurance companies without the policyholder taking possession.

- Like-kind Exchange: For tax-free treatment, the exchange should be of like kind; for instance, life insurance to life insurance (or PPLI) or annuity to annuity (or PPVA) or other transfer permitted under tax regulation.

- Same Policyholder: The owner of the new policy (PPLI or PPVA) should generally remain the same as the original policy.

2. Evaluating if PPLI or PPVA is Right for the Individual Investor:

- Investment Horizon and Objectives: Consider your long-term goals. PPLI and PPVA are more suitable for those looking at long-term growth with tax benefits.

- Risk Tolerance: Understand the investment strategies and risks involved in the new product.

- Liquidity Needs: Given potential surrender or tax costs and the nature of some investments within PPLI and PPVA, ensure you won’t need the invested money for immediate expenses.

3. Working with Experience Professionals:

- Specialized Insurance Advisors: They can provide insights into the best PPLI or PPVA products, help with the underwriting process, and guide on the nuances of the exchange.

- Lawyers and Accountants: Engage with them to understand the tax implications, ensure compliance with regulations, and get a grasp on the legal nuances of the exchange.

4. Steps to Start the 1035 Exchange Process:

- Document Review: Examine your current policy’s terms, including any surrender charges or special features.

- Application: Apply for the PPLI or PPVA policy. This might involve underwriting for PPLI.

- Initiate the Exchange: Once approved, inform your existing insurance provider about the desire to execute a Section 1035 exchange. Provide them with details of the new policy and insurer.

5. Potential Pitfalls and How to Avoid Them:

- Incomplete Documentation: Ensure all paperwork is complete to prevent delays or denials.

- Surrender Charges: Be aware of any fees that will be incurred from the current policy upon exchange.

- Tax Mistakes: Ensure the exchange is handled correctly to maintain the tax-free status. Avoid receiving the funds directly, which could make the transaction taxable.

- Underwriting and Age Issues: A 1035 exchange into a new life insurance policy generally requires underwriting of mortality risk. This may prove difficult based on the age, health and financial condition of the client. While a 1035 exchange into an annuity generally does not require such underwriting, age limitations may apply.

- Licensing: A 1035 exchange is a new insurance or annuity sale, so licensing is important, particularly in the state where the client resides.

6. Monitoring and Managing Your Investment Post-Exchange:

- Regular Reviews: Periodically review the performance of your investments within PPLI or PPVA.

- Stay Informed: Understand any changes in the investment landscape, regulations, or tax laws that might affect your policy.

- Adaptable Strategy: Consider rebalancing or adjusting the portfolio as market conditions and your personal financial needs change.

7. Additional Steps:

- Beneficiary Review: Ensure that beneficiaries are correctly designated on the new policy.

While a Section 1035 exchange to a PPLI or PPVA can offer enhanced tax advantages and investment opportunities, it's crucial to ensure the move aligns with your financial objectives. Collaboration with experienced professionals can aid in navigating the complexities of the process and maximizing the potential benefits.

Next Steps

Investors must regularly assess and reevaluate their financial strategies to ensure that they align with their goals and the current financial landscape. Be on the lookout for part 2 of this blog series, where we illustrate the process in action and the success sophisticated investors can achieve with a 1035 exchange into PPLI & PPVA.

For a fresh perspective, feel free to connect with us.

1. Scott A. Bowman and Nathan R. Brown, “A Primer on Private Placement Life Insurance,” Florida Bar Journal, July/August 2014 https://www.floridabar.org/the-florida-bar-journal/a-primer-on-private-placement-life-insurance/

2. Jennifer Schell, “Annuity Fees and Commissions,” Annuity.org, September 6, 2023. https://www.annuity.org/annuities/fees-and-commissions/

Tags:

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

Part 2: Case Studies In Part 1 of our blog series on the power of Section 1035 exchanges, we explore...

Navigating the investment landscape as an institutional investor comes with particular challenges an...

When it comes to executive compensation, striking a balance between a company’s goals and an executi...