How the CLO Structure Evolved for Enhanced Income Investing

Interview With Robert Klein, President and Chief Investment Officer of Structured Credit at Clarion Capital Partners

Across your career, you’ve witnessed evolution firsthand. In your case, the evolution of investment technologies—securitized assets and Collateralized Loan Obligations or “CLOs.”

I’ve seen it all.

What would you consider the most remarkable changes you’ve seen in the CLO industry over time?

Over the years, periods of adversity have challenged and strengthened the CLO structure for income investors. I would say that the financial crisis really improved the quality of the CLO structure.

Ok, so let’s go back to the beginning. How did CLOs start?

The roots of CLOs can be traced back to the concept of securitization. The idea of packaging a group of loans or cash flows into a single security goes back to the 1970s. At the time, the Government National Mortgage Association (GNMA) created the first pass-through mortgage securities. Ginnie Mae, you could say, was the mother of it all.

In the 1980s, the Federal National Mortgage Association (FNMA) or “Fannie Mae” issued the first collateralized mortgage obligations (CMOs). These early CMOs offered different tranches based on prepayment speeds. Tranche, of course, is the French word for slice.

Savory or sweet, if we could ask metaphorically?

Your choice. A tranche offers a share in the income and assets from a pool of securities, with cash flows split up by risk or other characteristics in order to appeal to different investors with varying appetite for risk and return.

So how did we get from CMOs based on mortgages to CLOs with corporate loans?

We had intermediate steps. In the mid 1980’s we saw the first asset-backed securities. These were backed by computer leases thanks to the Sperry Lease Finance Corporation. The trend to package various types of cash flows into securities continued and accelerated.

The first CLOs originated in the late 1980s. They were created so banks could package leveraged loans together and provide investors with varying degrees of risk and return to match their investment objectives.

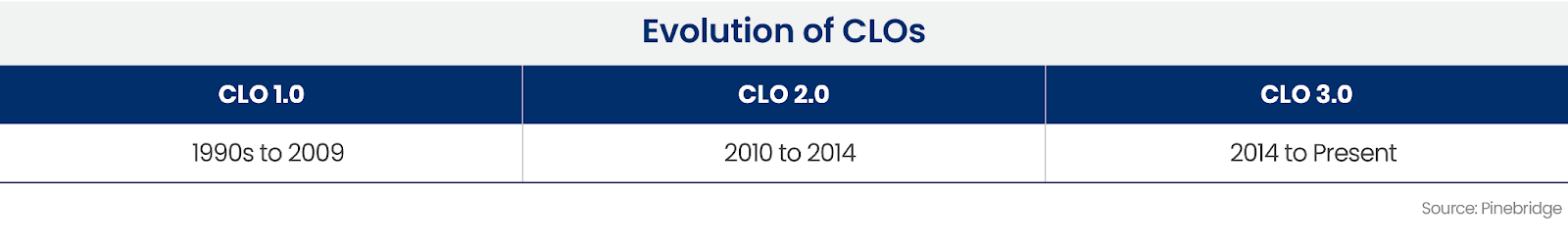

CLO 1.0

Looking back, these first CLOs were an experiment. That led to the first vintage of “modern” CLOs—CLO 1.0—designed to generate income via cash flows. The era of CLO 1.0 started in the mid- to late-1990s. This vintage of CLOs included some high yield bonds as well as loans and were the standard CLO structure until the financial crisis struck in 2008.

In retrospect, CLO 1.0 was truly an experimental stage, for better and sometimes for worse. The financial technology of securitization was in its development and refinement phase. Not every feature worked out so well. Fortunately, struggle can lead to improvement.

Speaking of struggles, what happened during the financial crisis?

First, let’s remind our readers that CLOs came through the GFC with minimal ultimate losses. CLO may rhyme with CDO and CMO, but CLOs proved to be far more resilient historically. CLOs as an asset class did not suffer the fate of those other instruments. CLOs have proven to be resilient across multiple crises. Not just during the Great Financial Crisis (GFC) but, most recently, during the Covid downturn in 2020.

So how did the experience of the GFC lead to improvements in the CLO structure?

The exploration and expansion of CLO technology pre-crisis went into the crucible of 2009 and came out a battle-tested product. The turmoil helped eliminate things that didn't work and homed in on things that did work. This process of homing in on things that worked led to the era of CLO 2.0 starting in 2010.

CLO 2.0

Name a key improvement to the CLO structure with CLO 2.0.

Uniformity of assets was a key enhancement for CLOs coming out of the financial crisis. This strengthened the credit quality of the underlying pools and the credit support for the structure overall.

Older CLOs mixed in high yield bonds and even some exotic assets. The crisis was not kind to such holdings. After the crisis, collateral was limited primarily to bank loans. High yield bonds were ultimately capped at 5% to 10% of the pool. The amount of assets rated CCC or below was also capped. With a uniformity of assets, only or mostly senior bank loans go into the collateral pool. You’re going to limit anything exotic that you put in the pool. Because high yield bonds, low rated securities, and other exotic things are what really led to worse outcomes during the financial crisis.

This focus on quality bank loans is integral to the “self-healing” structure of CLOs. Today, if a CLO pool faces too many downgrades, mandatory tests trigger a diversion of cash flows from the equity or even mezzanine tranche to buy additional quality loans or pay down and redeem the highest rated tranches until the CLO pool passes its internal tests again.

What was another improvement for CLOs that resulted from the financial crisis?

CLO 2.0 shortened the reinvestment period. CLO managers today can trade their portfolio during a two-to-five-year window. By trading, CLO managers can shed risky assets or take advantage of market opportunities. After the reinvestment period, the amortization period begins when investors receive the principal from maturing loans. Debt investors generally prefer the shorter time periods. A longer reinvestment period can leave investors vulnerable to the next credit cycle.

Shorter reinvestment periods sound pretty basic. What was another key improvement for CLOs that resulted from the financial crisis?

A key lesson of the crisis was that CLOs that had mark-to-market triggers didn’t work out so well. Crises tend to create indiscriminate selling. Good assets go out with the bad. Anxious sellers sometimes sell at any price. The result was that some CLOs began to fail their collateral tests and were forced to suspend cash flows or sell perfectly good assets at depressed prices. So CLOs evolved into non-mark-to market structures. CLO collateral tests evolved.

Soon after the crisis, new CLOs were created that tested actual cash flows as well as collateral quality based on ratings. If loans were paying their interest on a current basis and their ratings stayed at B or better, the collateral was deemed passing for CLO testing purposes. CLOs were no longer being whipsawed by market action. The quality of the collateral is what mattered.

Were there other major structural changes?

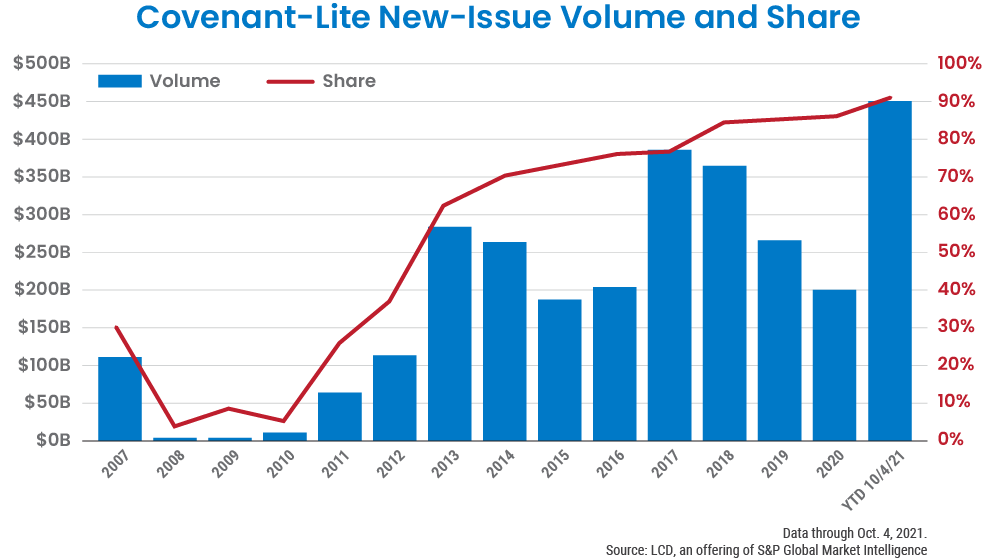

Yes, we moved into a world of covenant-lite or “cov-lite.”

Early on, leveraged loans were governed by both maintenance covenants and what are called incurrence covenants. Maintenance covenants typically test financial performance. A maintenance covenant may include a requirement that the borrower has a minimum amount of earnings to cover interest payments. Incurrence covenants apply to actions that impact a borrower’s finances, such as taking on more debt.

If the borrower violates a covenant, they are deemed to be in default on the loan. Once a default occurs, a lender can demand early repayment of the loan, impose additional interest or fees, or modify the terms of the debt. In some cases, the lender can seize collateral and sell it to recoup its losses. A lender can also waive the breach. From a practical point of view, if a borrower breaches a covenant, they must come to the table with the lenders and say how they’re going to fix it.

Shortly after the financial crisis, we saw a reduction in the number of loans with maintenance covenants. Loans became more like high yield bonds with incurrence covenants only. With high yield bonds and incurrence covenants, the only time that a covenant comes into effect is if you actively do something to the capital structure.

So, the loan market became “cov-lite.” Cov-lite loans were less than 10% of newly issued loans at the time of the GFC. Today, cov-lite loans make up 90% of new leveraged loans. This concerns some investors.

However, a number of dynamics drove this change. First, growing demand puts borrowers in a better negotiating position. There was also a more practical issue. As the asset class grew in popularity, an increasing number of leveraged loan investors were no longer professional lenders. It’s better for such a market to have fewer default triggers. According to a Federal Reserve study, many bank lenders would retain maintenance covenants as part of a revolving loan to better monitor the borrowers. The rest of the financing package would be syndicated out on a “cov-lite” basis to make it easier for others who don’t have the resources and experience to manage borrowers to invest.

Did you change your investment approach for a “cov-lite” market?

Well, if there are fewer maintenance covenants, you probably aren’t going to have as many defaults. If there’s not a test for whether the temperature is too hot in the room, the room’s probably just going to stay hot. What we saw as an important element to underwriting future downturns was not default risk as much as downgrade risk.

I think the battle test of the financial crisis made CLOs better. That was one phase in the evolution of CLOs, the structural phase, and then there was the regulatory response. The regulatory response led to CLO 3.0.

CLO 3.0

When was that?

CLO 3.0, the current vintage of CLOs, began in 2014, ushered in by the Volker Rule.

What was the Volker Rule?

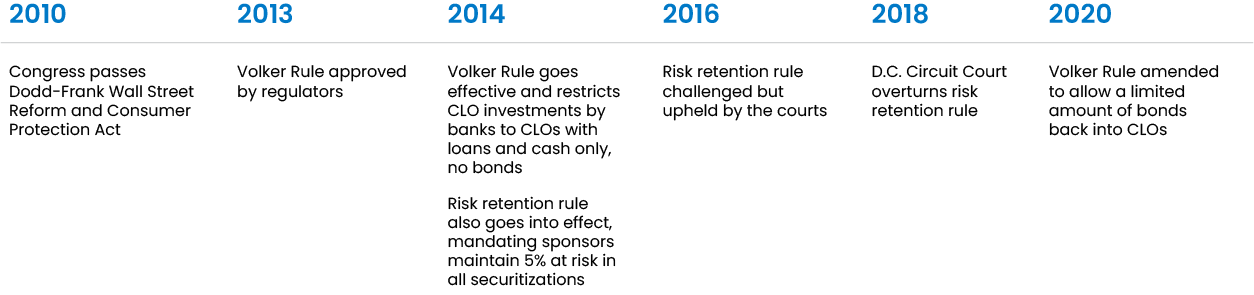

The Volker Rule was the result of the Dodd-Frank Act which was enacted in 2010. The full name of the law was a mouthful: the Dodd-Frank Wall Street Reform and Consumer Protection Act. Dodd-Frank overhauled financial regulation in the aftermath of the Great Recession. Dodd-Frank was the biggest regulatory change to the U.S. financial system since the Great Depression.

Paul Volker was the former Chairman of the Federal Reserve. Volker was the legendary inflation-slayer of the 1980s. He was also known as “Tall Paul” since he was six-foot-seven. President Obama brought him back to chair the President’s Economic Recovery Advisory Board in 2009.

A tall dragon-slayer?

Actually, he was brought back to strengthen the financial system. As a follow-up to Dodd-Frank, Volker proposed rules to restrict U.S. banks from making certain kinds of speculative investments that didn’t benefit customers. Volcker argued that banks’ speculative activity played a key role in the financial crisis of 2007–2008. The public was disinclined to bail out banks and the financial system again. It took years of wrangling among Congress and regulators, but the Volker Rule was finally approved in 2014.The rule placed strict limits on speculative, proprietary trading by banks, and severely curtailed banks’ ability to invest in or sponsor private equity funds or hedge funds.

How did the regulatory response impact CLOs?

The Volker Rule took effect in 2014. That began the era of CLO 3.0. The Volker Rule was subsequently amended, and parts of the Volker Rule were overturned by the courts. Nevertheless, the rules have had a lasting impact on CLO structures.

The Volker Rule said CLOs held by banks, the largest CLO investing group, could only hold loans or cash. No high yield bonds allowed. The goal was to reduce risk by eliminating high yield bonds. In 2020, the Volker Rule was amended. High yield bonds were allowed back in. Today, few CLOs permit high yield bonds in their portfolios. Those that do might limit exposure to between 5% and 10%. Similar limits apply to CCC-rated securities. To offset the extra risk, these CLOs may have increased levels of subordination to protect the holders of the debt tranches.

What’s your opinion of CCCs in CLOs?

Some CLO investors like the higher yields of a spicy mix with CCCs. Actually, as risk managers, we still prefer to avoid CLOs with excess CCC exposure.

Before the pandemic selloff in 2020, we decided to form a portfolio with lower triple Cs to start. Even in our cov-lite era, without maintenance covenants on most loans, you still have the rating agencies able to see problems and downgrade the loan.

How did this play out during the pandemic?

So, when the pace and quantum of downgrades increased, we had already stood aside from much of the drop in credit quality. And that just led to us being able to get through the pandemic when 43 loans were downgraded for every upgrade. Our portfolios were able to absorb that downgrade rate without having a payment interruption to the equity. At the height of the pandemic, 24% of CLO equity tranches had to reduce or suspend cash payments. We won’t take credit for knowing that a pandemic was on the way. Those CLOs with too many CCCs to begin with had no room to absorb the increased pace of downgrades. Those deals ended up having to suspend dividends to the equity and have their self-healing mechanisms go into effect.

How else did the Volker rule change CLOs?

Two words: risk retention.

Explain risk retention.

Risk retention sought to create an identity of interest between investors and manufacturers of securitized products, including CLOs. To oversimplify, a CLO manager was required to hold more than 50% of the equity tranche of any CLO issued. Having “skin in the game” was the new rule of the game.

As a result of the risk retention rules, many CLO managers were out raising capital, particularly the larger ones, to develop risk retention funds. This transformed the CLO management business from a fee-based AUM accumulation business to a capital-intensive enterprise. As a CLO manager, you had to put up 5% of the vertical layers or 50% of the equity layer of the CLO—each time you issued a new CLO!!! That could be something like four times a year!!!. That could be $200 million of capital you had to put into your business every year. That was unheard of in prior times. CLO managers began to offer risk retention funds for investors to finance and participate in creating CLO equity.

That’s a large amount of capital. That was a transformational change.

Indeed, the risk retention rule didn’t last long, but it had a long lasting impact on the industry.

What happened to the risk retention rule?

The rule ended up in the courts. In 2016, a lower court upheld the Rule. In 2018, the D.C. circuit court overturned the rule. Risk retention was over, but its impact remained.

That brief period of capital intensity created captive funds, the rebranding and renaming of risk retention funds. These are funds where the manager can put up the capital to buy the equity in its own deals, which is arguably the hardest part of the capital structure to sell.

But there is an unintended consequence of captive funds. This year, 70% of newly issued CLOs have been from managers that have the control to put up their own equity in what used to be risk retention funds, now captive funds. In our view, those funds are taking a lower IRR to grow their asset management CLO business. They’re accepting equity returns that are suboptimal relative to what you could achieve through the secondary market. But a secondary market transaction doesn’t grow the AUM of the CLO manager. So the unintended consequence of the financial crisis going to risk retention going to captive funds has led to a cohort of large CLO managers that can almost force issuance of new CLOs whether or not the net interest margin on new CLOs is as attractive as it could be.

Is that why so many CLOs are being created by the investment banks?

It’s largely attributable to these captive funds where the manager has investment capital committed to do only and all of that manager’s CLOs for the next two, three years, regardless of the starting yields on the equity.

How does that impact you as an investor in CLOs?

I'm not obligated to participate. I can invest wherever the best relative value is. I can go to the secondary market to buy CLOs with cheap liabilities and superior potential IRRs.

Timeline: Dodd-Frank and Volker Rule, and Impact on CLOs

You’ve described CLO 1.0, 2.0, and 3.0. What’s next?

We call the latest trend in CLOs the “democratization of CLOs.”

CLOs for all?

Sort of. Actually, it’s CLOs in registered fund vehicles. This development reflects the liquidity and sheer size of the CLO market, now over $1 trillion. This opens the door to individual and retail investors. Individuals can now invest in CLOs through closed-end funds traded on exchanges, the ever-popular ETF structure, and interval funds.

Let’s start with the exchange-traded closed-end funds.

Sure. The listed closed-end funds were the first wave in the democratization of CLOs. There are now a variety of listed funds that provide access to CLOs, private credit, and Business Development Companies (BDCs). As closed-end funds, they can use leverage to juice returns. Investors often buy these based on yields, so the managers are motivated to use higher levels of CCC and speculative securities. These funds took a beating during the pandemic.

What about CLO ETFs?

CLO ETFs are a more recent development, with the first launched in 2020. CLO ETFs focus on liquid, investment grade tranches. ETFs investing in AAA CLOs have gathered the most assets, but some CLO ETFs will invest in BBBs. We believe the ETF structure does not lend itself to holding less liquid mezzanine or equity tranches.

There is also a world of loan ETFs that we actually love, because they can become forced sellers in a downturn, selling good loans, bad loans, no matter. They have to meet redemptions and that creates buying opportunities for CLO pools that don't have that pressure. There’s no forced selling in a CLO. None of the debt stack can force a manager to sell any particular loan. Even when there are elevated defaults and CCCs, there is no forced selling. The cure for a CLO is not selling but taking money away from the equity dividend and putting it to work on de-leveraging or buying more assets. And it’s not a fixed dollar amount, it’s what is available, what would’ve been paid, and then that goes to work to heal the vehicle. But there’s no forced selling to generate that cash, reflecting the structural advantages of CLOs.

Let’s round out the discussion on the democratization of CLOs. What about interval funds?

Interval funds are registered under the 40 Act like a mutual fund, but only provide liquidity at intervals, typically every quarter. With interval funds, the mass affluent can gain access to interesting, less liquid investments. However, we’re watching how these investors may respond in a downturn. As newcomers, they’re more likely to panic and sell. Typically, investors buy high and sell low. So, you may get redemptions in downturns. As a result, CLO interval funds could face redemption pressures, though the redemptions are typically limited to a certain percentage of the overall fund size. This can potentially force the funds to sell good assets to meet investor redemptions. Forced selling creates bargains for investors like us.

The question remains whether interval funds are the right structure or wrapper for mezzanine or equity CLOs. At Clarion Capital Partners, we believe the architecture of the delivery structure should match the underlying instruments.

We’ve covered a lot today.

From early securitizations to CLO 1.0, 2.0, and 3.0, and even the democratization of CLOs.

What’s next?

The evolution will continue to be exciting. Check back soon.

Tags:

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

Introduction Marc Utay, Founder and Managing Partner at Clarion Capital Partners, sat down with ION ...

“In the beginning … there were potential profits.” While “warehouse” may be a metaphor, the potentia...

CLO mezzanine investments offer some of the highest yields within the Collateralized Loan Obligation...