Determining the Best Time to Invest in CLO Equity: A Closer Look

When is the best time to invest? For any asset class, finding the perfect moment is alluring; however, perfect timing is nearly impossible to execute and remains speculative even with thoughtful analysis.

At Clarion Capital Partners, we continually evaluate the Collateralized Loan Obligation (CLO) looking for optimal investments that align with the fluidity of the current market environment. We invest or adjust exposures in the near term, that fit the longer-term return profile that we seek. Through this we have learned that opportunities to profit or proactively manage risk can appear across varying points of economic and market cycles. With CLO equity as one of our primary investment focuses (alongside CLO mezzanine and CLO warehouse investing), we strive to be vigilant for opportunities—and risks—that may arise at unexpected times.

Historically, CLO equity has provided cash flows and total returns in the mid-teens with reduced correlations to other asset classes, including stocks, fixed income, and high-yield bonds.1 But when is the best time to invest in CLO equity?

The Art of Timing

Economic and market conditions vary widely over time. As the financial world continually evolves, conditions can become more or less favorable for certain investments.

However, success with investments can require a contrarian approach: being ready to buy when others are afraid to make the commitment. This is particularly true when investing in the equity tranches of CLOs.

Profitably evaluating economic and investment conditions requires a deep understanding of market history and dynamics. Knowing exactly where we are in a market cycle or what the future may bring will never be fully visible. This is why Clarion Capital Partners overlays multiple perspectives when investing in CLO equity in an effort to dynamically guide our portfolios to opportunities as the market evolves.

We focus on analyzing the range of current and past market conditions, to understand the potential rewards of specific investment opportunities and actions in the future. We do not seek to be market timers, but instead seek to create the best CLO portfolios under constantly shifting market environments.

Rising Interest Rates, Rising Income

Floating-rate securities can benefit from a rising interest rate environment, like we experience today. CLOs receive interest and principal payments from highly diversified portfolios of floating rate, senior secured loans made to U.S. corporations. As rates climb, so will the income from a CLO’s underlying loan portfolio, albeit not perfectly in sync. The “spread” paid to CLO equity holders can increase, also.

In addition, the prices of floating rate instruments are less sensitive to interest rate movements. In contrast, rising rates are a concern for holders of fixed-rate securities, which decline in value as rates rise.

The current period of rising interest rates began in March 2022 when the Fed began hiking its benchmark Federal funds rate. In the face of inflation, major central banks around the world have been increasing short-term rates and striving to unwind years of low rates and stimulus.

The high yields of CLO equity result, in part, from an illiquidity and complexity premium from the common investor perception that CLOs are difficult to understand. High CLO equity yields also reflect built-in leverage in a CLO’s capital structure. CLOs are financed mostly through debt (typically nearly 60% of the total structure is financed through AAA-rated floating-rate bonds alone) with CLO equity generally representing only 10% of a CLO’s total capitalization. Thus, CLO structures operate at a 10:1 leverage.

High and rising rates may bode well for CLO equity investors, as they may lead to an increase in income. CLO equity may be an attractive option for those seeking to capitalize on interest rate fluctuations.

Nevertheless, CLO equity investors must remain mindful of the credit risk of underlying loans. Rising rates can negatively impact the economy, rate-sensitive industries, and individual corporations. While CLOs invest primarily in senior secured loans, and the CLO structure includes a variety of built-in protections, credit risk requires diligent oversight. An adverse credit environment can lead to the reduction or suspension of cash flows to CLO equity. In such an event, the “self-healing” structure of a CLO must divert cash flows to redeem senior CLO debt tranches until distributions can resume to CLO equity.

At Clarion Capital Partners, we seek to understand and manage credit risk of our CLOs’ underlying loan portfolios to preserve the historically generous distributions to CLO equity. Across our years of experience in the CLO market, we have successfully navigated challenging macroeconomic and credit environments to maintain distributions on behalf of our investors.

Spread Dynamics: Unlocking Income for CLO Equity

The net return of CLO equity hinges on favorable spreads between the income from underlying loans and financing costs. The wider the spread, the greater the potential for income, thus increasing the attractiveness of CLO equity compared to other investment options.

The income to CLO equity is the interest earned from the underlying loan portfolio less interest expenses on the CLO debt. CLOs are funded mostly by CLO debt tranches with floating-rate coupons. The largest CLO debt tranche is AAA-rated and carries the lowest coupon across the structure. Coupons increase as the perceived risk (credit rating) of the bond increases. CLO equity holders receive the net interest, or “arbitrage” income, after paying the CLO debt tranches and other CLO operating expenses.

When spreads widen, CLO equity investors can benefit. Wider spreads equate to higher arbitrage income as the CLO’s liability spreads remain fixed over the vehicle’s life. As a result, this may potentially enhance the returns on CLO equity.

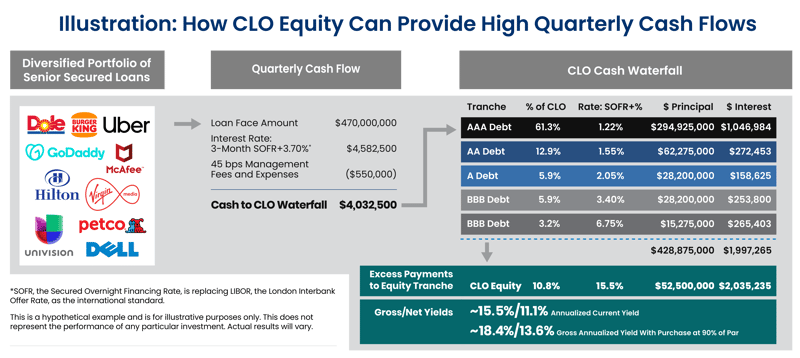

The example below illustrates how the income to CLO equity is comprised of the residual interest from an underlying portfolio of senior secured loans after paying the senior debt tranches as well as fees and expenses.

Note: Hypothetical example. For illustration only. Assumes an equity purchase price of 90% of par. Does not represent the performance of any particular investment. Actual results may vary. CLO equity investments are subject to high levels of risk. Net amounts reflect deductions for fund related expenses, management fees, and incentive fees. For fund related expenses, ongoing annual expenses are estimated at $0.1 million. The assumed management fee is 1.65% annually with a 15% incentive fee over an 8% hurdle (with a 100% catch up).

Source: Clarion Capital Partners

Cash flows from CLO equity have been historically strong (as illustrated in the charts above). Funds investing in CLO equity can seek to optimize cash flows by adjusting exposures during periods of higher spreads or targeting CLO structures that may offer favorable spread opportunities.

Profitable Paradox: How Volatility Can Increase Returns for CLO Equity

While turbulent markets often deter investors, CLO equity can potentially benefit from market volatility. The ability to capitalize on market fluctuations may offer CLO equity investors the opportunity to potentially reap substantial rewards.

CLO equity investors must be able to tolerate volatility to earn the potential excess profits that may arise during market volatility. CLO equity prices may loosely track the stock market and other risk assets, despite historically lower volatility and reduced correlations.2 As with many asset classes, CLO equity investors must be able to weather periodic drawdowns to earn higher cash flows and total returns over time.

1st Source of Potential Returns Amidst Volatility—Active Management of Loan Portfolios

The first source of potential profits amidst volatility for CLO equity is derived from the active management of underlying loan portfolios. In volatile environments, loan prices may fall. That’s when nimble portfolio managers can buy loans at discounted prices at higher effective spreads for increased yields. The manager can also buy new-issue, higher-yielding loans when spreads widen. These higher loan yields increase the income from a CLO’s underlying loan portfolio. Plus, loans purchased at a discount during market turbulence may return to par when markets settle. This can produce realized trading profits that ultimately flow to holders of CLO equity or can offset credit losses in the portfolio.

Navigating volatility requires skill and diligence by the CLO manager. A CLO manager’s role is to minimize losses from loan defaults while pursuing higher yields and trading profits. This requires sophisticated credit analysis and trading execution to proactively sell weakening credits on a timely basis. CLO provisions limit exposures to low-rated loans, further protecting CLOs during a downturn.

2nd Source of Potential Returns Amidst Volatility—Active Deployment through CLO Funds

The second source of profit is through managers of CLO funds. These professional investors in CLO funds may be able to acquire securities from motivated sellers looking to raise cash, such as hedge funds, which often face investor redemptions in market setbacks. Nimble managers of CLO funds are “waiting to pounce” on opportunities.

As outlined above, CLO equity investors have multiple ways that they can benefit from market volatility. However, knowing how to allocate to CLO equity in advance is key to capitalizing on volatility.

When Does CLO Equity Earn the Highest Returns?

Historically, the highest returns for CLO equity are found in the vintage years preceding recessions and periods of high volatility, including:

- 2006-2007 vintage CLO equity issued just before the financial crisis3

- 2019-2020 vintage CLO equity issued just before the pandemic-related downturn4

The potential benefit of investing in CLO equity before a downturn is also apparent in the vintage year internal rate of return data for fully realized CLOs.5 CLO equity tranches issued just before the financial crisis provided value-added returns for buy-and-hold investors.

As the Fed raises rates and battles inflation, a growing number of economists have expressed concerns over a potential recession.6 The historic data tells us that CLOs issued just before a recession tend to outperform. We attribute this to the resulting trading opportunities in the underlying loan portfolios during times of stress and distress. At Clarion Capital Partners, we believe that an economic downturn can provide opportunities for accomplished CLO managers to combine proactive risk management with the pursuit of excess returns.

CLO equity can present distinct opportunities in the face of market volatility.

CLO Equity — for Bulls or Bears

Bullish or bearish investors can uncover opportunities in CLO equity.7

In bullish environments, economic, industry, and company fundamentals support loan quality and cash flows for CLO investors.

In bearish environments, CLO managers can pursue bargains and higher yields. At the same time, the risk management features embedded in the CLO structure help to reduce risk in a downturn:

- CLO covenants limit allocations to lower-rated and riskier CCC assets.

- Coverage tests based on cash flows and collateral values, rather than market prices, support payments of interest and principal. CLO managers do not become forced sellers during severe market price variations in underlying loans.

According to Standard & Poor’s, which began rating CLOs in 1996, only 67 out of nearly 21,000 CLO tranches rated by the firm have defaulted through 2021, a rate of 0.3%.8

“Since the asset class emerged more than 25 years ago, CLOs have shown resilient performance through multiple economic downturns,” according to S&P Global.9

As risk managers, we also analyze the most challenging scenarios. In a credit-driven downturn, an increasing number of borrowers may default. If defaults occur, or if the underlying collateral deteriorates, cash flow to CLO equity may be suspended or diverted to other more senior tranches. In such an event, cash flow from CLO loan portfolios will be used to pay down the most senior CLO tranches until the loan pool once again satisfies the required over-collateralization and interest coverage tests. Then, cash flows to CLO equity can resume. This is the “self-healing” mechanism of the CLO structure.

Is This the Moment?

We believe that CLO equity represents an exceptional opportunity in the current environment.

A combination of factors makes CLO equity an investment to consider:

- High historic income

- Historic & potential total returns

- Risk management structure

- Flexibility to pursue changing opportunities over time

Previously, CLO equity was an investment accessible only to institutions and major private credit investors. Today, an increasing variety of delivery structures provide access to this asset class for a broader range of investors.

Learn More

For in-depth answers to your questions, or to explore CLO equity further, please set a time to speak with our team.

1. Source: JPMorgan, Wells Fargo Research, Nomura Research, Pinebridge

2. Source: Bloomberg. Data based on comparison of daily performance data of S&P 500 versus the Flat Rock Opportunity Fund (FROPX), a registered interval fund utilized as a proxy for CLO equity performance.

3. Source: Western Asset, JPMorgan, June 30, 2022

4. Source: Western Asset, JPMorgan, June 30, 2022

5. Flat Rock Global, Shiloh R. Bates, “An Introduction to CLO Equity,” p. 53, May 2022. Depending on the method of investment, Average US CLO Equity Internal Rates of Return will be reduced by commensurate fees and expenses of the chosen investment structure.

https://flatrockglobal.com/publications/

6. USA Today, Paul Davidson, “Are we headed for a recession? More economists think a 2023 downturn may come later than they thought,” February 27, 2023.

The Conference Board, Erik Lundh and Ataman Ozyildirim, “Probability of US Recession Remains Elevated”

March 5, 2023.

https://www.conference-board.org/research/economy-strategy-finance-charts/CoW-Recession-Probability

7. Western Asset Blog, Jeff Helsing, “Can CLO Equity Outperform If the Economy Tips Into Recession?”, September 26, 2022.

8. S&P Global, “Default, Transition, and Recovery: 2021 Annual Global Leveraged Loan CLO Default and Ratings Transition Study,” October 31, 2022.

9. S&P Global, Stephen A. Anderberg, Daniel Hu, and Evan M. Gunter “CLO Spotlight: U.S. CLO Tranche Defaults,” updated April 1, 2023.

Tags:

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

Introduction Marc Utay, Founder and Managing Partner at Clarion Capital Partners, sat down with ION ...

“In the beginning … there were potential profits.” While “warehouse” may be a metaphor, the potentia...

CLO mezzanine investments offer some of the highest yields within the Collateralized Loan Obligation...