9 Ways PPLI and IDFs Boost Executive Deferred Compensation Plans

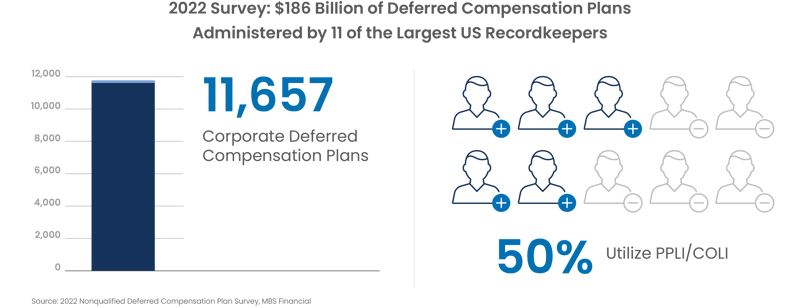

When it comes to executive compensation, striking a balance between a company’s goals and an executive's financial needs can be complex. Sophisticated companies use Private Placement Life Insurance (PPLI) and Insurance Dedicated Funds (IDFs) to significantly enhance executive deferred compensation programs. Together, these innovative tools can provide an array of benefits for both companies and executives:

- tax-efficiency

- stability for corporate balance sheets

- potential for diversification

- opportunities for higher returns

- tax-efficient access to alternative investments

The Basics: PPLI and IDFs

Let's revisit the basics of PPLI and IDFs before exploring their impact on executive deferred compensation programs.

Private Placement Life Insurance (PPLI)

PPLI is a type of variable universal life insurance designed for corporations and high-net-worth individuals. PPLI provides death benefits and cash value appreciation based on the performance of underlying investments. Contracts are structured so that the gains and income within the contract grow tax deferred. In addition, death benefits may be income tax free to beneficiaries. Generally, PPLI is lower cost compared to retail insurance structures. PPLI is also flexible and can be customized to meet a client’s specific needs. For instance, in the case of corporations, Company Owned Life Insurance (COLI) is a type of PPLI often utilized when implementing executive deferred compensation strategies.

Insurance Dedicated Funds (IDFs)

IDFs are specialized, commingled investment funds that accept allocations exclusively from the separate accounts of life insurance companies. As commingled vehicles, IDFs can accept allocations from multiple PPLI contracts issued by various insurance companies.

IDFs are available across a wide array of assets and strategies, including alternative investments like private credit, private equity, and hedge funds, offering diversification and return enhancement opportunities.

The Basics: Executive Non-Qualified Deferred Compensation Plans

To fully appreciate the potential benefits of integrating PPLI and IDFs into executive compensation strategies, it’s important to answer some basic questions on executive non-qualified deferred compensation plans.

What is a Non-Qualified Deferred Compensation Plan?

A non-qualified deferred compensation (NQDC) plan is a contractual agreement between an employer and an employee (in this case, an executive) in which the executive voluntarily agrees to have part of their income paid out at a later date, such as during retirement, rather than immediately.

These plans are termed ‘non-qualified’ because they do not have to meet the stringent qualification rules and requirements that apply to ‘qualified’ retirement plans such as 401(k)s, including non-discrimination testing. As a result, NQDC plans provide significant flexibility and can be tailored to meet the specific needs of highly compensated executives.

How Do NQDC Plans Work?

In a typical NQDC plan, the executive elects to defer a portion of their income. This deferred income is held by the company and often invested, allowing it to grow over time. The deferred income and its investment earnings are then paid out to the executive at a future date, often after the executive has retired and potentially in a lower tax bracket. Earnings also compound without current taxation for the executive and the company when NQDC plan assets are held within PPLI.

9 Benefits: PPLI & IDFs

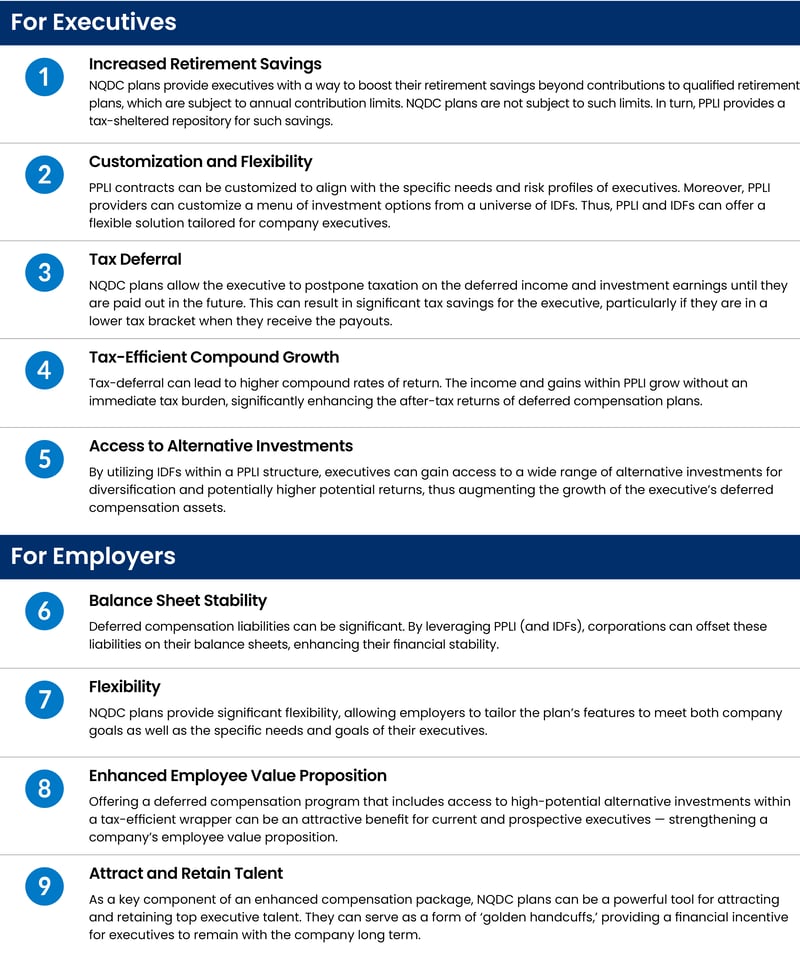

When integrated into executive deferred compensation programs, PPLI and IDFs can provide 9 key benefits for the executive and the employer:

A Win-Win Combination

PPLI and IDFs offer a powerful combination of benefits for both executives and corporations. These tools can enhance deferred compensation programs by delivering tax efficiencies, providing access to alternative investments, and enhancing after-tax returns.

Keep in mind that implementing these strategies involves considerations such as cost, insurance underwriting, and regulatory compliance. It’s always prudent to seek specialized professional advice when integrating these tools into an executive compensation program.

Learn More

To learn more about PPLI and IDFs, download our FREE guides:

The Advisor’s Guide to Private Placement Life Insurance & Variable Annuities

[or]

Advisor’s Roadmap to Insurance Dedicated Funds

Please note that Clarion Capital does not provide insurance, tax, or legal advice. Investors and advisors must consult their own insurance, tax, and legal counsel.

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

Sophisticated investors have increased their allocations to alternative investments in recent years ...

Navigating the investment landscape as an institutional investor comes with particular challenges an...

Private and institutional investors have shown growing interest in alternative investments, attracte...