How High Net Worth Investors Gain Tax Efficiency for Alternative Investments

High-net-worth investors are increasing their allocations to alternative strategies, according to a recent report by Cerulli Associates1.

These investors are also searching for ways to make these investments more tax efficient.

With stocks and bonds faltering and inflation rising, sophisticated investors are allocating more assets to alternative investments for a variety of potential benefits:

- diversification

- uncorrelated returns

- inflation hedging

- additional income

- special growth opportunities

Alternatives have been a long-time preference for high-net-worth investors, encompassing:

- hedge funds

- private equity

- venture capital

- private credit

- real estate

- commodities

- real assets

- and others

However, many alternative investment strategies often have inefficient tax profiles. Affluent investors can achieve the benefits of alternatives while also mitigating the tax-inefficiencies of these strategies by considering powerful insurance and annuity structures.

Private Placement Life Insurance (PPLI) and Private Placement Variable Annuities (PPVA)

Tax Issues

Understanding the potential tax issues of certain alternative strategies explains the potential appeal of PPLI and PPVA.

Some alternatives generate high levels of taxable ordinary income. For example, with interest rates on the rise, a variety of private credit strategies (such as CLO equity) are generating double-digit taxable yields in excess of 10%. The yield is appealing, but taxes erode net returns.

Some trading strategies can generate high levels of profits, but also taxable short-term gains. For example, macro trading and trend-following funds rose over 20% as a group in 2022, as indicated by the SG CTA Index, a leading index of Commodity Trading Advisor performance published by Société Générale2. However, trading strategies that generate significant short-term capital gains, are taxed at the highest rates.

Tax Arithmetic: Cut in Half

“It’s not what you earn, it’s what you keep that matters.”

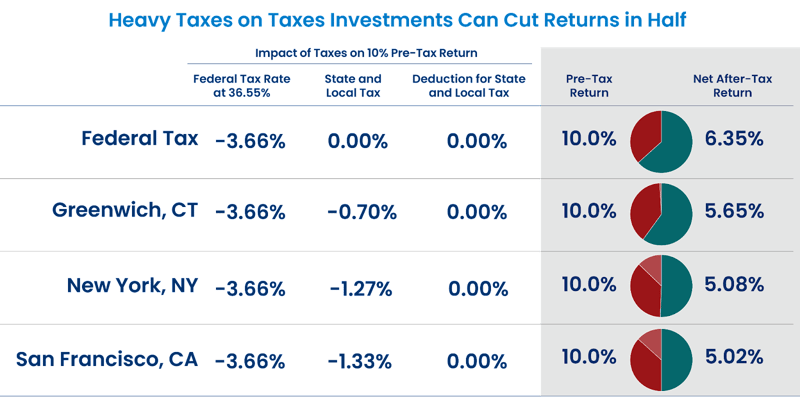

Investors face a heavy potential tax burden. Federal taxes on investment income and gains can significantly reduce after-tax returns. The top federal tax rates for 2023, including the 3.8% Medicare surtax on net investment income, are:

- 40.8% Ordinary Income

- 40.8% Short-Term Capital Gains

- 23.8% Long-Term Capital Gains

- 23.8 % Dividends

The combined impact of federal, state, and local taxes can further reduce returns for investors in high-tax locales. The combination can significantly reduce after-tax returns on alternative investments and other less tax-efficient strategies.

The nation’s most populous state, California, has the largest marginal tax rate for high earners: 13.3%. Californians are not alone. New York (10.9%) and New Jersey (10.75%) both have high marginal state tax rates. Many other states have burdensome income tax rates. Low-tax states are the exception3.

The combination of high Federal, state, and local taxes on investments can cut returns in half in affluent metro areas, a key issue for investors in alternative strategies generating high levels of taxable income.

For illustration only. Not an actual Investment. See assumptions below. Returns include 25% long-term gains and 75% short-term gains or ordinary income. 23.8% federal tax rate on long-term gains and a 40.8% federal tax rate on short-term gains and ordinary income. Combined state and local taxes of 6.99% for Greenwich, CT; 12.70% for New York, NY; and 13.30% for San Francisco, CA. State and local taxes are non-deductible due to the $10,000 limitation

Source: Winged Keel

A Potential Solution

Private placement life insurance and variable annuities can provide a way for affluent investors to mitigate the tax burden on their investments and increase after-tax returns. Advisors can utilize these vehicles to achieve “tax alpha” and enhance results for their clients. Tax alpha is defined as the potential value and enhanced returns created by effective tax management when investing, according to Morgan Stanley.1

What are Private Placement Variable Life Insurance and Annuities?

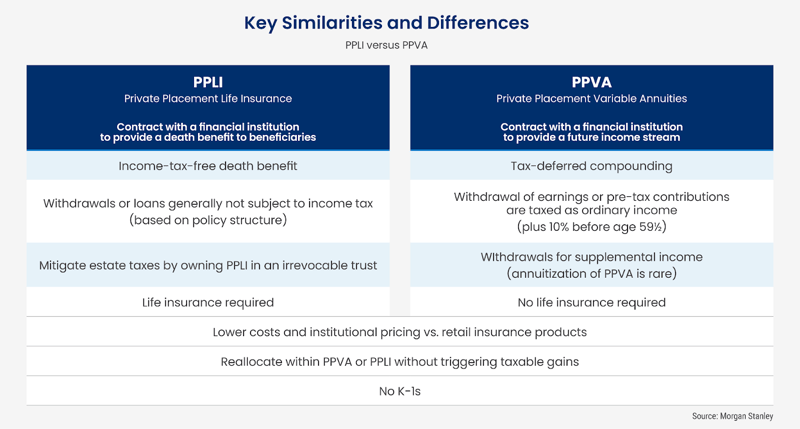

Private Placement Life Insurance (PPLI) and Private Placement Variable Annuities (PPVA) are insurance solutions for Qualified Purchasers and Accredited Investors that enhance the after-tax returns of alternative strategies and other investments that may generate substantial taxable income.

Policyowners can make allocations to tax-inefficient, high-return, and alternative investments through a PPLI policy or PPVA contract. When properly structured, growth within the PPLI and PPVA contracts will be relieved of current taxation, leading to higher compound after-tax rates of return.

Estate planning benefits may also apply because the insurance benefit proceeds received by a beneficiary, including any accumulated investments gains, are exempt from income tax. If held within a properly structured irrevocable life insurance trust (ILIT), proceeds may also be free of estate taxes.

PPVA accounts can be utilized to establish charitable legacies in a tax-efficient manner. If a private foundation or public charity is designated as the beneficiary of a PPVA Account, deferred gain become fully exempt from income and estate taxes at the death of the annuitant. Otherwise, the value of a PPVA contract above its cost basis is subject to income taxes at high ordinary rates when distributed to a beneficiary.

Diverse Applications

PPLI and PPVA have numerous applications in wealth and estate planning.

What are the key differences between PPLI and PPVA? PPLI provides tax deferred interest accumulation and an income-tax-free death benefit, while PPVA provides tax-deferred compounding but does not offer an insurance benefit. With the inclusion of life insurance, PPLI is often utilized in estate and legacy planning, but additional costs must be considered.

PPVA and PPLI both demonstrate the power of compounding in a tax advantaged environment.

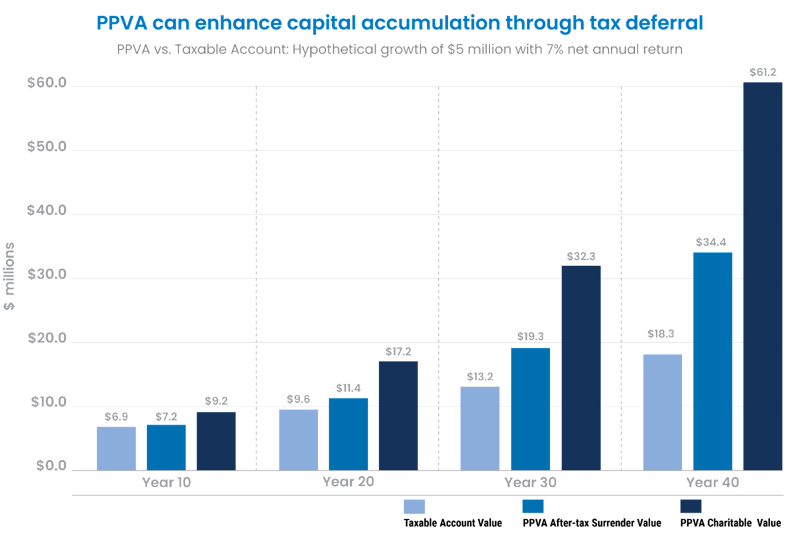

The Power of PPVA vs. Taxable Investing

Investors first discover the power of tax-deferred investing through retirement accounts. However, contributions to retirement accounts are capped. PPVA allows for unlimited contributions and tax-deferred accumulation.

The chart below illustrates the power of tax-deferred compounding in a PPVA. Over a 40-year period, investors can nearly double their after-tax value through tax-deferred compounding. Investors can more than triple their after-tax capital if they bequest their assets to a charity or family foundation.

Hypothetical illustration only. Not actual results. Not indicative of the performance of any investment. PPVA returns will vary and you may receive more or less than the amount invested. Assumptions: Hypothetical Connecticut resident with $25 million net worth , $5 million initial contribution, 7.00% net rate of return.

M&E expenses: 65 basis points <$10 million, 55 basis points $10-$20 million, 45 basis points $20-40 million, 37 basis points $40+ million

Based on 2022 maximum marginal tax rates: 37.00% federal income tax, 20.00% long-term capital gains tax, 3.80% Medicare surtax, 6.99% Connecticut income tax. Assumes 47.79% combined tax rate for short-term capital gains and ordinary income, and 30.79% combined tax rate for long-term capital gains

Source: Winged Keel

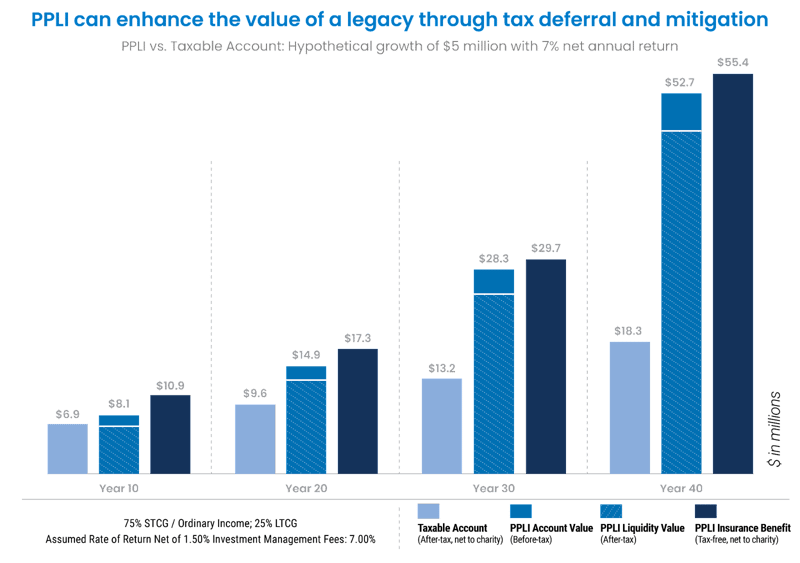

The Power of PPLI vs. Taxable Investing

In addition to offering enhanced after-tax returns, PPLI provides an insurance benefit for beneficiaries that is not subject to income tax. Moreover, owning PPLI within a properly structured irrevocable trust can mitigate estate taxes.

The chart below illustrates the power of tax-deferred compounding in a Private Placement Life Insurance policy. Over a 40-year period, investors can potentially triple their after-tax legacy to beneficiaries.

Hypothetical illustration only. Not actual results. Not indicative of the performance of any investment. PPLI returns will vary and you may receive more or less than the amount invested. Assumptions: Hypothetical Connecticut resident with $50 million net worth, Funding of $1.25 million per year for 4 years, 7.00% net rate of return

M&E expense: years 1-20 = 55 bps; years 21+ = 30 bps, Cost of insurance assumes preferred health rating

Based on 2022 maximum marginal tax rates: 37.00% federal income tax, 20.00% long-term capital gains tax, 3.80% Medicare surtax, 6.99% Connecticut income tax. Assumes 47.79% combined tax rate for short-term capital gains and ordinary income, and 30.79% combined tax rate for long-term capital gains

Source: Winged Keel

No K-1s Means Simplified Tax Reporting

In addition to potentially large tax bills, most alternatives come with K-1 forms and burdensome tax reporting, another problem solved by PPLI and PPVA.

An allocation to alternatives within a PPLI or PPVA structure generates no K-1s. Investors are relieved of complicated tax reporting. By moving an entire alternative allocation inside PPLI and PPVA, investors can also avoid the annual ritual of requesting an extension on filing their tax returns, since they’re no longer waiting for one or more delayed K-1s.

Avoid Phantom Income on Non-Deductible Investment Management Fees

Another challenge for taxable investors using alternatives is the generally non-deductible nature of investment management fees. Thus, investors pay taxes on gross pre-fee returns, rather than net after-tax returns. This creates phantom income and a larger tax bill for taxable investors. Once an investor moves their alternative investments inside the PPLI or PPVA structure, there are no longer tax payments on that phantom income, further enhancing net after-tax returns.

Insurance Dedicated Funds: Accessing Alts in PPLI and PPVA

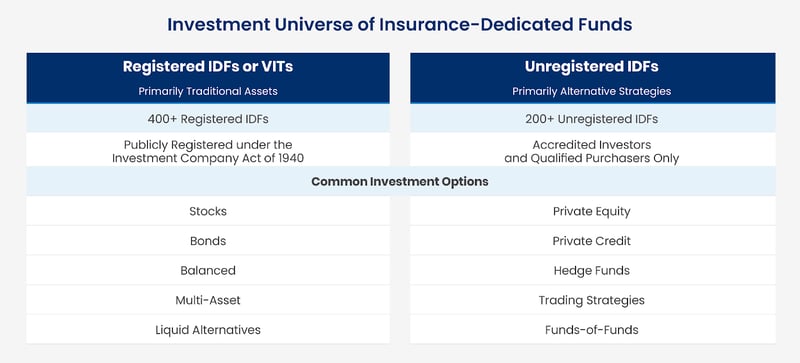

There are numerous options for investing within PPLI and PPVA. These investment options are structured specifically to meet stringent tax regulations. These funds are called Insurance Dedicated Funds or IDFs. There are two primary types of IDFs:

- Private or unregistered IDFs, which invest primarily in alternative strategies, including private credit, private equity, hedge funds, trading strategies, and funds of funds

- Registered IDFs, also called Variable Insurance Trusts or VITs, which invest mainly in traditional assets and offer daily liquidity

The universe of IDFs is robust, with over 600 investment options, encompassing the spectrum of traditional and alternative investments. Each insurance carrier will offer a curated selection from this universe for their policies or annuities. Investors may allocate and reallocate between IDFs without incurring taxes.

Separately Managed Accounts

Separately managed accounts represent a growing trend for the largest investors in PPLI and PPVA. With this approach, the insurance company retains an investment manager to manage a discretionary portfolio for the client within the insurance company separate account.

Strict Tax Rules for Investing: Control

In order for the PPLI and PPVA investments to maintain their tax-favored status, the investment manager of the IDFs and / or SMA must comply with two key tax provisions:

1. Investor Control Doctrine

Investing within an insurance structure requires strict adherence to the IRS Investor Control Doctrine to preserve the tax benefits. Under this doctrine, assets must be segregated and under the purview of the insurance company. Thus, insurance company segregated accounts or insurance-dedicated funds (IDFs) are utilized within the life insurance policy or annuity. The policyholder can then select from a menu of compliant investments within their policy or annuity.

In addition, the policyholder must not communicate with or direct the investment manager overseeing the assets. A policyholder may select the manager or the funds, but then must relinquish investment control to the fund manager. The policyholder is still free to change the portfolio of permitted funds within the policy or annuity.

2. Diversification Requirements

Insurance regulations require a diversified approach to investing to preserve eligibility for tax-favored investments. In general, each IDF or insurance company segregated account in a variable life policy or annuity must contain at least five investments with:

- No more than 55% of the account value represented by any 1 investment

- No more than 70% of the account value represented by any 2 investments

- No more than 80% of the account value represented by any 3 investments

- No more than 90% of the account value represented by any 4 investments

These rules, known as 817(h), are requirements for the managers of the investment funds within a policy or annuity, and are not direct requirements for the policyholder.

Staying in the Fairway

In the world of PPLI and PPVA, being a good citizen pays. Violating the investor control doctrine can have severe tax consequences.

In a landmark case, a tax court ruled against a venture capitalist who moved stock from three of his startup companies into his PPLI policy, took the companies through liquidity events, and then directed reinvestments into more companies. The court ruled that the venture capitalist violated the investor control doctrine and assessed back taxes. There have been subsequent Tax Court rulings with similar fact patterns, the IRS has won every case decidingly.

Investor Protection

Assets held within an insurance company separate account are segregated from insurance company assets and are protected from insurance company creditors.

For Alternative Investors, the Time for Enhancing the After Tax yield on Alternatives is now.

With tax hikes on the horizon, more individuals and families are exploring tax-favored approaches to alternative investments.

Under current tax law, a number of favorable tax provisions are scheduled to expire on December 31, 2025. For example, the current lifetime estate and gift tax exemption of approximately $12 million will be cut in half (adjusted for inflation). In addition, pending legislative proposals increase taxes on high-income and high-net-worth taxpayers.

The time to explore PPLI, PPVA, and IDFs is now.

Discovering Insurance Dedicated Funds

To learn more about alternative investing with IDFs, download our latest advisors' guide: “Tax-Efficient Access to Alternative Investments”

This article is not intended as tax, accounting, insurance, or legal advice. Investors must consult with their own qualified professional advisors about their particular circumstances and the suitability of any investment.

1. “High-Net-Worth Investors Embrace Alternative Investments,” Cerulli Associates, January 17, 2023.

https://www.cerulli.com/press-releases/high-net-worth-investors-embrace-alternative-investments

2. Tom Wrobel, “2022 CTA Index Performance Review,” AlphaWeek, February 9, 2023.

https://www.alpha-week.com/2022-cta-index-performance-review

3. “States with the Lowest Taxes and the Highest Taxes,” Intuit TurboTax, December 1, 2022.

https://turbotax.intuit.com/tax-tips/fun-facts/states-with-the-highest-and-lowest-taxes/L6HPAVqSF

4. Morgan Stanley, “Actively Pursuing Tax Alpha,” p.2, February 2022.

Tags:

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

Part 2: Case Studies In Part 1 of our blog series on the power of Section 1035 exchanges, we explore...

Part 1: Fundamentals High net worth investors and their advisors frequently encounter legacy life in...

Navigating the investment landscape as an institutional investor comes with particular challenges an...