Can Investors Create a Multi-Asset Portfolio with Insurance Dedicated Funds?

Advisors, affluent investors, and institutions are discovering the power of tax-advantaged investing within Private Placement Life Insurance and Variable Annuities (PPLI and PPVA).

There are numerous options for investing within PPLI and PPVA. These investment options are structured specifically to meet stringent tax regulations. These funds are called Insurance Dedicated Funds or IDFs.

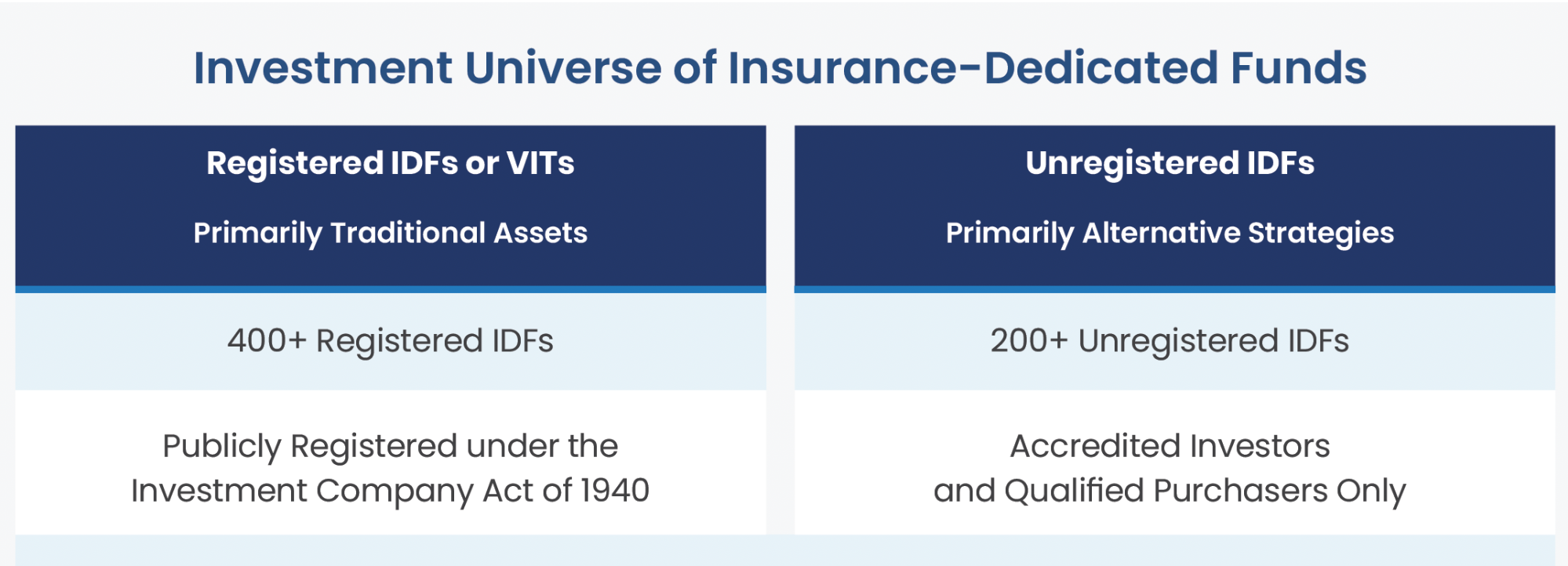

There are two primary types of IDFs:

- Registered IDFs, also called Variable Insurance Trusts or VITs, invest mainly in traditional assets, such as stocks and bonds.

- Private or unregistered IDFs invest primarily in alternative strategies, including private credit, private equity, hedge funds, trading strategies, and funds of funds.

The universe of VITs and IDFs is robust. The universe includes 400+ VITs and 200+ IDFs for 600+ total investment options across the spectrum of traditional and alternative investments1. Each insurance carrier will offer a selection from this universe for their policies or annuities. Investors may allocate and reallocate between IDFs without incurring taxes.

IDFs for Tax-Efficient Access to Alternative Strategies

Alternative investing has long been of keen interest to affluent investors seeking differentiated and uncorrelated investment opportunities. The growth of alternatives only increased after the double-digit declines for stocks and bonds in 20222.

High-net-worth investors are now increasing their allocations to alternative strategies, according to a recent report by Cerulli Associates. With stocks and bonds faltering and inflation rising, sophisticated investors are allocating more assets to alternative strategies for a variety of potential benefits:

- Diversification

- Uncorrelated Returns

- Inflation Hedging

- Additional Income

- Special Growth Opportunities

However, some “alts” generate a high level of taxable income. Investors are searching for ways to make these investments more tax efficient. For Qualified Purchasers, tax relief is available through IDFs.

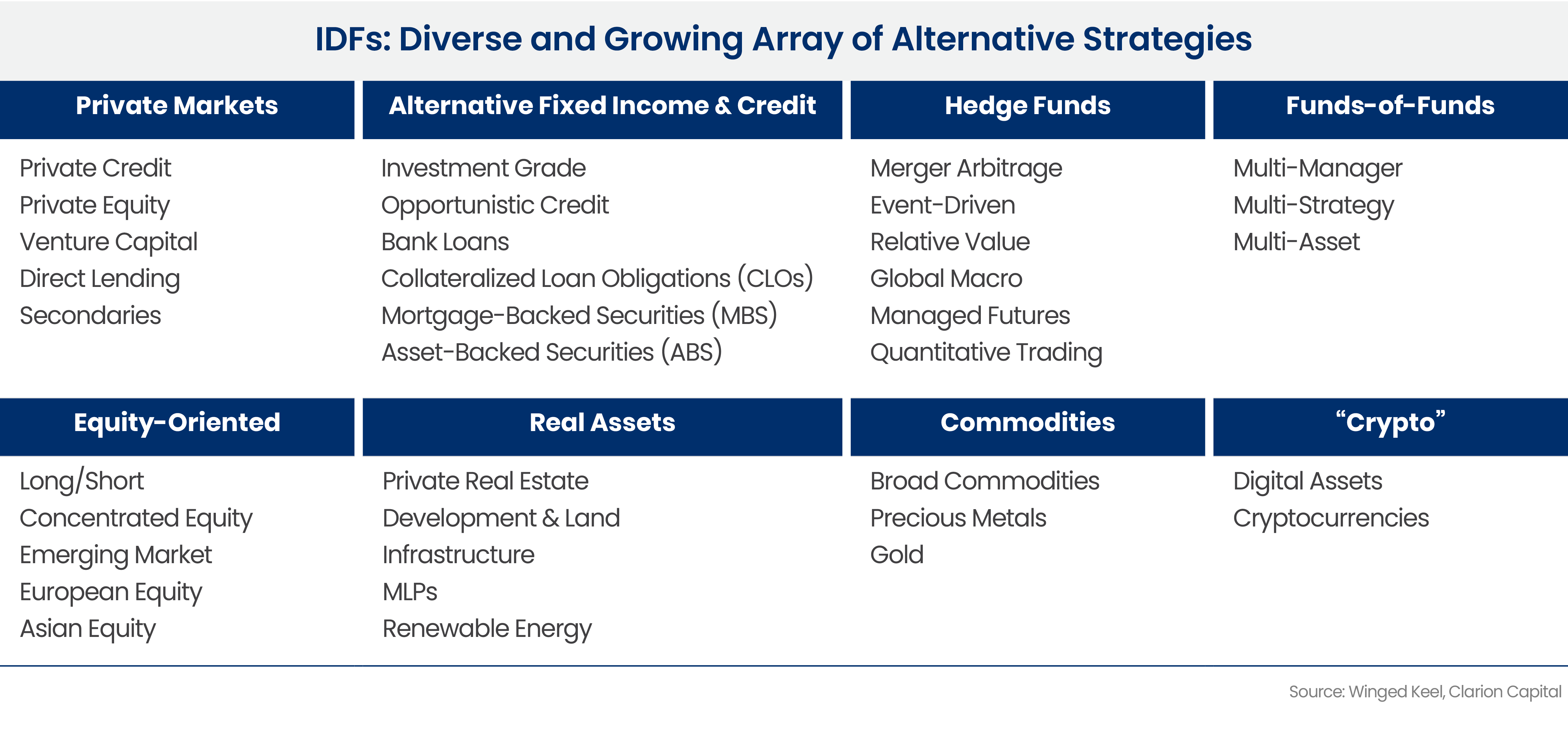

As a result, the IDF universe is undergoing growth and expansion, both in terms of total assets and the number of options. IDFs now encompass a diversified array of alternative strategies and risk/return profiles:

IDFs: Diverse and Growing Array of Alternative Strategies

Private Markets:

Private market investments have attracted trillions of dollars of assets from institutional and substantial private investors seeking high potential returns with less exposure to financial market volatility3. The sector encompasses both equity and debt in privately held companies (plus some private investments in public companies). Private market strategies available via IDFs include:

- Private Credit

- Private Equity

- Venture Capital

- Direct Lending

- Secondaries (discounted interests in private funds via the secondary market)

Alternative Fixed Income and Credit:

Rising interest rates have put higher yields back into income investing. Strategies with significant interest income benefit from the tax shield available to IDF investors. Specialized income strategies available to IDF investors include:

- Investment Grade

- Opportunistic Credit

- Bank Loans

- Collateralized Loan Obligations (CLOs)

- Mortgage-Backed Securities (MBS)

- Asset-Backed Securities (ABS)

Hedge Funds

Classic hedge fund strategies were among the first alternatives available through IDFs. Hedge funds use a range of strategies to generate returns, including long and short positions, leverage, arbitrage, and derivatives. Some hedge fund strategies can generate significant amounts of short-term capital gains through active trading, taxed at high rates. These trading gains are shielded from current taxation in the IDF structure. In 2022, managed futures was among the top-performing hedge fund strategies as stocks and bonds fell4. Some of the hedge fund strategies available through IDFs include:

- Merger Arbitrage

- Relative Value

- Global Macro

- Managed Futures

- Quantitative Trading

Equity-Oriented

Investors can allocate to specialty equity strategies through IDFs, from long/short equity to concentrated equity managers and sector specialists. Long/short equity was also one of the original hedge fund strategies. Equity-oriented strategies in IDFs encompass:

- Long/Short

- Options

- Sector

- Emerging Markets

- European Equity

- Asian equity

Real Estate and Real Assets

Real estate and real assets have been a long-time foundation of alternative investing. Investors can access private real estate, either equity or debt, through IDFs. Private real estate ranges from seasoned, income-producing property to development and land. Real assets range from infrastructure to energy. IDF strategies include:

- Private Real Estate

- Land and Development

- Infrastructure

- MLPs

- Renewable Energy

Commodities and Precious Metals

Commodities are often considered to be their own asset class or as part of a real asset allocation. Some investors allocate to commodities for potential inflation-hedging and diversification. Assets in this group available through IDFs include:

- Commodities

- Gold and Precious Metals

Multi-Manager and Multi-Asset

Funds-of-funds were early entrants into the IDF universe. Hedge funds-of-funds were predominant in the formative years of IDF investing. The IDF universe offers a broad variety of diversified and “all-in-one” solutions5:

- Multi-Manager

- Multi-Strategy

- Multi-Asset

“Crypto”

Since the advent of blockchain technology and Bitcoin, futurists and speculators have pursued digital assets and cryptocurrencies. The sector has endured significant volatility and controversy. Nevertheless, some advisors and investors consider the area to be a key component of the portfolio of the future. Within IDFs, investors can access:

- Digital assets

- Cryptocurrencies

Prominent Providers of VITs

While non-registered IDFs provide access to alternative investments, traditional assets are available through registered VITs.

For many investors, traditional assets are the foundation of a diversified investment portfolio. VITs are the primary way to access stocks, bonds, and money market funds for PPLI or PPVA policyholders.

VIT sponsors include leading U.S. and global asset management firms. Many VITs operate in parallel to taxable mutual funds offered by the same sponsor.

The VIT Investment Spectrum

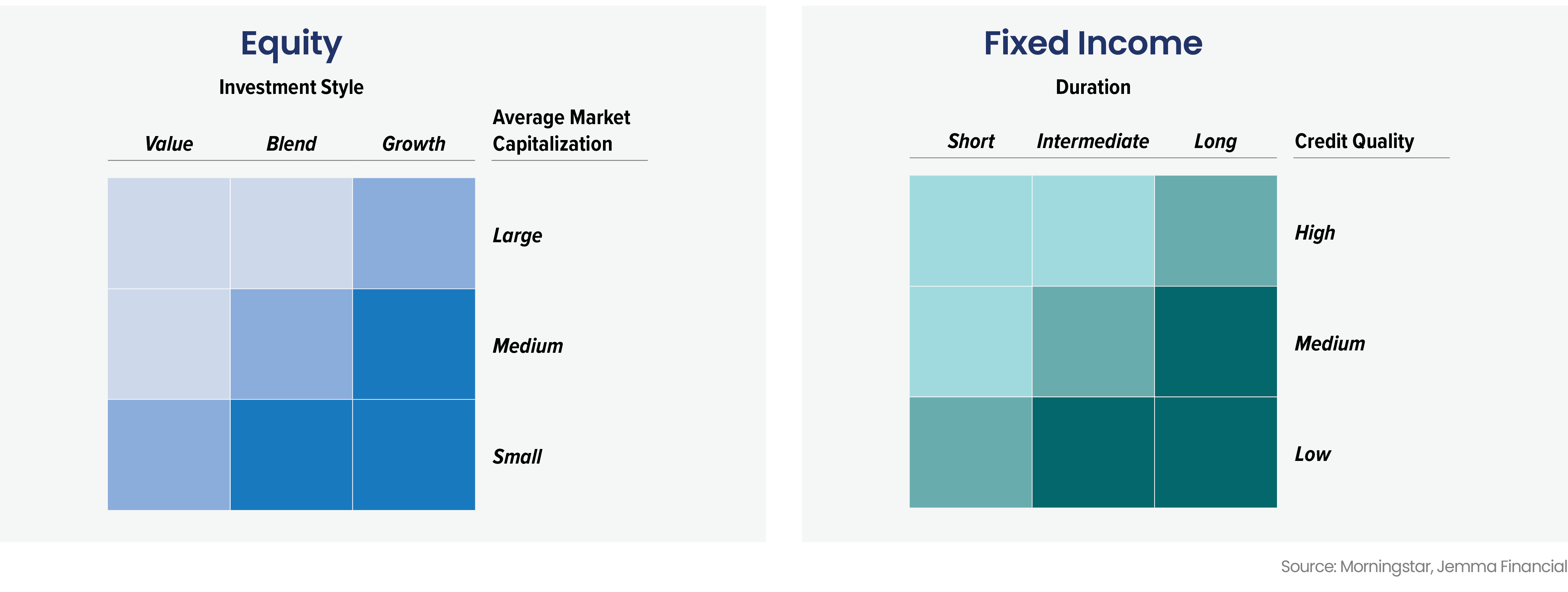

The VIT universe contains a large selection of active and passive approaches to U.S. and non-U.S. equity and fixed income. Investors can select from across asset classes and sectors through VITs.

The VIT universe is style-box driven for both equity and fixed-income funds.

VIT offerings also include sector funds, such as real estate and various types of multi-asset funds:

- Balanced

- Asset Allocation

- Multi-Asset

- Target Date

- Target Risk

Approaches to Implementation

Advisors and investors take various approaches when investing in IDFs and VITs:

- A diversified, multi-asset approach entails building a comprehensive investment program using both IDFs and VITs within a tax-favored insurance product wrapper.

- An alternative-focused approach may include only tax-inefficient alternative IDFs. This approach is intended to complement tax-favored assets and strategies held outside of a PPLI or PPVA wrapper, such long-term stock holdings or municipal bonds.

- A concentrated approach may include only one or a few IDFs, chosen as a special-purpose investment and to capitalize on tax-favored compounding.

Whatever the approach, advisors and investors are able to customize their fund and investment selection from a broad and growing range of IDFs and VITs.

Learn More

To learn more, download our latest advisor's guide: Tax-Efficient Access to Alternative Investments.

This article is not intended as tax, accounting, insurance, or legal advice. Investors must consult with their own qualified professional advisors about their particular circumstances and the suitability of any investment.

1. Aaron Abrams and Michael Mingolelli, Jr., “Private Placement Life Insurance and IRAs,” Trusts and Estates, November 1, 2019. Winged Keel Group, “Insurance-Dedicated Funds,” July 2022.

2. Tony Rifilato, “Advisors to Make Bigger Push Into Alts in 2023: Demand for alternative investment strategies surged over the past year, field by market volatility and greater advisor access,” FundFire and Financial Advisor IQ, December 29, 2022.

3. “McKinsey Global Private Markets Review 2022: Private Markets Rally to Hew Heights,” McKinsey & Company, March 2022.

4. Karrie Gordon, “2022: The Year of Managed Futures,” etftrends.com, December 15, 2022.

5. Winged Keel Group, “Insurance-Dedicated Funds,” July 2022

Tags:

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

Sophisticated investors have increased their allocations to alternative investments in recent years ...

Navigating the investment landscape as an institutional investor comes with particular challenges an...

When it comes to executive compensation, striking a balance between a company’s goals and an executi...