Understand income-producing real estate? Then you understand the income from CLO equity.

We all look for simple ways to understand what appears to be complex. Many investors work hard to understand the structured income from Collateralized Loan Obligations (CLOs), particularly the residual income to CLO equity.

If you understand income-producing real estate, you’ll be better able to understand the income from CLO equity.

Apartment Income

Imagine investing in a residential rental property. You own an apartment building consisting of hundreds of apartments. You receive rent from each apartment. Then, you pay the property expenses and your mortgage. The balance is the income you enjoy as the owner. Simple.

Income to CLO Equity

Now imagine a CLO. Like an apartment building, the CLO receives multiple income payments. The CLO holds a diversified pool of loans to hundreds of large companies such as American Airlines, DirecTV, Petco, and other household names. These companies pay “rent” or interest on their loans, generally at a floating rate. The CLO receives these payments, just like the owner of an apartment building receives rents.

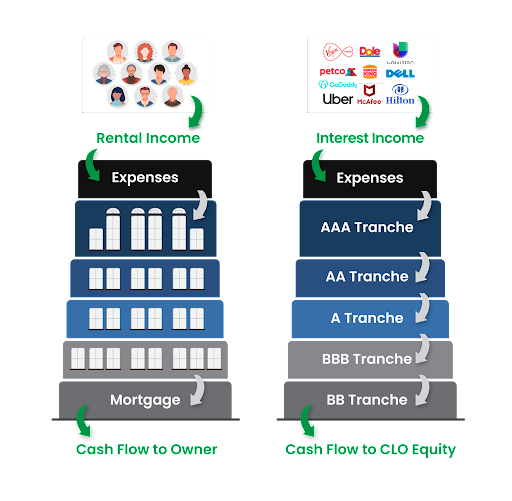

Also, like an apartment owner, an investor in CLO equity pays expenses and a “mortgage,” in this case interest payments on the CLO debt tranches. These debt tranches are rated from AAA (most senior) to BBB (most junior) by national rating agencies: S&P, Moody’s, and Fitch. As an investor in CLO equity, you enjoy the remaining income, just like the net income enjoyed by that real estate owner. Straightforward.

Keep in mind that the AAA tranche receives the lowest interest rate, in exchange for being first in line for interest income as the most senior tranche. With a low rate, the AAA tranche, the largest tranche, is like having a low-cost mortgage.

Go With the Flow: Income from Real Estate and CLO Equity

The graphic below helps illustrate the similarity between real estate net income and the income earned by CLO equity.

Note: Concept illustration only. Investing in real estate and CLO equity securities bears substantial and differing risks. The income and expenses applicable to real estate and CLO equity can vary significantly.

Inflation Hedge, Too

The income streams above can increase in times of inflation and rising interest rates.

Let’s start with the apartments. Let’s say your monthly rent is $1,000 per month. In times of inflation, you may be able to increase that rent to $1,100 per month when one resident moves out and another moves in. Your net income rises accordingly. That’s an inflation hedge.

CLOs can benefit from rising rates, too, as the underlying corporate debt is generally floating rate. Plus, there is turnover among the “residents” of the CLO. The underlying companies generally pay monthly principal or get acquired, go public, or refinance. Reinvesting the principal allows the CLO manager to find new corporate “residents” and potentially upgrade the portfolio and income stream.

Opportunity from Uncertainty

Challenging times test the mettle of every investor and investment manager. How does a residential real estate manager or CLO achieve potential profits in challenging times?

In real estate, an economic downturn can be a great time to buy. Anxious owners can become motivated sellers, providing agile real estate investors with opportunities to “buy low,” with the expectation of “selling high” later.

The same dynamic applies to the CLO markets. In tough times, less savvy CLO holders may look to sell if they need liquidity. Much of the selling occurs with high-yield tranches, which are perceived to be riskier. Nimble CLO fund managers can take advantage of the resulting bargains across CLO tranches as well as among the underlying loans.

Uncorrelated Returns

Now that you have a better understanding of CLO equity, keep in mind that it is a specialized credit instrument with distinctive risk and return characteristics. Thus, CLO equity can provide uncorrelated returns and income, which may be important for investors seeking diversification. Some investors will even seek to shelter the income and returns of CLO equity from taxes by investing within a retirement plan or other tax-favored structures such as private placement life insurance or annuities.

Hopefully, the analogy and illustration above improves your understanding of income payments to CLO equity holders. Just picture an apartment building in your mind and how it produces income.

To learn more about this specialized investment opportunity, visit the educational content on our new website.

--

Clarion does not offer tax advice or tax accounting matters to clients. The recipient should not construe the contents of this presentation as legal or tax advice and contact their own professionals for legal and tax advice and other matters relevant to the suitability of an investment for the recipient. Calculations that appear throughout this presentation are for demonstration purposes only. In addition, different assumptions will lead to different results. Any charts discussed in this presentation and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. No system or methodology has ever been developed that can guarantee profits or ensure freedom from losses. No representation or implication is being made that using the methodology or system discussed in this presentation will generate profits or ensure freedom from losses. There is no guarantee that the investment objectives will be achieved. The results shown do not include the deduction of advisory fees or other expenses which will reduce returns.

Tags:

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

Introduction Marc Utay, Founder and Managing Partner at Clarion Capital Partners, sat down with ION ...

“In the beginning … there were potential profits.” While “warehouse” may be a metaphor, the potentia...

CLO mezzanine investments offer some of the highest yields within the Collateralized Loan Obligation...