How to Coordinate PPLI/PPVA Experts for Tax-Advantaged Access to Alternative Investments

We believe that the key to achieving higher after-tax returns and compounding wealth across an investor’s lifetime and even across generations lies in tax solutions.

Tax planning may be particularly important for affluent and institutional investors utilizing alternative strategies that otherwise generate high levels of taxable income.

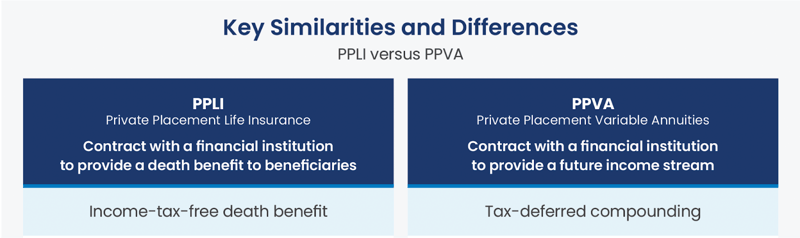

Private Placement Life Insurance (PPLI) and Private Placement Variable Annuities (PPVA) are potentially powerful tools to shield taxable investment income and enhance after-tax returns for qualified purchasers. Insurance and annuities receive a variety of tax benefits due to special provisions long established in statute and in the tax code.

However, implementing PPLI and PPVA requires expertise across multiple disciplines:

- Insurance

- Financial, tax, and estate planning

- Investment analysis and asset allocation

- Law and accounting

It is imperative to have the right experts on board to comply with tax regulations and avoid the expensive pitfalls of mistakes.

If you’re ready to incorporate PPLI or PPVA into your investment or estate plan, read on to learn more about the professional team needed to assist with implementation.

Benefits Refresher

Which professionals do you need to analyze and optimize PPLI or PPVA for your specific situation? First, let’s revisit how the benefits of PPLI and PPVA differ and the most suitable application for each.

PPLI Refresher

PPLI provides for the tax-deferred accumulation of policy values, a potentially powerful contributor to compounding investment returns. The institutional pricing of PPLI further enhances compound investment returns. As a result, PPLI can be structured to mitigate the impact of both income and estate taxes. While receiving tax benefits, policyholders can access a portion of the value through tax-free policy loans.

However, PPLI entails insurance underwriting, medical exams, and the cost of insurance. Policyholders can make significant contributions to PPLI, but annual deposits are regulated by IRS guidelines and insurance policy capacity.

PPVA Refresher

PPVA can also increase after-tax returns for investors and benefits from low-cost institutional pricing. Income and gains are generally not subject to current income taxes for the life of the annuity. However, income taxes on earnings will be due when withdrawn, unless left to a charity or family foundation. As a result, one can utilize PPVA to build a charitable legacy while retaining control of underlying assets.

PPVA offers easier implementation than PPLI, since PPVA is not subject to insurance underwriting. PPVA also avoids the cost of life insurance, which can be significant in the early years for PPLI in order to meet stringent IRS requirements. PPVA contributions are also not limited by insurance constraints, permitting larger contributions.

Investing Through PPLI and PPVA

Both PPLI and PPVA provide a wide variety of investment options through non-registered Insurance Dedicated Funds (IDFs) and registered Variable Insurance Trusts (VITs). IDFs provide access to alternative strategies (such as private equity, private credit, and hedge funds), while VITs provide access to traditional investments (stocks and bonds). IDFs and VITs are designed to adhere to tax rules for tax-advantaged investing through insurance structures.

Most importantly, IDFs and VITs enable tax-deferred compounding for investors in alternatives and other investments that may otherwise produce significant taxable income.

Team of Specialists

Developing and implementing the right PPLI or PPVA solution for an investor requires a team of specialists. Typically, investors will look to one or more of the professional team members to guide the process. The professionals working on a client’s behalf may vary, depending on the specifics of the case, with some members of the professional team serving multiple roles.

1. INSURANCE PROFESSIONAL

PPLI and PPVA are regulated insurance vehicles. An insurance professional expert in the structuring and administration of these vehicles is a critical member of your team.

The insurance structuring professional on your PPLI/PPVA team will offer:

- Product expertise

- Case design and illustrations to meet client objectives and optimize results

- Development of a client risk profile

- Guidance throughout the underwriting and pricing process

- Negotiation of underwriting with insurance companies

- Prepare applications and place coverage

- Ongoing service for clients and advisors for the life of the contracts

For PPVA, insurance underwriting (including medical exams) will not be necessary. The application process will be more straightforward. The insurance professional will guide the client through the application process.

2. FINANCIAL ADVISOR

Financial advisors may work for RIAs, single- and multi-family offices, or be affiliated with a securities firm. These professionals may recommend or assist with PPLI or PPVA as part of a client’s overall financial or investment plan.

The financial advisor on your PPLI team will offer:

- Financial and investment planning and recommendations

- Comprehensive review and understanding of the transaction

A client’s financial advisor may serve as the “quarterback” for the PPLI/PPVA process, but a licensed insurance professional will still be required.

3. INVESTMENT CONSULTANT

Investment consultants work with larger private and institutional investors, developing investment policies, asset allocation studies, and implementing multi-asset, multi-manager investment programs.

Some investment consultants (or teams within investment consulting firms) are dedicated to alternative investing, and may tap PPLI or PPVA for tax-advantaged access to “alts.” Some consultants may manage custom separate accounts or IDFs under a PPLI or PPVA umbrella for their largest clients.

When implementing PPLI and PPVA, the services of investment consultants include:

- Asset allocation guidance

- Investment policy statements

- Research and due diligence on IDFs and VITs

- Advice on investment choices

- Coordinating PPLI and PPVA with a client’s overall investment allocation

4. ATTORNEY

Legal specialists in tax and estate planning are important members of the PPLI and PPVA implementation team. Specialized expertise is needed to stay current with the latest legal developments, techniques, and compliance requirements to achieve tax efficiency for client investments and for estate planning and estate tax mitigation.

Sophisticated legal analysis is required not only for wealthy individuals, but also corporations, financial institutions, and retirement plans using insurance structures for tax-advantaged investing.

The contribution of legal talent to PPLI and PPVA implementation encompasses:

- Legal and tax expertise and analysis

- Developing and updating estate documents

- Document oversight for corporate or fiduciary entities

- Advice on structuring policy ownership

- Negotiating with counterparties on behalf of clients

5. INSURANCE COMPANY

Insurance companies issue PPLI and PPVA. As the manufacturer and product provider, the role of the insurance company is critical, to say the least! The insurance company provides and manages the infrastructure and significant staff and resources to assure durability, compliance, and successful operations over time.

The insurance company plays multiple roles:

- Underwriting and issuing policies and contracts

- Providing investment options (a key factor in policy selection)

- Reinsuring excess risk for large policies

- Policy and contract administration

- Paying income and death benefits

- Processing policy loans

- Reporting policy values to the policy owner in partnership with service professionals

Some of the largest U.S. and global insurance companies are major sponsors of PPLI and PPVA platforms, including:

6. FUND AND INVESTMENT MANAGERS

To maintain tax benefits, the law requires that insurance and annuity holders must not exercise direct control over investments. Thus, fund and investment managers oversee the portfolios within PPLI and PPVA via IDFs, VITs, and custom separate accounts. Nevertheless, policyholders do retain the ability to change and update their allocations among approved investment options within each policy and contract.

The fund and investment managers must also adequately diversify their portfolios to comply with another tax requirement: the investment diversification rules under IRC Rule 817(h).

PPLI and PPVA fund and investment managers perform a variety of portfolio, operational, and compliance functions:

- Execute investment management agreements with insurance companies, IDFs, or VITs

- Manage assets

- Certify 817(h) diversification compliance

- Report portfolio or fund values

Ready to Implement PPLI or PPVA?

Bringing together the right team of experts is critical when utilizing PPLI and PPVA.

Are you ready to implement PPLI and PPVA in your estate, tax, or investment planning? Reach out to us to discuss how we can be a part of your team of experts.

Tags:

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

Part 2: Case Studies In Part 1 of our blog series on the power of Section 1035 exchanges, we explore...

Part 1: Fundamentals High net worth investors and their advisors frequently encounter legacy life in...

Navigating the investment landscape as an institutional investor comes with particular challenges an...