Risk: Should Cov-Lite Loans Be a Concern for CLO Investors?

The current trend of rising rates, concerns over the health of the economy, and the potential for a credit downturn have been a source of unease in the corporate leveraged loan market.

These factors, paired with the perceived lack of covenants in the leveraged loan market, have been among the topical issues for financial market commentators today.

In our view, this concern over the impact of cov-lite loans in Collateralized Loan Obligations (CLOs) is exaggerated.

What Are Cov-Lite Loans?

Cov-lite loans are corporate loans with little to no covenants. Covenants are agreements that require a borrower to fulfill certain conditions or place limitations on the borrower. For example, a covenant may require a level of financial performance or may restrict a borrower from paying a dividend without permission.

The Rise of Cov-Lite Loans

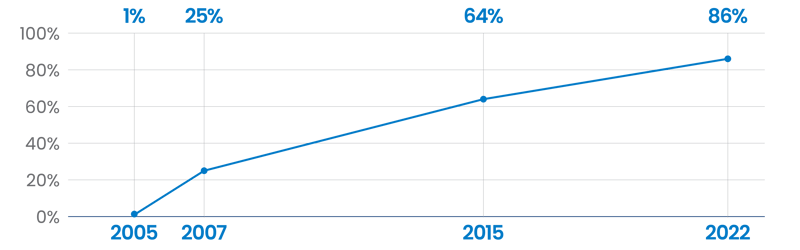

Cov-lite loans account for roughly 85% of the $1.4 trillion loan market, compared to 1% of the loan market in 2005.1 The growth in the loan market along with a decline in loan documentation has been the concern for pundits.

Growth of Cov-Lite Leveraged Loans

2005-2022

Source: S&P Global

However, according to a 2019 working paper from the Federal Reserve Bank of Philadelphia:

“Nearly all leveraged loan borrowers remain subject to financial covenants and banks have retained their traditional role as monitor of borrowing firms.”2

According to the research, cov-lite loans arose as bank lending to corporations evolved. Cov-lite loans are generally issued as part of a broader financing package. A bank can issue a revolving loan with typical financial covenants and strict credit monitoring. Cov-lite loan terms can also be offered to the leveraged loan market, including to CLOs which represent more than 60% of the buyer universe of leveraged loans.3 This structure “evolved to facilitate bank monitoring while mitigating the bargaining frictions that have arisen with the entry of nonbank lenders,” according to the Federal Reserve study. The study observes that “corporate loan contracts frequently concentrate control rights with a subset of lenders.”

In other words, dedicated bank credit professionals monitor the borrowers behind cov-lite loans, in addition to the mutual funds, ETFs, pension funds, insurance companies, and hedge funds which may invest in leveraged loans but may lack the resources to monitor borrowers. Moreover, in case of a loan default, the two-tier structure significantly reduces renegotiation costs “for the benefit of lenders,” according to the Fordham Journal of Corporate & Financial Law.4

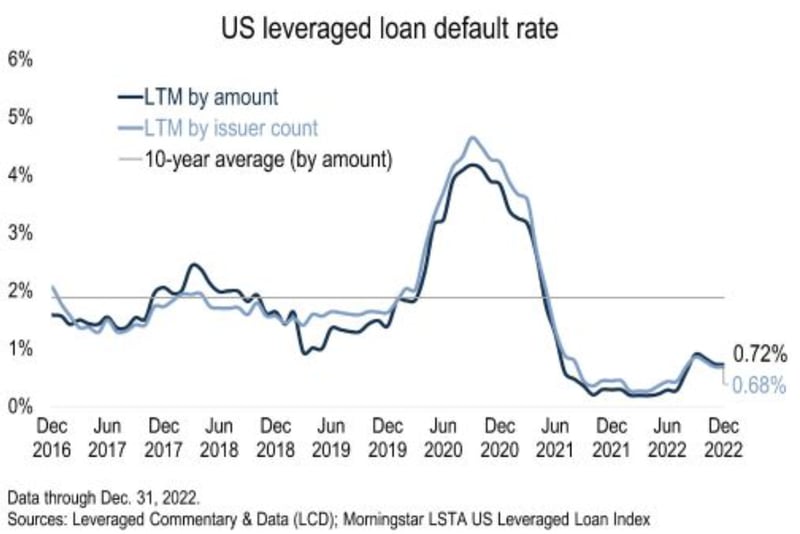

Low Default Rates

Default rates for leverage loans remain muted. While default rates have increased amidst recent market volatility and economic crosscurrents, they remain at historic lows. According to Pitchbook, loan default rates were 0.72% as of December 2022, below the long-term historical average of 2.73%.5

By limiting financial covenants, we have observed that borrowers have greater flexibility in managing their business and cashflows through periods of stress, rather than triggering a covenant that would force them to restructure or renegotiate. This dynamic has contributed in part to the recent low levels of loan defaults.

Ultimately, the jury is still out: will cov-lite loans materially change credit outcomes?

Importantly, initial leverage rather than covenants is the leading predictor of credit losses based on default correlations.6 Nevertheless, we believe it is prudent to sensitize our models for the potential impacts of lower loan recoveries accompanying an elevated loan default period.

Active Risk Management

CLO managers can mitigate potential credit losses that impact CLO performance. How? Through active portfolio management and diligent credit underwriting.

CLO managers and their credit research teams typically underwrite each loan in a CLO portfolio. To start, they evaluate a borrower’s financial health as well as the borrower’s ability to generate profits and pay interest and principal. The CLO manager and their credit teams will then continuously monitor the financial strength of each borrower and loan quality for the life of the CLO.

If the financial health of a borrower begins to deteriorate, or if the borrower’s industry faces headwinds, a CLO manager has the ability to trade loans out of their CLO portfolio.

Further, CLO managers actively manage not just credit quality but diversification within their CLO portfolios. CLO documentation generally requires broad diversification across borrowers and industries with further limitations on portfolio concentrations to low-quality loans. The CLO manager can then seek to enhance the credit dynamics of the overall portfolio. Selecting a CLO manager is important, as some managers are consistently better able to manage credit quality than others.

CLO Credit Performance During the Great Financial Crisis

We believe history may provide insight to the potential default risk of CLOs compared to the underlying leveraged loans.

During the Great Financial Crisis (2007 to 2009), CLO managers were able to reduce their peak default rate to 6% and outperform the broader loan market.7 In Q1 2009, the default rate in the loan market peaked at 10.8%.8 (At the start of the crisis, cov-lite loans were approximately one-quarter of the total loan market.)9 CLO managers were thus able to significantly reduce the default rate of CLOs compared to the underlying leveraged loan market. We believe that this superior performance helps illustrate the structural and diversification benefits of CLOs which help to mitigate downside risk.

Top-tier CLO managers were able to lower the loan default rates across their portfolios through active management and credit selection, as well as through the CLO structural benefits. Successful CLO managers were able to fortify their CLO portfolios by actively trading and even building trading gains by taking advantage of volatility to offset losses from other loans.

Today’s Risks

Market conditions and the macro-economic environment continue to shift rapidly. CLO investors and managers must be mindful of the potential for rising downgrades and defaults in the leveraged loan market from what are currently historically low levels. Some CLO market observers not surprisingly forecast rising defaults in the event of a recession.

As CLO investors, we remain vigilant, but believe that this asset class benefits from its historic resilience.

CLOs: Still A Compelling Income Alternative

Should cov-lite loans should be a concern for investors in CLOs? As explained above, that concern may be exaggerated, and we believe CLOs remain a compelling income alternative.

To learn more, please contact us for an in-depth discussion of the risks and opportunities in this specialized sector.

References:

1. Abby Latour, “Covenant-lite deals exceed 90% of leveraged loan issuance, setting new high,” S&P Global (October 8, 2021).

2. Mitchell Berlin, Greg Nini, and Edison Yu, “Concentration of Control Rights in Leveraged Loan Syndicates,” Federal Reserve Bank of Philadelphia (October 2019).

3. Guggenheim Investments, SIFMA, JP Morgan, Bank of America. Data as of 6.30.2022.

4. Javier El-Hage, “Will the Leveraged Loan Market Trigger a Financial Pandemic? Understanding Cov-Lite Loans, CLOs and EBITDA Add-Backs,” Fordham Journal of Financial and Corporate Law, Blog (May 4, 2020).

5. Rachelle Kakouris, “US loan default rate ends 2022 at 0.72%; downgrades, distressed volume in focus,” Pitchbook (January 4, 2023).

6. Leveraged Commentary & Data (LCD), “Default, Transition, and Recovery: 2021 Annual Global Leveraged Loan CLO Default And Rating Transition Study,” October 31, 2022.

7. Morgan Stanley, CLO Primer, February 2017, page 14.

8. Rachelle Kakouris, “US loan default rate ends 2022 at 0.72%”.

9. Bo Becker & Victoria Ivashina, Covenant-Light Contracts and Creditor Coordination 3 (Swedish House of Finance Research Paper, No . 16-09, 2016)

Tags:

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

Introduction Marc Utay, Founder and Managing Partner at Clarion Capital Partners, sat down with ION ...

“In the beginning … there were potential profits.” While “warehouse” may be a metaphor, the potentia...

CLO mezzanine investments offer some of the highest yields within the Collateralized Loan Obligation...