Who are the Investors Who Grew CLOs Into a Trillion-Dollar Asset Class?

Who Invests in CLOs and Why?

The global market for collateralized loan obligations (CLOs) now exceeds $1 trillion.1

What’s been driving the appeal of this asset class? Which investors are at the forefront of this growth and why?

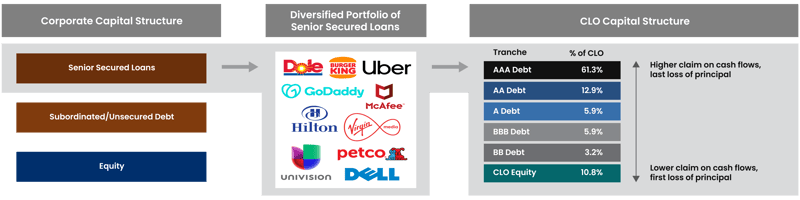

CLOs are debt securities backed by diversified pools of floating rate, senior secured leveraged loans, primarily to U.S. corporations. CLOs now account for nearly two-thirds of the leveraged loan market, which has become a major source of corporate financing.2 CLOs issue rated tranches with varying degrees of risk and return tailored to different investment objectives.

As a result of this range in quality, as well as their comparatively high yields to other similarly rated credit asset classes, CLOs have attracted diverse investor types from across the U.S. and globally. CLO investors range from banks, insurance companies, and pension funds to asset managers, hedge funds, mutual funds, and ETFs.3 Over the past two decades, the CLO investor base has increased dramatically and has evolved with improved regulations.

As a securitized asset, CLOs offer investors “slices” of the interest income from their underlying loan portfolios. CLO tranches can be structured to provide higher credit quality (and reduced risk) or higher yield (and higher risk).

Every CLO structure includes investment grade, mezzanine, and equity securities.

Illustrative CLO Structure

Source: Clarion Capital Partners

AAA and AA: For Investors Seeking Stability and Competitive Yields

The most senior part of the CLO capital structure includes AAA and AA securities. These instruments have first priority to receive cash flows from the underlying pool. Due to their priority position, senior CLO tranches (AAA/AA) receive higher credit ratings than the loans in the underlying pools (BB/B). AAA CLOs represent the largest of CLO tranches, approximately 60% of the overall CLO capital structure.4

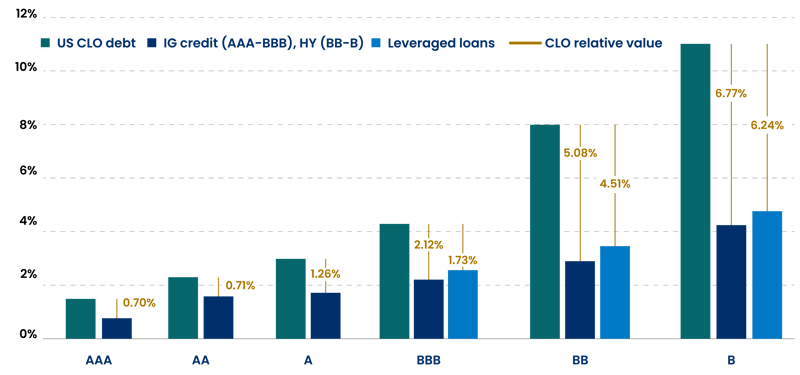

According to S&P Global, AAA CLOs have never suffered a default across the nearly 21,000 CLOs issued since 1996 (the first year for ratings data). AA CLOs witnessed only one default in the same period. Because of this track record, senior CLOs are popular with banks, insurance companies, and conservative investors. Due to their perceived complexity, AAA and AA CLOs offer higher yields than similarly rated government and corporate instruments, further enhancing their appeal.

Other senior investment-grade CLOs are rated single-A, and offer more yield compared to AAA or AA tranches.

Compelling CLO Spreads

Versus Corporate Credit and Leveraged Loans

Source: JP Morgan, Bloomberg, and S&P/LCD as of 8/31/21

Mezzanine CLOs for More Aggressive Investors

Mezzanine CLOs are generally rated BB, or B—below investment grade—and pay higher yields. Mezzanine CLOs are popular with yield-seeking investors such as asset managers, hedge funds, specialty credit funds, and some insurance companies.

Mezzanine CLOs can be subject to high levels of price volatility during unsettled markets or economic periods, or at times when corporate credit quality is deteriorating. A limited number of mezzanine CLOs have even been impacted by defaults.5

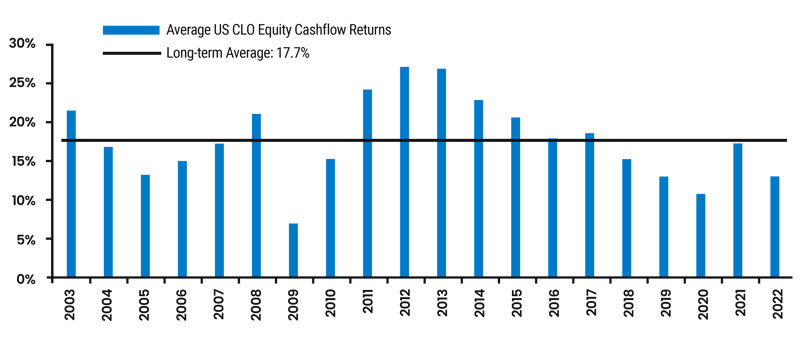

CLO Equity: For the Most Aggressive Investors

The most junior tranche of a CLO’s capital structure is CLO equity, generally held by asset managers, hedge funds, and specialty credit funds.

CLO equity investors receive the remaining interest after payments are made to the higher-rated debt tranches. CLO equity offers a highly leveraged return opportunity for corporate credit investors. CLO equity investors include managers of dedicated CLO funds or who use CLO securities as part of a broader credit or opportunistic strategy.

CLO equity is the riskiest part of the CLO capital structure. CLO equity suffers first if any underlying securities default or the pool fails to meet cash flow or collateral tests. As necessary, payments to CLO equity are suspended and diverted to pay interest and principal to the senior CLO tranches. After these payments sufficiently reduce the amount outstanding on the senior tranches, payments to the CLO equity can resume.

In exchange for this risk, CLO equity investors generally seek high, mid-teen IRRs over time.

CLO Equity: Cash Flow Returns

Annual and Average

2003 to 2022

Source: J.P. Morgan, November 2022

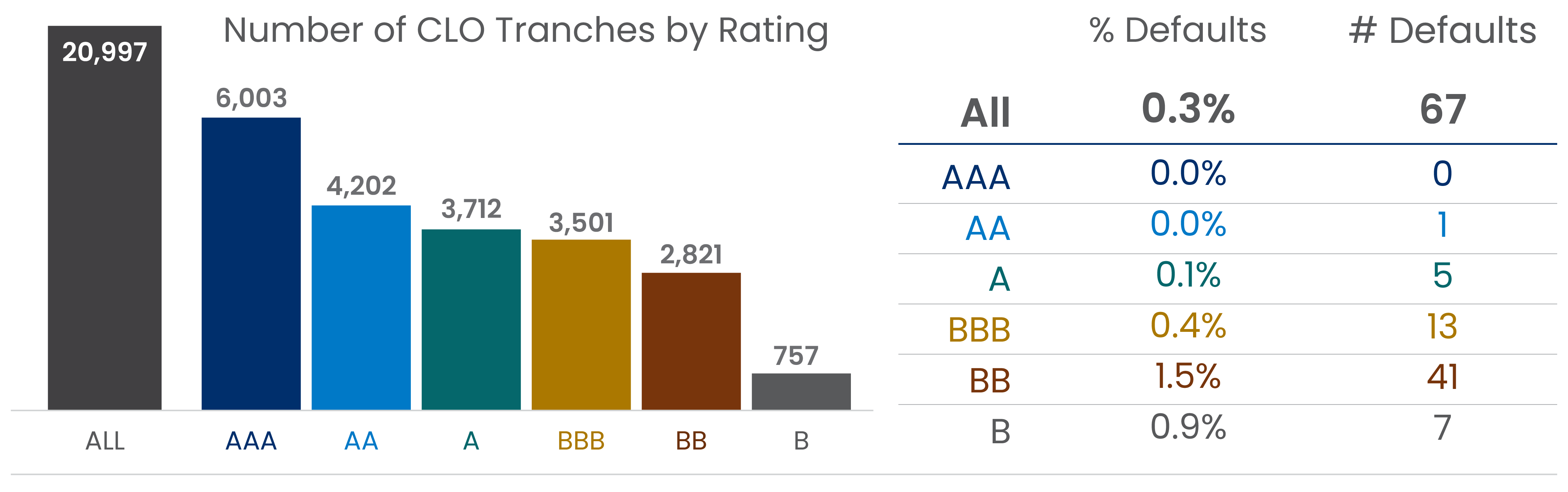

CLOs: Crisis Tested and Time Tested

The strength of CLOs was tested during the Global Financial Crisis (2007-2009) and more recently during the Covid-19 downturn (2020). In each period, CLOs experienced significantly fewer defaults than corporate bonds of comparable ratings.6

Since Standard & Poor’s began rating CLOs in 1996, the asset class has “historically shown strong credit performance with few defaults” according to S&P, which has rated nearly 21,000 CLOs.

CLOs: Low Default Rate Over Time

1996 to 2021

Source: S&P Global

Potentially Broad Appeal

We believe the resilience and higher yields of CLOs relative to other similarly rated credit asset classes—as well as the appreciation potential for certain tranches—provide an appealing opportunity for a wide variety of investors.

CLO Investor Profiles

Below is an overview of different CLO investor types and their preferences.

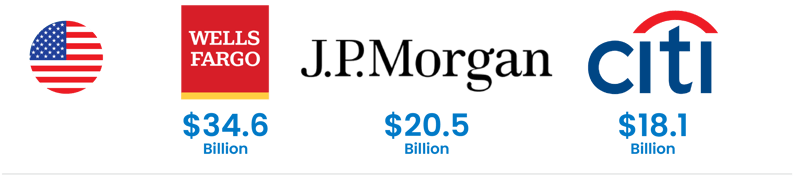

U.S. Banks and AAA CLOs

U.S. Banks are major buyers of AAA CLOs, seeking both high quality and extra yield. According to S&P Global (data as of 2019), the largest bank buyers of CLOs include:

Largest Holders of CLOs Among U.S. Banks

Source: S&P Global

Other banks in the “billion dollar club” of CLO holdings include:

Source: S&P Global

In addition, bank holding companies are CLO investors.

Foreign Banks and the Search for Yield and Quality

In 2016, Japan adopted a negative interest rate policy to combat decades of deflation and encourage economic activity. Searching for sources of positive returns, Japanese banks became large buyers of AAA CLOs. According to S&P Global, the largest holders of CLOs among Japanese banks included:

Largest Holders of CLOs Among Japanese Banks

Source: S&P Global

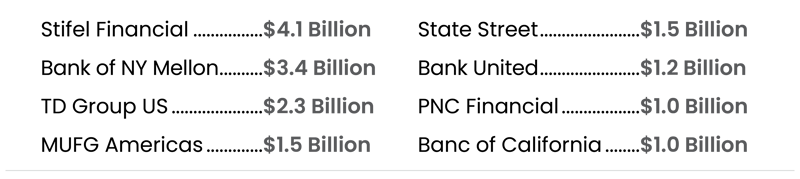

Insurance Companies: Diverse CLO Exposure

U.S. insurance companies are among the largest investors in CLOs, buying senior issues (AAA and AA), mezzanine securities (BB and B), and even a limited amount of CLO equity issues. According to S&P Global, a variety of insurers invest in CLOs, but life insurers dominate:

Types of Insurance Companies Investing in CLOs

Source: National Association of Insurance Commissioners, S&P Global

Large CLO investors among life insurers include:

Total CLO Investments by Leading Insurance Companies

Source: S&P Global

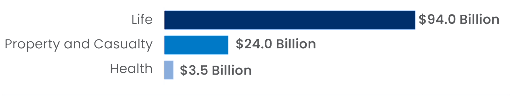

According to Moody’s, insurance companies invested across the CLO risk spectrum, based on ratings:

Insurance Company CLO Investments by Rating

Source: Moody’s, S&P Global

Mutual Funds: Diversifying With CLOs

Mutual funds are long-time investors in CLOs, as well as major direct investors in senior loans, the underlying securities of CLO collateral pools. Mutual fund managers allocate to CLOs to diversify a variety of fund strategies, from multi-asset and diversified income to credit and liquid alternative funds.

Some major mutual fund sponsors may also manage CLO pools.

Notable mutual fund managers investing in CLOs include:

Leading Mutual Fund Managers Investing in CLOs

Source: CLO Research Group

Among other registered funds, traded closed-end funds can provide access to less liquid parts of the CLO market. A limited number of exchange-traded closed-end funds are dedicated to CLO equity and mezzanine securities. The closed-end structure enables the fund managers to run their portfolios without the outflows seen in mutual funds, while investors can gain liquidity by trading their fund shares.

ETFs: The Democratization of CLOs

ETFs dedicated to CLOs are a recent development. These new CLOs represent the “democratization” of CLOs. They enable investors of all types to quickly make a dedicated allocation to a security type that was once limited to institutional buyers.

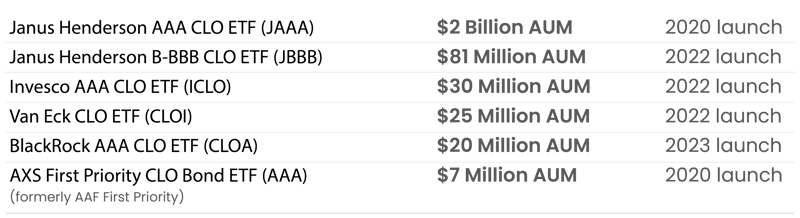

Early sponsors among this new breed of CLO ETFs include:

The First ETFs Dedicated to CLOs

Source: ETF.com

Opportunistic Investors: Asset Managers, Hedge Funds, and Private Funds

The most opportunistic (and risk-seeking) CLO investors include asset managers, hedge funds, and private funds, such as dedicated credit and CLO funds. These investors pursue the highest yields, trading opportunities, and appreciation potential by actively investing across the CLO spectrum, with a focus on CLO mezzanine and equity. These investors may also choose between U.S. and European CLOs for the best opportunities.

Learn More About CLO Investing

CLOs can offer diverse applications for a wide range of investors. To explore opportunities in CLO investing for you or your clients, feel free to schedule a call with our team.

References

1. Leveraged Commentary & Data (LCD), Quarterly Review, December 31, 2022.

2. Leveraged Commentary & Data (LCD), Quarterly Review, December 31, 2022.

3. S&P Global

4. Wells Fargo Securities, “CLO Desktop Primer,” March 2, 2017.

5. Wells Fargo Securities, “CLO’s: How Bad Was It? CLO Market After Action Review: Part 1,” November 29, 2017.

6. Wells Fargo Securities, “CLO’s: How Bad Was It? CLO Market After Action Review: Part 1,” November 29, 2017.

S&P Global, “Default, Transition, and Recovery: 2021 Annual Global Leveraged Loan CLO Default And Rating Transition Study” (2022) https://www.spglobal.com/ratings/en/research/articles/221031-default-transition-and-recovery-2021-annual-global-leveraged-loan-clo-default-and-rating-transition-study-12535652

S&P Global, “Those $700B in US CLOs: Who holds them, what risk they pose” (2019)

FEDS Notes, “Who Owns U.S. CLO Securities? An Update by Tranche” (2020)

FEDS Notes, “Collateralized Loan Obligations in the Financial Accounts of the United States” (2019)

Tags:

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

Introduction Marc Utay, Founder and Managing Partner at Clarion Capital Partners, sat down with ION ...

“In the beginning … there were potential profits.” While “warehouse” may be a metaphor, the potentia...

CLO mezzanine investments offer some of the highest yields within the Collateralized Loan Obligation...