What is the Liquidity Risk in the $1 Trillion CLO Market?

When markets become unsettled, liquidity becomes a concern for some investors.

Investors want to know if they can sell an investment when they need cash, and at a price that reflects its value. In volatile markets, raising cash can be a challenge, and forced sellers may be compelled to accept a low price when buyers are scarce.

What is the liquidity of the Collateralized Loan Obligation (CLO) market?

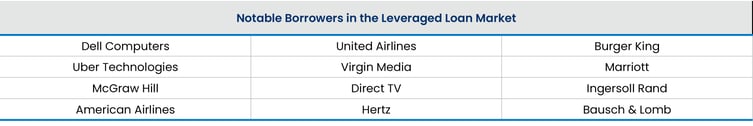

Major Corporate Borrowers

CLOs represent interests in senior, secured leveraged loans to large and middle-market U.S. corporations. The outstanding leveraged loan market has nearly tripled in size since 2009 and is currently $1.4 trillion, nearly the size of the U.S. high-yield bond market at $1.5 trillion 1. This growth has attracted large and well-established borrowers across diverse industries:

Source: Clarion Capital

The diversity and profile of these borrowers help support the liquidity of the CLO market.

Global and Institutional Investor Base

Large, active markets are the foundation of liquidity for any investment type.

Over time, the CLO and leveraged loan markets have grown in tandem. The U.S. CLO market surpassed $1 trillion in size in recent years2, and today CLOs account for nearly two-thirds of the leveraged loan market. By comparison, CLOs accounted for 49% of the leveraged loan market in 2008.3

Higher yields, diversification, structural risk protections, and an actively traded market, have attracted a diverse investor base from across the globe. CLOs offer a broad range of investment profiles that can satisfy a wide-range of risk-reward appetites among investors. For example4:

- U.S. and Japanese banks are major investors in AAA CLO tranches.

- Insurance companies are significant investors in CLO tranches with Investment Grade Ratings (AAA through BBB)

- Opportunistic hedge funds prefer the greater yields, returns, and aggressive risk/return profile of CLO equity and mezzanine tranches.

CLO investors are not just global, but diverse, with buyers matching their “slice” of the CLO market to their investment focus and needs:

Sources: Pinebridge, Guggenheim, SIFMA, LCD, as of June 30, 2022.

A large, global, institutional, and retail marketplace contributes to the liquidity of CLOs.

Large Primary and Secondary Markets

A $1.4+ trillion dollar universe of high-profile borrowers and investors drives CLO liquidity. CLOs benefit from large trading volumes every day, an expanding universe of investors and borrowers, as well as a robust trading ecosystem. The result is both a large primary and secondary market for CLOs.

In primary CLO markets, a CLO manager issues a new CLO transaction. Since 2018, new issuance has approached or exceeded $100 billion each year.5

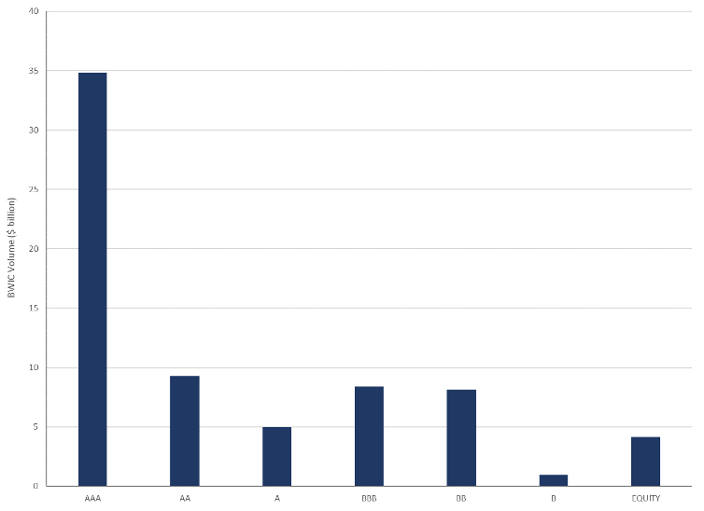

In secondary CLO markets, buyers and sellers trade existing CLO debt and equity securities. In the secondary market, the majority of CLO securities are traded through a competitive, auction-style process in which buyers bid on securities, and the bidder with the highest price purchases the security. This process is called “Bids-Wanted-In-Competition” or “BWIC.” In 2022, over $56 billion of U.S. CLO securities were traded in BWIC markets.

2022 CLO Secondary Market Trading Volume: Bids-Wanted-in-Competition (BWIC)

Volume by Rating ($ billions)

Source: City Velocity as of November 22, 2022

Liquidity In Crisis Environments

The CLO markets weathered both the Great Financial Crisis of 2008 and the COVID downturn of 2020. While unsettled markets impacted pricing, trading continued. Opportunistic CLO investors capitalize on the volatility to acquire securities at attractive prices.

Learn More

Effective active management is critical to enhancing resilience and performance for CLO investors. This is what we strive to offer our investors at Clarion Capital Partners.

To learn more, please contact us for an in-depth discussion of the risks and opportunities in this specialized sector.

References

1 Rachelle Kakouris, S&P Global, “After risk-on run, US leveraged finance market tops $3 trillion in size,” July 15, 2021. Fidelity, “An opportunity for income seekers: Leveraged loans may offer higher yields and inflation protection,” September 14, 2022.

2 Leveraged Commentary & Data (LCD), as of December 31, 2022.

3 Pitchbook LCD.

4 Source: Pinebridge, Guggenheim, SIFMA, LCD, as of June 30, 2022.

5 S&P LCD, 8/3/22 “U.S. BSL CLO And Leveraged Finance Key Themes, Q3 2022” August 3, 2022.

Tags:

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

Introduction Marc Utay, Founder and Managing Partner at Clarion Capital Partners, sat down with ION ...

“In the beginning … there were potential profits.” While “warehouse” may be a metaphor, the potentia...

CLO mezzanine investments offer some of the highest yields within the Collateralized Loan Obligation...